Perennial's LIC with a twist

Summary: Perennial Value is floating a listed investment company called Wealth Defender Equities that aims to cushion investors against market falls. The fund uses risk management strategies with the aim that WDE would only fall half as far as the broader market in times of stress. The managers take a long-term view and hope to offer investors some peace of mind. |

Key take-out: The LIC is designed for SMSF investors, with plans for regular dividends and a strong mid-cap bias. |

Key beneficiaries: General investors. Category: Shares. |

In the rush of listed investment companies that have floated in recent times, a new offering with a twist has arrived from a well-known fund manager. Perennial Value's Wealth Defender Equities (WDE) has been designed with SMSF investors firmly in mind, particularly those who are already retired, and aims to use a particular set of risk management strategies to protect funds. WDE is hoping to raise between $50 million and $160 million, with the offer open now and closing on May 5.

Perennial Value has $8.2 billion in funds under management, and its Australian Shares Trust has posted a long-term outperformance of 2.61 per cent per annum net of fees over the past 15 years, when compared to the S&P/ASX 300 Accumulation Index.

Protecting capital

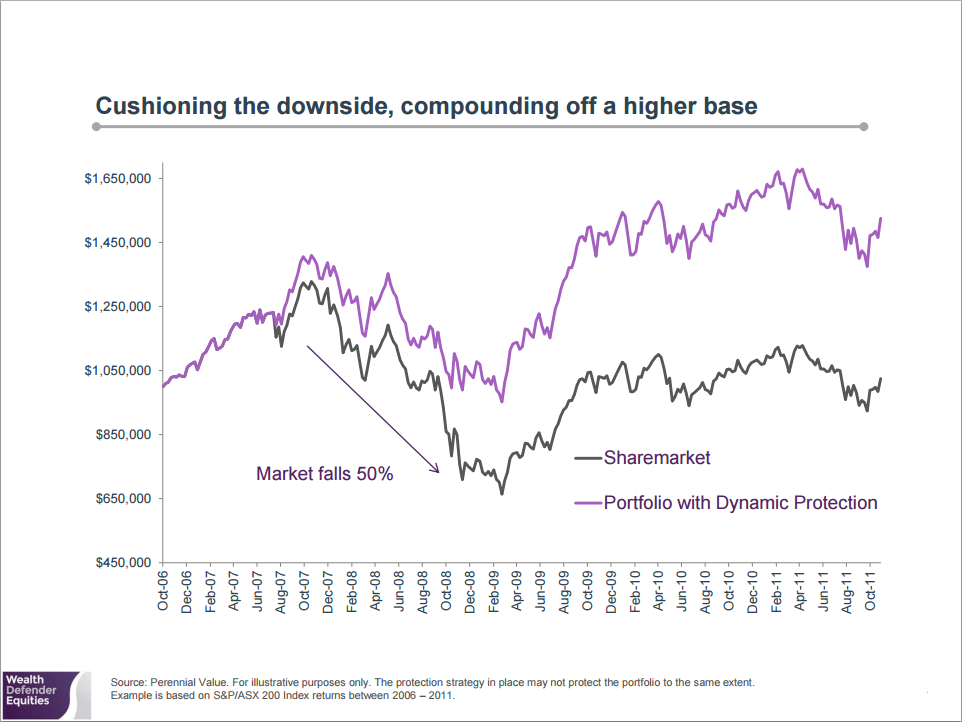

The fund is designed to preserve capital, and Perennial Value managing director John Murray compares its strategy to a cushion or an airbag against market shocks. If a fund falls less sharply than a broader share market down turn, not only is a greater proportion of the capital preserved, but the funds are then able to compound from a higher base, Murray explains. The LIC aims to preserve capital in times of market stress, with the aim that WDE will only fall half as far as the market. This means that if the index falls 50 per cent, WDE would expect to fall 25 per cent. This means WDE then has to rise only 33 per cent to return to its initial position, while the index would have to rise 100 per cent to return to where it started. “That's a wild example, that's a GFC-type example, which doesn't come along that often,” Murray says. “Well who knows, maybe it will – it's an uncertain world out there.”

Figure 1: Perennial's illustration of its protection strategy

WDE expects to invest 97 per cent of its funds under management in Australian equities and 1-2 per cent in capital protection strategies at all times, predominantly by using derivatives. Portfolio managers Dan Bosscher and Scott Stewart have experience in derivatives trading at investment bank UBS. The fund's risk management technique is to buy put options over the S&P/ASX200 Accumulation Index – that is, buying the right to sell the index for a specific price if the index falls below that price. If the index does fall, the options become valuable, creating a profit that offsets falls in the LIC's share portfolio. “It's not a guarantee like insurance is, but it operates in a similar fashion,” Stewart says.

Stewart says individual investors could purchase derivatives on their own in order to cushion their portfolio, but that as an institution it's possible to buy the instruments for at least one third cheaper. He also says an individual might buy an option and leave it in a drawer and forget about it, but the team of managers can make sure that the fund has the most up-to-date protection as the market moves.

Murray emphasises the fund's “prudent” use of derivatives for risk management purposes. He points out that there is no short selling and no gearing across the portfolio.

Focusing on SMSF investors

Murray hopes the fund's emphasis on capital protection can give investors peace of mind, as well as preserve their assets over what may be a very long retirement period. He says the idea for a fund that cushioned against market falls arose after watching the steep losses incurred in the GFC, where many funds were compelled to remain fully invested despite falling prices, and where some financial products that purported to offer protection meant investors were locked into cash at the bottom of the cycle, unable to take advantage of opportunities to buy cheaply. Perennial's research shows that over the 20 years to 2014, more than 90 per cent of negative six-monthly periods were falls of up to 20 per cent. Falls of greater than 20 per cent are much rarer.

Meanwhile, conscious of SMSF investors' income needs, Perennial expects the LIC to pay dividends twice a year, with an initial yield between 4 per cent and 4.5 per cent (that is, between 6 per cent and 6.5 per cent grossed up).

Murray also notes SMSFs' substantial allocation to Australia's big banks, miners, supermarkets and Telstra. “That worries me, that high concentration, because not every business is perfect, and things can go wrong from time to time,” he says. The LIC has a strong bias to stocks outside the ASX20, allowing it to provide some diversification. The bulk of the funds are set to be held in mid-cap stocks, with around 6 per cent in small caps in the $250m-$750m market cap range.

Murray points out that this is an Australian equities fund – although the prospectus allows for a small allocation to international securities of up to 10 per cent, he says this is designed to allow for dual listed stocks or the purchase of international derivatives, should it ever be desirable. The fund will not have an exposure to international shares, even though this is an area where many SMSFs have traditionally been underweight. This could be seen as a drawback by SMSFs looking for offshore exposure, but Murray says that offshore investing would have been more attractive when the Australian dollar was much higher, and that the currency has already fallen too far for the fund to consider an international allocation.

But there are still mid-cap Australian stocks that are in value, and there is also value available at the smaller end of the market, even if the overall market looks a little bit over-valued, Murray says. He declines to name individual picks as the fund is not yet invested. On the other hand, he singles out healthcare as one sector that is particularly expensive, with high price-earnings ratios and lower yields. He looks for companies with strong balance sheets and growing profits and prefers to avoid investing in companies with high debt levels.

Calculating fees

The LIC has a base fee of 0.98 per cent per annum. Perennial hopes to raise up to $160 million at IPO, but over time, if the funds under management pass $250 million, the base fee will reduce to 0.8 per cent.

The LIC will also charge a performance fee of 15 per cent of its net returns (with the base fee already taken out) above its benchmark, the S&P/ASX300 Accumulation Index. The performance fee is still payable in the case of a negative return that still beats the benchmark.

The fee structure also includes a high water mark, meaning that if the fund misses its benchmark one year, then in the second year, its performance must recover to the level it should have reached had it met its targets both years, in order for the performance fee to be payable.

“We've always aspired over the 15 years at Perennial Value to a fair day's pay for a fair day's work and this is no exception,” Murray says.

Investing for the long term

Over 15 years Perennial's portfolio turnover has been around 30 per cent, that is, turning over the portfolio around once every three years, taking a longer-term view than many other funds with a turnover of 100 per cent of the portfolio every year.

Both Lonsec and Zenith have given the LIC a “recommended” rating, although they acknowledge the degree of key person risk inherent in the boutique fund manager. Murray will be an investor in the float of the new LIC, in keeping with Perennial staff members' voluntary investment in the group's funds. He sees the fund as a long-term proposition of five years plus. The IPO is structured to minimise short-term trading, at least initially. Each share in the IPO comes with one option, which is granted only if the shareholder holds their full allocation for six months after the float.

Investors are right to think carefully about funds that charge a performance fee even in times of negative returns. But WDE's focus on risk management and capital preservation, combined with an emphasis on regular dividends, is sure to make it worthy of examination for many self-funded retirees.