Property: Anything to worry about?

| Summary: A slowdown in the US property market could have implications for Australia, as the same factors that drive a correction there would also occur here. |

| Key take-out: Recent data points to a slowdown in the US property market, and the harsh winter only tells part of the story. If a slowdown continues as the weather improves, it will have an impact on sentiment here and could pose a serious challenge for domestic property investors. |

| Key beneficiaries: General investors. Category: Property. |

What’s happening in property, and in particular US property? We need to know, not necessarily because everyone should be holding US property, but moreso because of the domestic investment implications.

In recent weeks, we’ve seen growing concerns over whether the US housing market will slow. Well, in some respects it already has slowed, notwithstanding this week’s surprise spike in new home sales – up nearly 9%.

The problem is that another much larger series – sales of existing homes (homes already built) – dropped by around 5% in January, and while weather definitely played a part, it wasn’t the entire story.

For instance, southern California, which isn’t experiencing these harsh weather conditions, saw home sales fall almost 20%. Similarly, the pending home sales index dropped nearly 9% in December and has fallen in each of the last seven months to be down about 17% over that period.

On the face of it, these are good reasons to believe that maybe there is more to the slowdown than the weather. Thus the growing concerns of a slowdown, or even a correction there.

Indeed, Federal Reserve chair Janet Yellen has urged caution in interpreting economic data, noting that the slowing "may reflect in part adverse weather conditions, but at this point it is difficult to discern exactly how much."

The point is that if there is a correction in the US, the same factors that drive that correction would occur here.

If the slowing is beyond weather factors then that would likely be a serious challenge for property investors here. Obviously those who directly invested in the US in recent years would be first hit but ultimately a US housing slowdown would affect sentiment here.

That’s the last thing we need if this investment cliff is even remotely correct, as housing was to be a key driver of growth – one of the rebalancing items. Certainly alarm in Australia would intensify, and that by itself could kill sentiment, especially since people are already concerned about a correction in Australia. According to RP Data, two thirds of respondents are worried about this. Probably more now, following the capex numbers.

So, why would the US housing market slow?

There are two elements of concern:

1. Rising mortgage rates. Since the Fed first announced and then subsequently started to taper, (reduce the pace of quantitative easing) mortgage rates have risen sharply as global bond yields rise. Indeed, the national average 30-year fixed rate is up a full per cent at 4.43% from 3.41%.

2. The spike in prices itself! The idea is that the 22% gain in house prices over the last two years – 13% in just the last year – has priced a lot of people out of the market. For instance, and as in Australia, first home buyers in the US represent a much smaller proportion of the market than normal because of the cost of housing (26% v 40%).

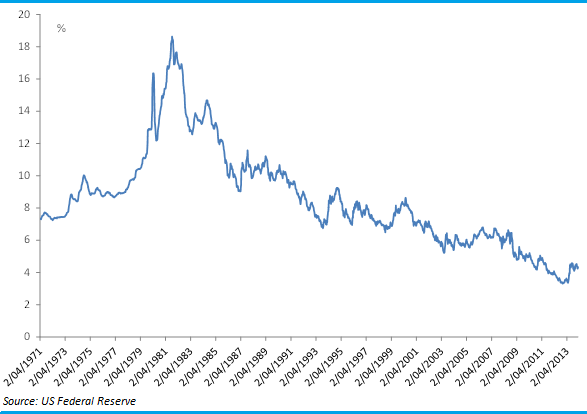

On the issue of rising mortgage rates, it is true that the low – 3.3% – is long gone and not likely to be seen again for some time. However, at 4.4%, the 30-year mortgage rate is still only just above the average seen since the GFC. Over the previous three years the average has been 4%. So the lift in the mortgage rates since the taper is extremely modest. It looks bad compared to the low – up over 1%, but perspective is important – the fact is that a rate of 4.4% – fixed for 30 years – is still incredibly low, as the first chart below shows. It’s still around the lowest in 50 years.

Chart 1: US mortgage rates still almost at a 50-year low

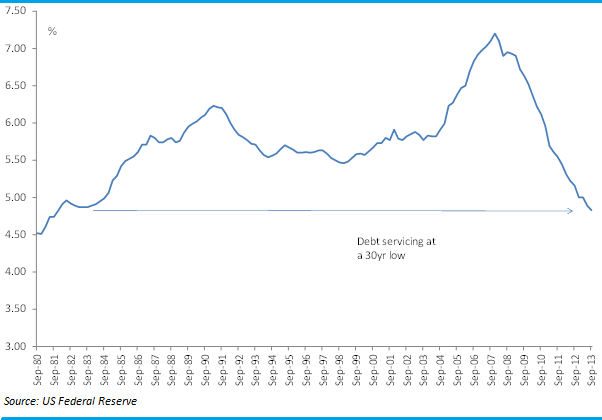

This is important because debt servicing is, as you can see from my second chart, very low. So I don’t think it’s right for analysts to be concerned that investors will be scared off by higher rates of interest. That just doesn’t make any sense. According to the US government, the average loan size in the US is around $US270,000. With an interest rate of 4.4%, that means your average interest payment is $235 per week – cheaper than the average rent (estimated at around $280).

Chart 2: US household debt servicing at a 30-year low

Now, as for the idea that the spike in house prices itself acts as a restraining force, I think the economics and logic behind it is wrong, because history shows house price inflation creates its own momentum and there are no signs of distress at the moment. There’s still a long way to run.

Think of it this way: Price gains of 13% or so and rental yields of 5-6% on average for the US eclipse the 30-year rate of 4.4%. The rental yield alone does. It is worthwhile in those circumstances to dis-save and gear-up. Only when those conditions change, which we are a long way from, is there any disincentive to buy property. Especially as the worst case scenario (in the US context) is that homebuyers or investors simply walk away from their loan and hand in the keys.

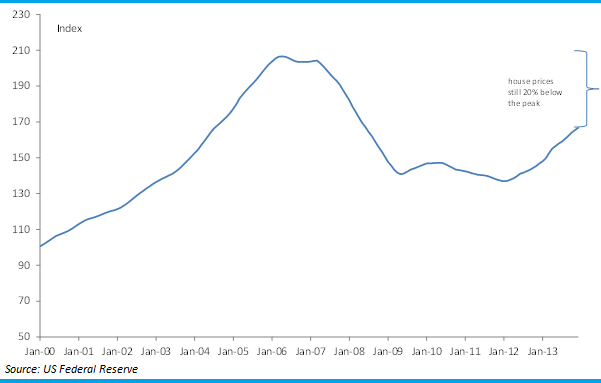

More to the point, US house price are still some way from their peaks. The chart below shows that while price momentum is currently strong, the overall level of prices is still about 20% below the peak reached in 2006. Record low interest rates, and the promise to hold them there for years to come, combined with a 30-year low debt servicing burden suggest the peaks of 2006 could easily be eclipsed.

Chart 3: US house prices still some 20% below a peak

Ok, so there’s no danger zone, but what if momentum just slows anyway - are there better investments than residential property?

Well, there’s no doubt a short-lived spontaneous slowing in price growth could occur this year, and I’m not going to table thump against it as prices don’t keep accelerating exponentially. Indeed, a Reuters poll shows most US economists expect housing price growth to moderate sharply this year, to something like 6 or 7% instead of the 13% gain we saw in 2013. That’s not a bad return by any means, but it does raise the issue as to whether better returns could be earned elsewhere.

If we do get that slowdown, I still wouldn’t be throwing in the towel on property. I think the sector will remain a strong performer both in the US and Australia and any moderation in price growth would be temporary. Why? Well if the above factors weren’t reason enough, there is one more that investors need to consider when thinking about the sector.

There is no sign yet of an emerging oversupply of housing.

Chart 4: Month’s supply of existing homes

In the US, there is 4.9 months of supply at the current sales pace, which shows that demand is strong relative to supply. The National Realtors Association advises that a supply of six months represents a rough balance between buyers and sellers. In Australia, the situation is similar and this week construction numbers even showed, residential investment falling.

The bottom line is that the US is a long way from the point where key distress indicators would suggest a problem. In many respects Australia is even further away. With that in mind, I don’t think the slowing in US housing foretells disaster. It’s been a very bad week for sentiment in Australia and I can understand that nerves have been rattled, but the fundamentals for both the US and Australian property are very strong.

* I realise a topic on everybody’s mind in recent days has been the domestic capex numbers. Headlines have been alarmist and I will deal with them, but I want to leave it to next week once we’ve seen the GDP numbers next Wednesday March 5.