Recession! Are you kidding?

Summary: The Australian economy expanded almost 1 per cent in the March quarter, beating expectations. As good as that number was, it's probably still understating true growth momentum. The data is still far too inconsistent in many cases, especially with regard to household spending, public demand and the way in which it is adjusted. Correcting for inconsistencies yields an economy that is growing at trend or above. |

Key take-out: Despite rampant concerns, a recession is highly unlikely after today's GDP result and in the context of robust job growth, a construction boom and solid consumer spending. |

Key beneficiaries: General investors Category: Economics and Investment strategy. |

Joe Hockey reckons that analysts who are constantly going on about recession are ‘clowns', and I think that's about right. Yet, despite this week's better than expected 2.3 per cent GDP result, concerns are rife.

All of it flows from a surprisingly weak business investment reading for the March quarter. A slump in mining investment has been long anticipated but this isn't the source of angst. Rather it's the fall in non-mining investment. The plan had been, and I'm as surprised as anyone, that non-mining investment would pick-up as mining investment slumped – and this hasn't happened. So without that offset, concerns are rampant that a recession could ensue.

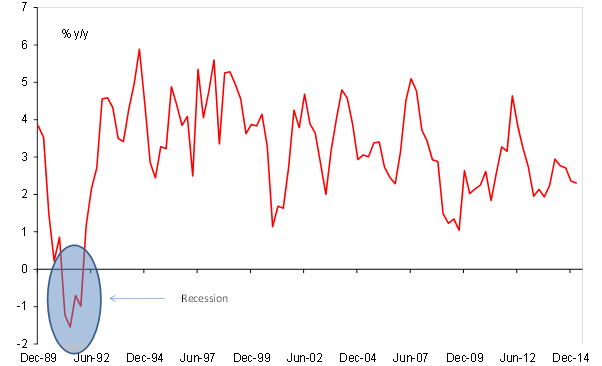

Chart 1: The Australian economy is doing just fine

If we did have a recession what would it mean for investors?

In the event that we did have a recession, I suspect it would be one of the most bizarre in modern times and – as ridiculous as this may sound – very investor friendly.

For a start, it wouldn't be driven by anything tangible. Typically when we have recessions, they are horrid affairs and always induced by policy – either a large fiscal contraction or monetary tightening. Growth gets crunched and job shedding is aggressive.

During the last recessionary period – late 80's early 90's – GDP growth was flat for two years, the worst period of growth in the first half of 1991. At that point, GDP fell by nearly 1 per cent to be 1.5 per cent lower over the year. On the jobs front, 337,000 jobs were lost in one year, nearly 30,000 per month. The unemployment rate for its part spiked to 11.1 per cent at the peak from 5.8 per cent.

All of that was driven by a cash rate that peaked at 13.4 per cent.

If we went into a recession now, I don't think we'd follow the same path as in previous recessions. To a large extent that's because the downturn wouldn't be policy induced and so would be unlike any other we've ever had. With a cash rate of 2 per cent (which will fall in the event of a recession) any slump in growth would be driven entirely by a huge drop in mining investment. As for the other components of GDP, the key problem here isn't that they are/would be slumping. That's what you'd normally see in a recession. It's just that they wouldn't be strong enough to offset huge falls in mining investment.

A recession would be in name only

So weird would this recession be, that it would be characterised by a construction boom and solid consumer spending. Unprecedented in history. It may be the case that these other components of GDP are not sufficient to offset a 70 per cent fall in mining investment – thus the technical recession. Yet the rebound that we saw/are seeing elsewhere wouldn't be irrelevant.

It would mean that the recession is the only one in history where jobs growth was robust.

Even with a near 20 per cent slump in mining investment to date, the country has generated about 450,000 jobs since the mining boom was declared over. That's not as amazing as it might sound because not many people are employed in the mining industry and investment is only one component of that. The mining industry as a whole barely accounts for 2 per cent of the labour market and investment may be only half of that. Retail and construction in contrast account for nearly a quarter of all jobs.

Would a fall in non-mining investment limit the jobs outlook? Not really. I mean why would it? Non-mining investment is already at its weakest since the 1991 recession. The fall we saw in the March quarter was one of the largest falls since the GFC – and yet jobs growth is still strong. That the unemployment rate is over 6 per cent has less to do with sluggish jobs growth and more to do with the inability of the statistician to seasonally adjust the data. So instead they relied on a subjective assessment that some of the employment numbers couldn't possibly be as strong as indicated by usual seasonal patterns. So they lowered them. For me that is not an acceptable statistical practice.

All of that means that any recession would be short-lived. The main implication for investors is that interest rates, already at a very stimulatory setting, would probably go lower. In fact in a recessionary environment and given the rampant hysteria in the market at the moment – on any given issue – the RBA would likely start its own quantitative easing (QE) program.

Ironically, in a world where bad policy seems to be market friendly, the Aussie share-market would rally hard. This might occur after an initial pull-back, but you only have to see the experience of the US and Europe to see why it would probably happen here as well.

Elsewhere, lower rates would intensify the hunt for yield and lift the attractiveness of property as an investment. In that sense a recession would be a windfall for investors. That sounds like a strange thing to say, and, again, I'm not endorsing policy in anyway or making a comment on the social desirability of one. That would be the investment reality though.

How likely is a recession anyway?

Well, after today's GDP result, you'd have to say it's highly unlikely. The economy expanded by almost 1 per cent on the ABS figures, but as good as that number was, it's very important to note that the ABS figures are still probably understating true growth momentum. The data is still far too inconsistent in many cases, especially with regard to household spending, public demand and the way in which the ABS is adjusting the data (similar to problems the US is having with its GDP data). Remember that small variations in any of these things yield entirely different results. Correcting for them yields an economy that is growing at trend or above.

Either way, one thing stands out. Even with the mining investment slump and weak non-mining investment, the economy is nowhere near a recession. This is the irony: All the things that those ‘clowns' think will cause a recession are already here, yet we are not having one.

That's probably why most reasonable people attach a low probability to a recession. As at the March quarter, a Bloomberg survey showed the chance at about 18 per cent. The recent decline in capital expenditure plus all the press on a housing bubble will no doubt see that rise, but it would still be under 25 per cent on any update. That would be the chance of a technical recession only. The chance of having a real recession – with the associated slump in jobs, surge in the unemployment rate, etc., is much lower – at about 5 per cent.