Prepare for a sharp house price punishment

The housing debate heated up this week with spirited discussion between Professor Steve Keen and Christopher Joye on both Business Spectator and The Australian Financial Review. Though some of the economic message may be lost among the personal politics, households and investors should heed their basic warning: house prices are increasingly overvalued and are at a genuine risk of falling sharply in the years ahead.

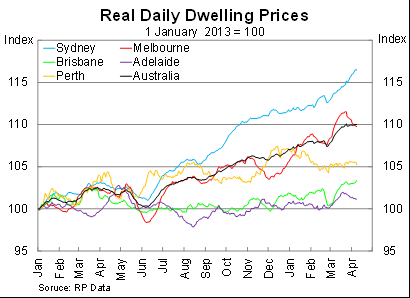

It is hard to ignore the rapid rise in house prices since the beginning of 2013. Sydney house prices, adjusted for inflation, have climbed by 16.5 per cent over the past fifteen months. Melbourne prices are up by almost 10 per cent over the same period.

What has been interesting about this boom is how localised it has been. Outside Sydney and Melbourne growth has mostly tracked incomes.

Speculative activity is the distinguishing factor between Sydney and Melbourne compared with the other capital cities. The strong growth in Sydney and Melbourne simply cannot be explained by fundamentals such as income growth or construction costs. The likes of Brisbane and Adelaide have experienced little growth in speculative activity and consequently observed little price growth.

There is a tendency in Australia to believe that house prices always rise. It is a product of rapid growth during the two decades up to the early 2000s when momentum in the housing market could rarely be quelled. The view has been pushed further by dodgy property spruikers, state and federal governments with vested interests and the media’s sometime unhealthy obsession with housing.

What is often not appreciated is how unique that period was. A number of factors conspired to create a perfect storm for house price growth: banking deregulation, demographics and the resource boom.

First, banking deregulation, low interest rates and low inflation created an environment where households could borrow more than ever before. Lending capacity rose sharply, credit growth with it and housing was the major beneficiary.

The two decades from the mid-1980s created what I like to refer to as a structural break. It was a one-off boost to house prices, which took around twenty years to flow through the market, and can never be replicated again. Housing debt will never again increase almost five-fold as a share of income; consequently neither can house prices sustainably rise as they did during the 1990s.

Second, favourable demographics – such as the rise of two-income families – were a boon for the housing sector. But with female labour market participation no longer rising and overall participation on a downward trajectory, our demographics have finally begun to work against the housing market. With the ‘baby boomer’ generation beginning to retire, demographics will begin to put downward pressure on house prices.

Third, the resource boom led to an unprecedented period of economic prosperity for Australia. Strong income growth and over twenty years of uninterrupted expansion created a perfect environment for housing speculation but also for legitimate price growth. With the terms-of-trade boom in the rear-view mirror, and demographics working against the economy, Australia can no longer assume that recessions are solely the problem of other lesser economies.

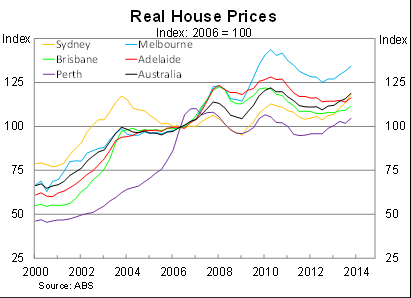

However, despite largely favourable conditions, house prices do fall and it happens more often than many think. Over the past decade Sydney has experienced three serious housing downturns; the other capital cities have had two downturns and a milder period of stability between 2004 and 2006.

The Sydney downturn in 2004 offers insight into today’s episode. Then, like now, there was a rapid rise in Sydney house prices that was primarily driven by speculation. When investor demand subsided, house prices declined to such an extent that it took a decade before Sydney prices returned to their previous peak.

The biggest threat to house prices right now isn’t the next interest rate rise, which remains some way off, but the likelihood that investor demand will soon become exhausted. Low interest rates cannot encourage investors to bring forward their investment decisions indefinitely, even if foreign buyers and self-managed super funds are boosting demand.

What will happen to prices when owner-occupiers and first home buyers are required to fill the void? History suggests that prices could decline sharply. I’d be very concerned if I was jumping into the market right now; there’s a good chance you’ve already missed the boat.

Despite what you might hear – particularly from property spruikers – house prices do fall. Three property downturns in a decade, combined with the recent boom in Sydney and Melbourne, suggest that the next one might be right around the corner.

However, investors and other buyers must also be aware of some of the long-term risks. For two decades the housing market benefited from a number of one-off factors – such as banking deregulation, favourable demographics and the mining boom – none of which can be replicated. Past performance is not an indicator of future performance and rarely can that be applied better than to Australian housing.