Property v shares: The 2016 scenario

Summary: Property has performed better than shares over the last year but many factors will support both over the next year. Equities are very cheap compared to property as sentiment on Australian stocks is terrible. Shares are more volatile, although that creates investment opportunities that aren't often available in the property market. |

Key take-out: The scope for a double digit rally is greater for shares than property over the next 12 months. The property boom will live on but there is a limit to how long gains in Sydney and Melbourne can keep pushing at double digit rates. |

Key beneficiaries: General investors. Category: Shares, property. |

Which is more likely to outperform over the next year? Equities or property? It's a tough question, notwithstanding the fact that property has been the hands down winner over the last 12 months. Gains in Sydney have been around the 23 per cent mark, but other cities have fared well also. Property in Melbourne has returned around 15 per cent, Brisbane 9 per cent and Adelaide 8 per cent (all total return).

Equities on the other hand are barely into positive territory on an accumulation basis, although to be fair, only couple of weeks ago that was a 6 per cent gain. The market is very volatile at the moment.

To some extent, many of the fundamental factors supporting equities are the same as property. Ultra-low rates support the outlook for both, as does the strengthening economy. Indeed it is becoming much more obvious that the economy has more momentum than many had assumed. That's especially the case in the consumer space – with spending excluding food growing at a very strong pace. This is important, because consumer spending alone is about 55 per cent of total economic activity.

Even the RBA is becoming much more optimistic in its rhetoric – partly because the unemployment rate is so much lower than they expected and jobs growth stronger. A total of 243,000 jobs have been created over the last 12 months, with employment gains at their strongest in over four years.

At its last meeting, the RBA board suggested that “domestically, economic activity had generally been more positive over recent months” and went on to say “output growth was expected to pick up gradually from its below-average pace over the past year to exceed 3 per cent in 2017”.

These developments – a lift in growth domestically and offshore, strong jobs gains, a low unemployment rate – will act to underpin earnings growth, multiple expansion and ongoing strong gains in property.

But which has more value?

Well, on the traditional metrics (and they're not necessarily comparable it has to be said), a case can be made that both property and equities are expensive and that is the common wisdom. On a trailing basis, equites are currently at a 6 per cent premium relative to historical multiples, although admittedly that falls to a discount of between 12 and 20 per cent on forward earnings basis.

Property is, as we've all heard, in bubble territory and many people talk about the high price to income ratios as proof of just how bad this overvaluation is. As the Reserve Bank notes however, price-income ratios are not an appropriate measure of value. Indeed it couldn't even be said that it's even a valuation tool, as it's not mean reverting. Prices have in fact risen faster than incomes for the last six decades. The lack of information content in measure such as price-income ratios, makes it unlikely buyers in the market look at that ratio before making a purchase. So it's not relevant.

Cost of debt servicing – interest repayments and the like are more relevant and some like to make comparisons to rent. So for instance The Economist magazine has a series which compares house prices to rent and concludes that if the ratio is above average, then this points to an overvalued market. On that basis, Australian property is approximately 50 per cent over-valued. However this method suffers the same problem as price to income ratios – it's not mean reverting and simply noting that prices rise relative to incomes and rents consistently over the last 100 years or so tells us nothing about value.

Where absolute measures of value may fail, relative measures of value may give more valuable information.

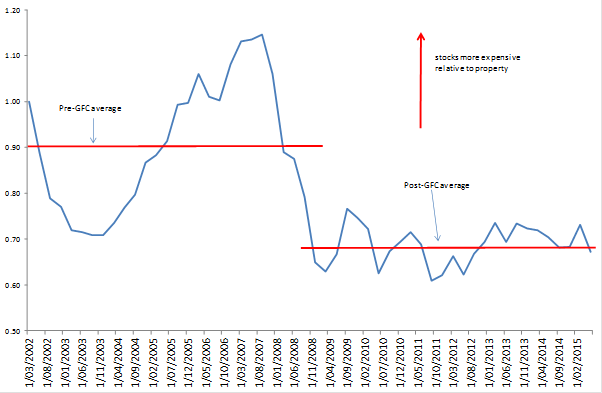

Chart 1: Which is cheaper, property or equities?

Chart 1 gives us a sense of relative value between equity prices and property prices and it suggests that comparatively – equities are very cheap compared to property. At a 25 per cent discount to the pre-GFC average.

When you look at the performance of our equity market over the last year or two you can get a sense of why that is the case. Mainly, it's because sentiment on Australian stocks is terrible – banks are weighed down by the actions of regulators and mining stocks are being smashed by concerns over commodity prices and China. Elsewhere, foreign investors are currently nervous about buying Australian stocks given the obsession so many have with forcing a lower exchange rate. Naturally, investors don't want to take the currency valuation hit.

And herein lies the problem. Equities and property both have great fundamental support, yet as a broad asset class stocks are comparatively cheaper. What isn't clear is what will break all this negative sentiment on the Aussie market, or when it will crack. It was only about four months ago that stocks were 10 per cent higher and the talk was of whether CBA cold crack $100. Who's to say we won't be facing these same conditions in another four months. Equities are much more volatile than property and things can and do change rapidly.

With that in mind it's a fair point – just on comparative valuations and given the much better yields on offer in the equities space – to note that the scope for a double digit rally is greater for stocks. At least over the next 12 months. That's not necessarily because stocks are intrinsically better as an investment. It's simply because equities have been so beaten up – so unloved – which makes them comparatively so much cheaper.

In my view, both property and equities stand as a great investment at this point. But they have different characteristics. Equities are much more volatile – investors have to be able to wear a 10- 20 per cent drop on what are, on the fundamentals, very good stocks. Yet that fact also creates opportunities for investment that you don't often get in the property space. I think we are in one of those periods for the equity market.

As for property, there is a limit to how long gains in Sydney and Melbourne can keep pushing at double digit rates – the risk is that growth moderates here. Sure, attention will increasingly focus on other areas and the property boom will live on but we aren't yet facing down the prospect of double digit gains just yet.

On balance, I think there is greater scope for that kind of performance in the equity market over the next 12 months.