Prepare for more labour market pain

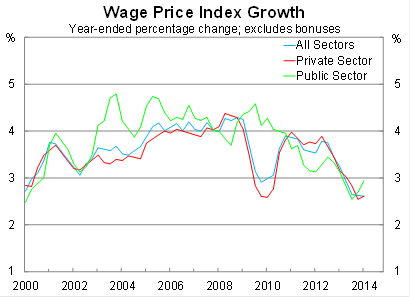

Wages excluding bonuses rose by 0.7 per cent in the March quarter, consistent with market expectations, to be 2.6 per cent higher over the year. Australian wages are growing at their slowest annual pace in at least 16 years (the measure only goes back to 1998).

Private sector wages continue to be weak, rising by just 2.6 per cent over the year. By comparison, public sector wages rose by 0.8 per cent in the quarter to be 2.9 per cent higher over the year.

Private sector wage growth has slowed further than it did during the global financial crisis. However, unlike the crisis, public sector wage growth has also followed suit.

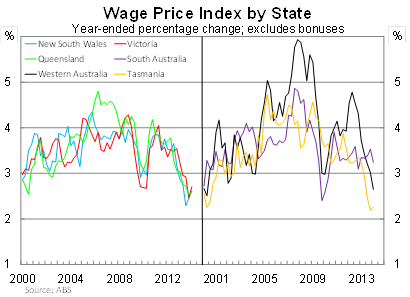

At the state level, wages have slowed significantly in every state besides South Australia. However, wage growth there is propped up by a particularly large September result and it should converge with the other states towards the end of the year.

Wage growth is subdued across basically every industry, including the mining sector. It’s fair to say that few Australians have enjoyed much of a pay rise over the past year.

The persistent weakness in wages has some important implications.

First, it provides further evidence of rising spare capacity in the Australian labour market. When new jobs have become available, there has been no shortage of available candidates. That is leading to soft wage growth.

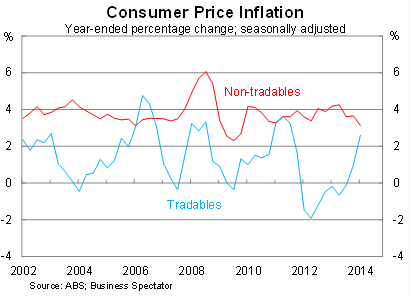

Second, it indicates that domestic inflation pressures are likely to stay contained in the near term. Wage growth feeds directly into non-tradeable inflation, which is showing signs of moderation. That should continue as long as wage growth remains at historically low levels.

Third, living standards have fallen over the past year with inflation exceeding annual wage growth. Effectively our wages can purchase less than they could last year.

Fourth, it indicates that household spending growth is likely to moderate following a particularly strong start to the year. Although households can continue to spend out of their accumulated savings, households are likely to take a more cautious approach following the announced budget measures.

If the recent decline in consumer confidence is any indication, households may begin to tighten their belts sooner rather than later. The Westpac-Melbourne Institute measure of consumer confidence fell sharply in May -- though at a comparable level to some other budget months -- while the ANZ-Roy Morgan measure has declined to its lowest level since the global financial crisis.

An important caveat though is that households can sometimes overreact to the budget and confidence measures could normalise in the following few months.

Conditions in the labour market, including wage growth, are one of the reasons why I am concerned with the federal government’s decision to cut benefits and tighten eligibility for unemployment benefits.

Cutting benefits and tightening eligibility makes some sense when the economy is operating at around full employment. In that situation, a prolonged period of unemployment is more about the individual than the economy.

But when the economy is subdued, the blame shifts: long-term unemployment has more to do with the economy than the individual. Basically, cutting benefits is fine as long as there are sufficient jobs being generated with good wages and conditions. That isn’t the case right now.

Despite a modest pick-up in employment growth earlier this year, this has yet to feed through to wage growth or wage demands. There remains considerable spare capacity across the Australian economy, with many Australians struggling to find a new job, and this will likely result in inflation remaining within the Reserve Bank of Australia’s target band of 2 – 3 per cent over the medium term.