Profiting from an ageing population

| Summary: Australia’s ageing population presents enormous opportunities for companies in the healthcare sector, and many are already in the box seat when it comes to capitalising on this trend. The only problem for investors is that the upside is already priced into many of these companies. But there are other investment opportunities, as older investors tend to prefer risk-averse assets. |

| Key take-out: In addition to defensive assets including bonds, another investment pasture beyond healthcare is companies that cater to the elderly through other products and services. |

| Key beneficiaries: General investors. Category: Strategy. |

The baby-boomer effect is well known, but far too often is misunderstood. We have an unprecedented rise in the over-65 age group and our working population is growing at a more modest rate. There are problems ahead, but there are also opportunities to profit as the population landscape changes.

Australia’s ballooning retirees

Australia’s overall population is rising by 407,027 people per year, comprising approximate growth of 97,000 in the 0-25 year-old bracket, 190,000 in the 25-64 year-olds, and 120,000 in the over-65s.

Just to clarify, this does not mean that we are accepting 190,000 new migrants or magically giving birth to a 76 year-old. Rather, there is a significant shift in our “demographic curve”. More specifically, the over-65 segment is growing at an unprecedented rate.

This spike in the over-65s has widespread implications. First and foremost, the Liberal government is going to have a tough time getting the books to balance. The logic is that we have fewer taxpayers and more claiming benefits; and this ratio of workers to non-workers takes its toll on the government’s finances. This means that the revenue collected in taxes will be unable to meet the increase in social security payouts (Centrelink payments such as the age pension) – a significant headwind when trying to turn around a deficit into a healthy surplus. Unfortunately for Prime Minister Tony Abbott and his successors, this is a structural change and will most likely be with us for a long time.

But rather than looking at the negatives; there are also positives. More specifically, many intelligent people are pointing to this spike in the over-65s as an area of opportunity. The theory is that the retirees (typically the over-65s) tend to increase spending on healthcare services and household necessities whilst reducing spending on other areas.

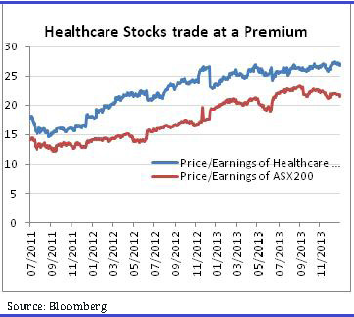

For this reason, healthcare services should theoretically be expected to increase their profits at a faster rate than other sectors. And, in this anticipation, I see a premium in the price people are willing to pay for healthcare stocks.

As an investor, your job is to find a high-quality asset and preferably pay a low price for it. This willingness to pay more for healthcare is an example of its popularity as an investment choice. The allure is understandable given the defensive nature of their income streams, but investors need to comprehend the fact that the majority of the upside is already priced in.

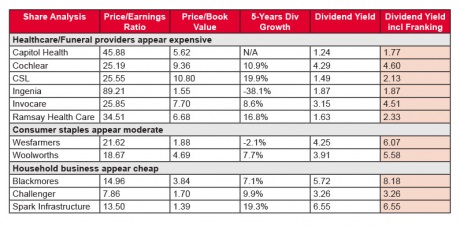

For contrarians that would prefer a bargain, you will be hard pressed finding anything in the healthcare sector with a price/earnings ratio of under 15-20x (the majority are over 25x). For this reason, most of the “value” managers worth their salt are avoiding healthcare. After all, the last thing you want is an expensive stock that is a dud.

Why the working population matters more

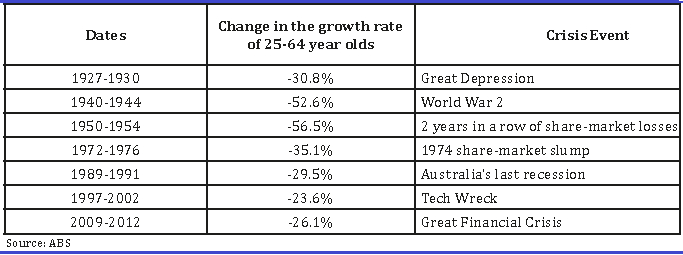

Outside of equities, data analysis also showed something extremely insightful. It appears that the movement in our working population has a far greater predictability of future opportunities than the over-65s category.

The grey shaded areas of the chart above shows a significant correlation between the biggest falls in the growth rate of this 25-64 year-old demographic and our most troublesome times. Said another way, in every single period noted above, the sharemarket fell sharply at some point during the time in which the working population suffered a setback.

At first glance, the naysayers might say this was coincidental or even causal; and they may be right. For example, World War II was not caused by a change in the Australian working population (it was clearly the other way around). Yet, regardless of cause and effect, the pattern is certainly striking and worthy of consideration.

I would not be so complacent to say that the prosperity of the economy or sharemarket hinges precisely on the number of 25-64 year-olds in Australia. Clearly, it is a small fish in a very large pond.

Yet, in a world where it is getting increasingly harder to outwit your competition, keeping an eye on this type of data can uncover something that the experts overlook.

How to invest in the face of this major change

Identifying a structural change is only half the battle, and requires another level of skill to profit from it. To reiterate my earlier point; the majority of demographics articles point investors to think about services for the elderly (healthcare, retirement villages and even funeral homes come to mind). This is all logical, but the premium to buy a company in these sectors arguably offsets the opportunities to gain.

Instead, recognise that an ageing population can create conservatism. It is a simple way of saying that as we age we tend to become more risk averse, meaning that bonds and other defensive investments (that offer conservative returns) will increase in popularity as our population ages. Indeed, the strong following garnered by bank stocks over the last two years reflects this trend – while the broader S&P/ASX 200 lifted by almost 20% in the 12 months to December 2013, the larger banks – buoyed by their bond-like yields – rose by up to 30%.

For those wanting a tactical tilt, retirees are hungry for secure earnings and a fat dividend cheque.

Separately, it’s clear that far too many are focused on the obvious attractions of healthcare, while other stocks that cater to the elderly with preferable valuation metrics are less well-known.

A standout in this space is household utilities and personal product companies often trading on a price/earnings ratio of less than 15x, which look far more fundamentally attractive than their healthcare peers.

As always, doing your homework and turning over rocks can quite literally pay dividends.

This is an edited version of an article which first appeared in “The Investing Times” newsletter, which is published by Lachlan Partners and to which Scott Dixon is a regular contributor.