Reality bites as the trade boom ends

A once-in-a-lifetime terms of trade boom resulted in an unprecedented period of economic prosperity for Australians – 22 years and counting – but now we face the challenge of a terms of trade decline. The sheer size of the anticipated decline in mining investment, combined with an ageing population, suggests that the challenges of this terms of trade decline may prove more difficult than those in the past.

Research by the Reserve Bank of Australia, Macroeconomic Consequences of Terms of Trade Episodes, Past and Present, provides new light on what to expect as the mining boom ends. The Research Discussion Paper found that following a terms of trade peak, growth is typically well below trend for two years before returning towards trend after around five years.

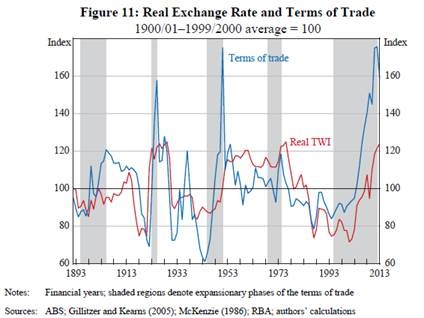

Australia’s terms of trade – the ratio of export prices to import prices – increased significantly over the past decade before peaking in 2011 at around 85 per cent above the average of the previous century. The result was an unprecedented period of economic prosperity for the Australian economy, characterised by strong investment and income growth.

The current terms of trade boom is largely unprecedented in size and scope, persisting around three times as long as previous booms. This appears largely due to its cause – the industrialisation of China – and the inability of supply to adjust quickly to the sharp rise in demand. Previous terms of trade booms for Australia were typically driven by high wool prices; it is much easier to increase the supply of wool than it is to boost production of iron ore and coal.

Australia now finds itself on the other side of a terms of trade boom. Although the terms of trade remains at an elevated level, it is expected to decline further over the next few years. What are the implications for the Australian economy?

On a positive note, we will see further growth in exports for two reasons.

First, Australia’s real exchange rate is largely driven by the terms of trade. When that falls, so does the exchange rate. That will help our export exposed industries become more competitive globally.

Second, it takes time for the mining industry to react to elevated prices. Resource projects take years to plan, organise and complete; many of these projects are only just beginning production. The considerable size and risk associated with these projects may have also led to some firms delaying investment decisions. To some extent, the decline in the terms of trade will reflect increased supply from Australian producers.

The result is that exports will be Australia’s major driver of economic growth over the next few years, led by resource exports. However, other export industries should also see a boost in activity.

Unfortunately, history tells us that exports will be one of few beneficiaries of a terms of trade decline and the economy as a whole will experience a prolonged period of relatively soft growth. This will be led by investment growth – or in this case, a lack thereof.

Investment drove the Australian economy following the onset of the global financial crisis, with engineering activity rising by an annual rate of almost 25 per cent over the five years to December 2012. Since then, engineering activity has fallen by 6.6 per cent.

Following a peak in the terms of trade, investment typically slows and then eventually falls. This process can often be delayed due to the long lead times associated with investment activity. The planning and approval processes associated with resource investment are more extensive than most business investment.

For that reason, it is not surprising that the drop off in investment activity has been fairly slow so far, with ABS capital expenditure estimates suggesting that mining investment will only decline moderately in the 2013/2014 financial year.

Nevertheless, history shows that investment activity will provide a significant headwind to economic growth over the next few years. GDP per capita is likely to turn negative, as it has done following several terms of trade declines in Australia over the past century.

Conservative estimates suggest that declining investment activity could reduce annual GDP growth by around 3 percentage points, although it could end up being as high as 5 percentage points. Exports will fill that gap to some extent but housing investment and consumption will struggle to fill the rest.

A further complicating factor is that, unlike previous terms of trade episodes, demographics will not be working in the economy’s favour. We cannot rely on increasing participation, the rising number of women in the workforce or an increase in prime-age working Australians to boost output.

Instead, our population is ageing, resulting in subdued employment growth. As a consequence, GDP growth per capita may be weaker than in previous terms of trade episodes.

In Australia, the end of a terms of trade boom has historically resulted in two years of below-trend growth before returning to trend after five years. However, this time I expect growth will be weaker and the return to trend may take longer.

First, the decline in mining investment is expected to be particularly nasty and this may result in more weakness than in previous terms of trade declines. Second, weak employment growth resulting from an ageing population suggests that not only will below-trend growth persist longer than in previous episodes, but when the economy does return to trend growth, that trend will be a lot lower than we have come accustomed to in the past.

We have enjoyed the benefits of the boom and now Australia has to get ready to face some significant economic challenges.