Prepare for an equities acceleration

PORTFOLIO POINT: Companies with high profit potential and good dividend streams are set for growth in the next year.

About six months ago I suggested that it was possible to construct an equity portfolio that would reward investors with a return of about 10% per annum, compounding over the next few years.

This view was generally at odds with many commentators, who were preoccupied with the gloom emanating from Europe, the perceived slowdown in China and uncertainty in the US. While markets dipped around May-April, we have since witnessed a fairly solid rally in stock prices since then.

This rally has been driven by the continuing and unrelenting pervasive effects of the quantitative easing (QE) programs undertaken in major offshore economies – by which central banks are increasing money supply to stimulate growth. The rally in equity prices is the result of the sustained rally in bond yields generated by a gathering market belief that calamity has been averted by QE policies.

In my view, the outlook for the first half of 2013 is for more of the same. There is no end in sight of the QE programs, and there could well be a significant expansion in the US (again) concurrent with the massive QE to be undertaken in Europe. Across in the UK and Japan, the reliance on QE will be omnipresent once again as both of these economies continue to exhibit signs of distress.

From the Australian perspective, I believe the recent rally in our equity market has some way to go and therefore it is easy to build the case for the expectation of another 10% return from our equity market over calendar 2013.

Indeed the returns might exceed this should, as I expect, the Australian dollar depreciates against the US dollar in the second half of 2013. I believe the US economy and its political resolve are building a base to propel the economy into a solid recovery. This development will be positive for the Australian market, as will the continued growth in China’s economy.

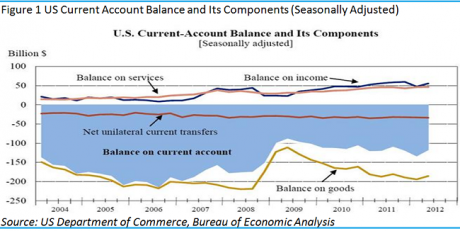

My view of the US is supported by the improvement in the US current account deficit. The mild improvement since 2006-07 is the result of the lower cost of debt (a QE effect) in spite of increasing absolute debt levels. The current account will improve dramatically when the US fully develops its burgeoning unconventional energy sector, which is heavily based on shale gas.

I believe that the current and soon-to-be negotiated economic policies (“fiscal cliff”) plus the development of its energy sector will balance the current account in 2014-15 (Also read Clearing the cliff overhang). If this becomes apparent, then the US dollar will rise and so will US bond yields (bond prices down).

I note that the potentially calamitous effects of the declining value of long-term US bonds are currently being resolved by successive “operation twists”, whereby the Federal Reserve (Fed) continues to purchase large quantities of long-term bonds. Remember it is long-term bonds that will suffer the most capital loss should bond yields rise. This is due to their duration, but this loss will mainly be borne by the Fed (with printed currency). I suspect that there are large international pension funds that also own these assets and they will have a bit more time to unwind their positions. The risk and return profiles of 10 to 30-year US bonds do not make sense, but that is not our worry at this point. Rather, the low offshore yields support a positive view of the Australian equity market because these low offshore interest rates are now washing ashore into the Australian market. This is the effect of the massive capital flows that emanate from QE.

It is the ongoing pervasive effect of QE that supports a rising Australian equity market. The emergence of a recovery in the US could well be the icing on the cake.

While good returns will be generated by equity yield or dividends, I suggest that capital gains for our market could accrue at an increasing rate as the capital values of income generating assets (equities and hybrid securities) are bid up. In fact, this is already happening (click here). The question is whether these gains are excessive or sustainable. To resolve this dilemma it’s important to have a realistic view of what is the absolute desired return from the different classes of investment assets. To do this we must accept that the risk-free rate of return (as defined by the 10-year bond yield) has been debased. Therefore, we must be careful not to accept low returns by overvaluing yielding assets.

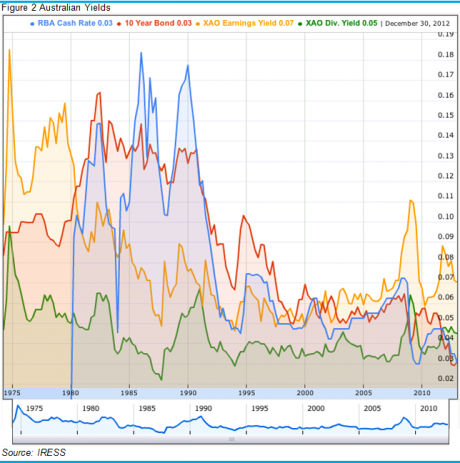

The following chart is instructive. It tracks the longer-term interaction between short-term interest rates (set by the RBA), the Australian 10-year bond (set by the open market), and the earnings and dividend yields of Australian equities. A quick observation notes that the current market prices are unlike anything witnessed in the last 40 years. While bond yields and interest rates are at historically low levels, the earnings and dividend yields of equities remain at elevated levels. Assuming bond yields stay low (the QE effect) and the RBA remains aggressive in cutting rates (trying to offset the QE effects on our currency), then the equity market looks attractive.

The above chart suggests to me that the Australian equity market is in value, on a relative basis, compared to bonds or interest-earning assets. Looking further out, I would suggest that an economic recovery across the world in the second half of this decade will lead to far better returns from equities than interest-based securities. A declining A$ should propel Australian company earnings and offset the negative valuation effects of rising bond yields. After many years of going sideways (now over seven years), the Australian sharemarket is set for steady gains and the pre-tax dividend yield returns from Australian equities will generally exceed those of term deposits.

Summary

While I do not deny or underestimate the economic and debt issues that confront the Western World, I am suggesting that positive economic policies are slowly changing the economic environment. In turn, this is creating an upward draft on the value of equities.

I remain most concerned about the outlook for the larger European economies of the UK and Spain. Also, there is political upheaval developing in Italy at a most inopportune time. But my concerns for the Eurozone are tempered by the observation that its members do seem to have developed a political consensus on a path to safeguard the integrity of the Eurozone, however convoluted that path may be. As for the UK, we should watch developments with interest because it is looking increasingly isolated with no clear way forward.

In passing, I maintain a positive outlook for China and a developing positive outlook for the US swamps the concerning issues emanating from Europe. Remember the US and Chinese economies now represent 35% of world GDP and are therefore twice the size of the Euro economic zone.

As for Japan, I remain perplexed by its ability to survive under its mountain of debt with its ageing population. But it has done so for many years now. Time is running out for Japan, but not just yet.

As always I temper my macro-economic observations with a disciplined valuation methodology – driven as it is by a realistic view of what a proper investment return should be. On this basis, and due to my expectations of lower interest rate returns, I can reaffirm my positive outlook for equities and more so for those companies that exhibit high profitability characteristics and solid dividends. It worked last year and it will continue to work in 2013.

John Abernethy is the chief investment officer at Clime Investment Management. If you’re a sophisticated investor, wholesale investor or have $500,000 or more to invest, Clime are offering you the opportunity to discuss your portfolio and investment options with John Abernethy. Click here

Clime Growth Model Portfolio

Return since June 30, 2012: 20.89%

Returns since Inception (April 19, 2012): 12.42%

Average Yield: 6.40%

Start Value: $111,580.24

Current Value: $134,887.03

Clime Growth Portfolio - Prices as at close on 13th December 2012 | |||||||

| Company | Code | Purchase Price | Market Price | FY13 (f) GU Yield | FY13 Value | Safety Margin | Total Return |

| BHP Billiton | BHP | $31.45 | $36 | 4.64% | $42.35 | 17.64% | 15.01% |

| Commonwealth Bank | CBA | $53.10 | $61.28 | 8.09% | $61.37 | 0.15% | 21.65% |

| Westpac | WBC | $21.13 | $25.98 | 9.57% | $27.54 | 6.00% | 27.35% |

| Blackmores | BKL | $26.25 | $32.04 | 5.93% | $29.85 | -6.84% | 25.32% |

| Woolworths | WOW | $26.80 | $29.53 | 6.48% | $31.22 | 5.72% | 14.26% |

| Iress | IRE | $6.55 | $8.01 | 5.69% | $7.62 | -4.87% | 24.16% |

| The Reject Shop | TRS | $9.15 | $15.88 | 3.78% | $15.53 | -2.20% | 57.02% |

| Brickworks | BKW | $10.10 | $11.15 | 5.25% | $12.27 | 10.04% | 13.74% |

| McMillan Shakespeare | MMS | $11.82 | $13.51 | 5.39% | $13.84 | 2.44% | 18.59% |

| Mineral Resources | MIN | $8.95 | $9.19 | 7.46% | $11.95 | 30.03% | 5.68% |

| Rio Tinto | RIO | $56.50 | $62.75 | 3.87% | $65.20 | 3.90% | 10.85% |

| Oroton Group | ORL | $7.30 | $6.85 | 10.64% | $6.22 | -9.20% | -0.58% |