Putting the weak US payrolls result into perspective

The US labour market might have suffered a brief misstep but that was to be expected after a remarkably strong six months for job growth. There’s no reason to believe that the labour market won’t get back on track in September and finish off the year on a high note.

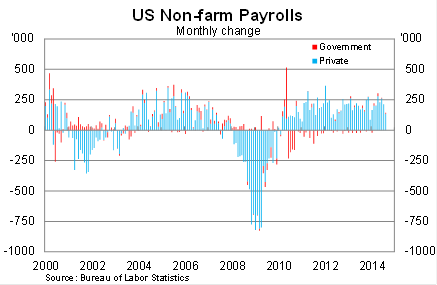

In a mixed labour market report, non-farm payrolls rose by 142,000 in August, missing market expectations, following strong gains since February. Payrolls were revised up slightly for July to 212,000 (from 209,000).

This might seem like a disappointing result but it should be put in some perspective. Non-farm payrolls rose by more than 200,000 in each of the past six months, during which time the labour market posted its strongest gains in more than eight years.

An ‘off’ month was always on the cards -- and perfectly normal even during strong periods -- but we simply didn’t know the timing. Anyone who believes, on the back of these data, that the US recovery suddenly looks shaky or that businesses have become more cautious is simply jumping the gun.

Private non-farm payrolls rose by 134,000 in August, while government payrolls were up by 8,000. Local government is driving public sector employment, with the federal government continuing to cut jobs over the past year (although momentum has shifted more recently). Government payrolls -- at all levels -- remain well below their peaks.

The services sector continues to drive the recovery, gaining a further 120,000 jobs in August. Over the past year, the services industry has accounted for 83 per cent of job growth, which is a little below its share of total employment.

The dominance of the services sector -- and muted household spending -- brings into question how many of the new jobs are solid, reliable, well-paying positions?

According to a report by the National Employment Law Project, lower-wage sectors accounted for 22 per cent of job losses during the recession but 44 per cent of employment growth through to February this year (Cautious consumers aren’t helping the US recovery; September 1).

People are finding jobs but they are often settling for lower-paid positions than they had prior to the global financial crisis. But who can really blame them? With long-term unemployment still about three million there remains no shortage of Americans who are desperate to take any job offered.

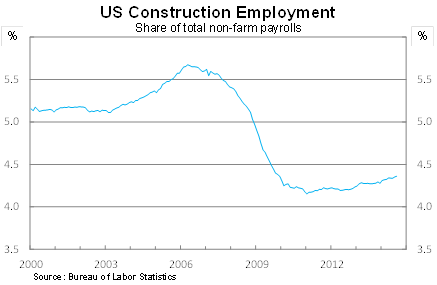

But there may be a gradual shift towards higher paying jobs soon. The construction sector has increased sharply over the past four months and has accounted for 9.5 per cent of total employment growth over the past year (well above its share of total jobs). I expect construction’s share to trend higher over the remainder of the year.

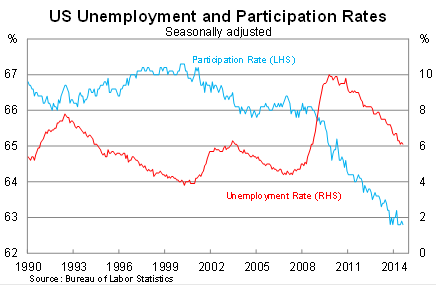

The unemployment rate fell modestly to 6.1 per cent -- from 6.2 per cent in July -- to be 1.1 percentage points lower over the year. The decline largely reflected a fall in the participation rate, which has stabilised recently but still faces some downward pressure from an ageing population (‘baby boomers’ retiring) and the long-term unemployed becoming fed up with fruitless job searches. The participation rate is now at its lowest level since 1978.

Although there remains considerable spare capacity and wages remain subdued, the labour market is generally performing more efficiently. Obviously job creation has been strong -- even if growth has been concentrated in lower-wage sectors -- but the median length of unemployment has declined to just 13 weeks; well down on the 22 weeks it typically took the unemployed to find a job back in late 2011.

Despite a bit of a misstep, the US labour market continues to improve and is heading towards its strongest year since 1999. Is everything perfect? Of course not and the recovery still has a way to go but recent data indicates that the Federal Reserve will be able to complete its asset purchasing program in October and then prepare the market for a rate rise in the first half of 2015.