Rates robbery: Don't get caught

That the Reserve Bank would keep official interest rates on hold at 1.5 per cent on Tuesday was the big non-news story of the week.

Yet, right under the central bank's nose, and borrowers' noses for that matter, banks and other lenders have been overtly lifting their mortgage interest rates since late last year.

First came fixed rates, with Australia's major banks increasing their rates on two, three, four and five-year loans for investors and owner-occupiers.

The banks have cited increases in their long-term financing costs as the primary reason for the fixed-rate rises.

Those higher financing costs relate to the banks' own cost of borrowings on overseas capital markets, primarily in the United States, where the Federal Reserve Bank has started hiking up official interest rates. It expects to announce more rate increases this year.

But, now, Australian lenders are beginning to lift their variable mortgage rates as well, despite expectations by many economists that the RBA will actually move to cut the official cash rate during this year.

This week Eureka Report asked financial research firm Canstar to search its database for lenders that had increased their variable loans rate over recent months.

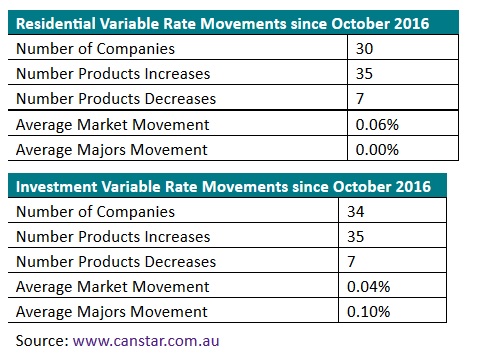

Canstar found that more than 30 lenders have increased both their investment and residential lending rates outside of the RBA's rates cycle, with an average 10 basis points rise by the big banks on investment property loans.

The above data is based on standard variable loan amounts of $350,000 on an 80 per cent loan-to-valuation ratio with principal and interest repayments.

“The major banks have increased investment rates but not residential rates, whereas the rest of the market does not appear to have discriminated between residential and investment,” says Canstar's group executive, financial services, Stephen Mickenbecker.

“The upward movement by the major banks exceeds the market average. This suggests that the 10 per cent cap on investment is biting and as they are having to ration investment lending, they are taking the opportunity to use the price lever. This is no doubt some of the heavy lifting in preserving margin.”

Know your rates

Interestingly, online home loan provider UBank released its own research this week showing 85 per cent of Australians don't know what interest rates they are paying on their mortgages.

UBank chief executive Lee Hatton says actively monitoring and seeking the best rate should be a priority for homeowners.

“Buying a home is one of the biggest investments of your life, so it's really important that you find the right loan that suits your individual needs. Simply knowing your exact home loan rate and managing it closely could save you thousands of dollars a year.”

Canstar's data shows the upward rate movements have generally been 10 to 15 basis points for both residential and investment loans.

But it hasn't all been one-way traffic, with some lenders producing decreases as well to remain competitive with other loan product providers.

In more recent moves on residential loans, RESI cut its variable rate by 25 basis points to 3.99 per cent, while Macquarie Credit Union went even further in dropping its rate by 60 basis points to 3.69 per cent.

In investment loans, Macquarie dropped its variable rate by 60 basis points to 3.88 per cent, Firstmac by 28 basis points to 4.09 per cent, loans.com.au by 30 basis points to 3.79 per cent, and Qudos Bank by 55 basis points to 4.39 per cent, putting them all well inside the market.

“There's been interesting moves by some of the smaller players. Some residential mortgage backed bond rates have come off in recent months, and I suspect that some of these guys have been able to fund favourably,” says Mickenbecker.