PE ratios: The franking factor

Summary: Franking credits add more than 2% per year to the returns of many investors. Calculations of price/earnings ratios don’t reflect the benefit of franking credits. But it is possible to work out a company’s earnings yield including franking credits, as well as its PE ratio including franking credits. |

Key take-out: If the value of franking credits is factored in, many companies’ earnings yields and PE ratios appear much more attractive. |

Key beneficiaries: General investors. Category: Shares. |

Franking credits are a key benefit to Australian investors who invest in companies paying franked dividends. But calculations of price/earnings (PE) ratios don’t reflect franking credits. Given that franking credits are worth at least an extra 1.5% of return per year for an average portfolio of shares, and for an Australian investor are equally as valuable as the cash component of a dividend, it would make sense for the PE ratio to reflect this.

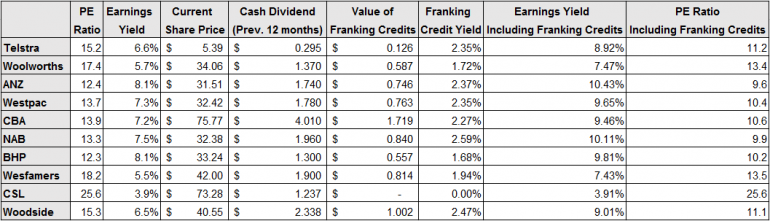

We can work franking credits into the PE ratio using our own calculations. The impact can be substantial – for example, the value of franking credits for Telstra is an additional annual return of 2.38%. If this is factored in, Telstra’s PE ratio drops from 15.2 to 11.2.

The PE ratio, alongside a company’s dividend yield, is the most common financial ratio used to help assess companies or markets or, as Percy Allen showed recently, various asset classes (See Over-valuation? Not in this share market). There is some evidence that suggests companies with lower price/earnings ratios, which are often termed “value companies”, might provide investors with higher long-term returns. Some of the research of Gene Fama, last year’s Nobel Prize winner in economics, supports this notion. A lower price/earnings ratio signals that a company has a higher level of earnings for a given price.

Perhaps a more intuitive way to understand this is to take the inverse of the PE ratio, which gives us the earnings yield of a company. For example, let’s consider three companies with a PE ratio of 20 (company A), 15 (company B) and 10 (company C). To calculate the earnings yield of each of these we divide 1 by the PE ratio. For company A, the earnings yield is 1/20 = 5%. For company B the earnings yield is 6.7% and for company C the earnings yield is 10%.

The reason I find this easier to understand is that the earnings yield immediately gives me an idea of what return I can expect from the company that I invest in. Company A provides an earnings yield of 5%, compared to company C’s earning yield of 10%. Of course, there is still limited information contained in this calculation. It does not give us information about earnings growth (or decline) over time, or what the price movements of the shares might be and how that translates to shareholder return. But what it does do is give us some information about how the earnings compare to the current share price.

Let’s extend this further for some well-known Australian companies – Telstra, Woolworths, Commonwealth Bank, National Australia Bank, Westpac, ANZ and BHP – and calculate the earnings yield for each company.

PE Ratio | Earnings Yield | |

Telstra | 15.2 | 6.6% |

Woolworths | 17.4 | 5.7% |

ANZ | 12.4 | 8.1% |

Westpac | 13.7 | 7.3% |

CBA | 13.9 | 7.2% |

NAB | 13.3 | 7.5% |

BHP | 12.3 | 8.1% |

This earnings yield shows us the company earnings – some of which will be paid to investors as dividends, some of which will be used by the company for new projects and to repay debt.

A key application of PE ratios and earnings yield is made by Wharton Business School Professor Jeremy Siegel. A PE ratio of 15 equates to an earnings yield of 7%. He argues that if that company with a 7% earnings yield can increase its income by the rate of inflation, and its expenses by the rate of inflation, an investor could expect to receive a return of around 7% after inflation, which is similar to the long run return investors have received from investing in shares (he uses US share market data from 1802 – 2012 to show the returns after inflation were 6.6% per year over this extremely long period).

The core point of this article is to add the value of franking credits into these calculations of PE ratios and earnings yield. The following four-step process does this.

Step 1

All seven companies that we looked at in the previous table pay fully franked dividends, so the value of franking credits can be found by multiplying the cash value of each company’s dividend by 3 and dividing by 7.

Step 2

Once we have found the franking credit value we can express this as a percentage return, which I have titled the “franking credit yield”, by dividing this cash value by the current share price. It is worth noting just how valuable franking credits are – providing an extra 1.66% return in a relatively low dividend yield share like BHP, through to an impressive additional 2.42% return for ANZ.

Step 3

Add this franking return to the earnings yield and we have the “earnings yield including franking credits”.

Step 4

We can turn this into a PE ratio including franking credits. As the table shows, including franking credits in our calculation of PE ratios makes the PE ratios considerably more attractive.

An important limitation of this calculation is that it focuses on the return that we as Australian investors receive, rather than the way the overall market might assess the value of any particular company. Including franking credits in a PE ratio does not make the stock more attractive to overseas investors.

Adding the value of franking credits to the earnings side of the PE ratio is also not as “neat” as it might seem at first glance. However, it is worth remembering that franking credits are generated from a company’s payment of tax. On that basis we have effectively modified the earnings of the company to include the tax benefit passed on to investors.

Conclusion

Franking credits are an attractive part of the Australian tax system, and add more than 2% per year to the returns of many investors. This additional source of returns is very rarely used when we calculate financial ratios but, when we do, we find that a company like Westpac, on a PE ratio of 13.9, provides a franking credit return of 2.4% per year. When this return is added to the “earnings” part of the PE ratio of the company, it drops to 10.3.

Frequently Asked Questions about this Article…

Franking credits are a tax benefit that Australian investors receive when they invest in companies paying franked dividends. They add more than 2% per year to the returns of many investors, making them a valuable component of investment returns.

Franking credits are not typically reflected in standard PE ratio calculations. However, by factoring in franking credits, the PE ratio can appear more attractive, as it effectively reduces the PE ratio by increasing the earnings component.

Earnings yield is the inverse of the PE ratio and provides an idea of the return you can expect from a company. For example, a company with a PE ratio of 20 has an earnings yield of 5%. It helps investors understand how earnings compare to the current share price.

To calculate the earnings yield including franking credits, you add the franking credit yield to the standard earnings yield. This gives a more comprehensive view of the potential returns from an investment.

Franking credits are specific to the Australian tax system and provide benefits primarily to Australian investors. Overseas investors may not receive the same tax advantages, making franking credits less attractive to them.

For companies like Telstra, factoring in franking credits reduces the PE ratio from 15.2 to 11.2. Similarly, Westpac's PE ratio drops from 13.9 to 10.3 when franking credits are included, making these companies appear more attractive to investors.

Franking credits can add more than 2% per year to investment returns, which aligns with long-term returns observed in the share market. This additional return can significantly enhance the overall performance of an investment portfolio.

The process involves calculating the franking credit value, expressing it as a percentage return (franking credit yield), adding this to the earnings yield, and then adjusting the PE ratio to reflect the inclusion of franking credits.