Patience, income investors - rates to move higher… eventually

| Summary: The global economic recovery is occurring more slowly than normal after a sharp downturn. While the Australian dollar will head lower over the next few years, in the short term, overseas actions by central banks will override other factors in setting the dollar’s direction, which will in turn – along with commodity prices - determine the outlook for interest rates. Mortgage rates will drift higher, but slowly. |

| Key take-out: A review of Clime’s Eureka’s income portfolio suggests it is best to hold the current position. The returns of the income portfolio from inception and over this financial year remain excellent. |

| Key beneficiaries: General investors. Category: Economics and Investment Strategy. |

| Recommendation: Hold Macquarie Group floating rate note (MBLHB) and hold NAB income securities (NABHA). |

Economists seem to continually attract criticism from investors and I think there is a fairly simple reason for this. Essentially economists are fairly hopeless in predicting the short term direction of markets – but in their defence, I ask who is?

No one should discount the significance of economic analysis in assessing markets and cycles. I suggest that it is always vitally important to analyse and consider current events from a historic context. The power of economics is in its presentation of the economic environment. From this, a view can be developed on the sustainability and durability of a cycle, noting that we are constantly living through large and short cycles.

Think about it before you dismiss economic analysis as non-essential. For instance, are not the outlooks for inflation, commodity prices, the currency and economic growth all vitally important for determining the fair level of interest rates? It is from an understanding of the direction of interest rates that an investor can derive their required return for investment assets based upon their specific risk profile.

In this report I will consider the outlook for the income portfolio and to do so let’s first understand the economic environment.

A review of recent RBA charts

To begin I believe that the March Chart Pack from the RBA is certainly helpful in understanding the current market forces at play which may affect the returns of our income securities in the coming year.

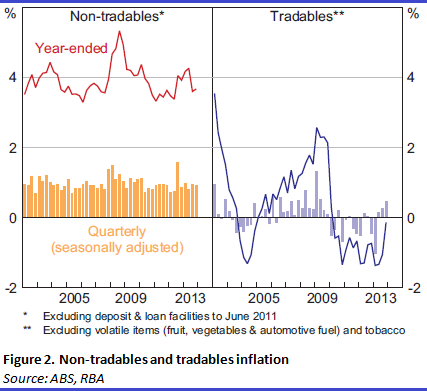

The key starting place is the current level of Australian inflation. Figure 1 shows that the inflation rate is trekking upwards towards and possibly above 3% in 2014/15. We will see below (refer to Figure 2) that Australian inflation is high based on international comparisons and this should certainly affect the direction of interest rates.

We can see the reason as to why the inflation is rising in Figure 2. The lift over the last 9 months in the level of “tradables” inflation that resulted from the devaluation of the Australian dollar from above parity against the US dollar. Concurrently the Australian dollar has devalued against the currency of our largest trading partner – China. You will recall that China effectively pegs its currency against the US dollar.

Prior to early 2013, it was the high level of the Australian dollar that created the deflationary effects of imported or tradable inflation. We can now observe that the Australian dollar has depreciated in line with the prices of our major commodity exports. Current indications are that commodity prices will remain in a downtrend as current prices are clearly well above long term averages. A weaker Australian dollar spells a heightened inflation risk generated from imported inflation from China in particular.

Prior to 2012/13 Chinese inflation averaged over 3% per annum but it was the 20% appreciation of the $A against the Chinese renminbi that snuffed out imported inflation between 2008 and 2013. Elsewhere in the world it is observable that inflation has been subdued (less than 2% per annum) for the 5 years since the GFC. Today the 3 major economies of the world (excluding China) are recording inflation of about 1% and so Australia has inflation of 1.5% to 2% higher than most major economies. It is noteworthy that the European Central Bank has recently alerted markets to the risk of deflation (i.e. negative inflation) in Europe akin to that which afflicted Japan for a decade or so.

Markets are efficient at reading inflation and so Australia has an inflation rate that approximates the yield differential to overseas bonds. Like inflation our bonds yield 1% to 2% above the comparative rates seen overseas. Australian 10-year bonds yield about 4% against equivalent US bonds of 2.6%, German bonds of 1.6% and Japanese bonds of 0.8%.

Arguably if it were not for the extensive activities of central banks in utilising quantitative easing and setting historically low cash rates, then bond yields across the world would be 1 to 2% higher than current yields.

Cash rate settings across the US, Europe and Japan, are now at such low levels that there is little more that can be done by central banks. Notably these cash rates sit at 1 to 1.25% below inflation creating a negative “real” yield.

In Australia, cash rates (currently 2.5%) are set below inflation and this has led to speculation that rates set by the RBA will soon rise. However, based on overseas observations of monetary policy (refer to Figure 8) this is not necessarily so and my view is that interest rates settings will not be adjusted by the RBA in 2014. As inflation permeates through the economy, I suspect that bill rates and thus term deposit rates will move higher in the second half of 2014. This will accelerate if the $A weakens further.

In the meantime, interest rates set in the housing and mortgage lending markets will remain at historically low levels, held down by the cash rate settings of the RBA and aggressive competition between the banks to grow their assets. That is good news in the short term for the housing markets but it will not be a sustainable position whereby the banks cost of funds rise and their lending rates fall.

In effect we are living in a period where borrowers are benefitting from historically low interest rates which currently ignore the risk of inflation. Meanwhile savers are penalised with term deposit rates barely above the inflation rate.

In economic theory, it is this concurrence of events that should stimulate consumption as households are incentivised to borrow rather than save. However, an aging demographic outweighs this effect because more households are saving for a long retirement. Low interest rates force move savings into low yielding income securities and to find yield more savings are directed to riskier income securities.

Conclusions

The current world economic environment can be described as a period of slow economic recovery. It is not a normal strong recovery from a sharp economic downturn. The economic settings in major offshore economies is over-bearing on the Australian economy. This is seen in an elevated currency and low interest rate settings. It is the level of the Australian dollar in particular and commodity prices in general that will determine the general outlook for Australian interest rates.

I perceive that the Australian dollar is heading down and it will clearly be lower in a few years’ time. However its short term trajectory is completely hindered by international central banks. This view is strengthened by my view that our commodity export prices are also drifting lower and are still currently elevated when compared to historic prices.

So in reviewing our income portfolio I would suggest that we make no changes and hold our positions. The returns of the income portfolio from inception and over this financial year remain excellent. Also I remain convinced that the next move in Australian cash rates will be up but that it may not be until 2015. In the meantime market interest rates will drift higher but at no great pace.

As for the income securities which today offer the best longer term returns, my picks remain MBLHB and NABHA. These rather boring securities still generate yields higher than term deposits. Further, they are floating rate securities that pay quarterly distributions. The real longer term upside is that each security may be renegotiated in coming years due to the new capital rules imposed on banks. If that occurs then a capital windfall for patient investors is possible.

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Income Portfolio Statistics

Return since June 30, 2013: 13.83%

Returns since Inception (April 24, 2012): 43.01%

Average Yield: 7.24%

Start Value: $150,754.88

Current Value: $171,611.54

Dividends accrued since June 30, 2013: $6,317.44

Clime Income Portfolio - Prices as at close on 18th March 2014 | ||||

| Hybrids/Pseudo Debt Securities | ||||

| Company | Current Price | Margin over BBSW | Running Yield | Franking |

| MXUPA | $84.29 | 3.90% | 7.77% | 0.00% |

| AAZPB | $98.30 | 4.80% | 7.58% | 0.00% |

| MBLHB | $83.70 | 1.70% | 5.20% | 0.00% |

| NABHA | $77.05 | 1.25% | 5.06% | 0.00% |

| SVWPA | $90.73 | 4.75% | 8.20% | 100.00% |

| RHCPA | $106.99 | 4.85% | 7.05% | 100.00% |

| High Yielding Equities | ||||

| Company | Current Price | Dividend | GUDY | Franking |

| TLS | $5.03 | $0.29 | 8.24% | 100.00% |

| WBC | $33.59 | $1.83 | 7.78% | 100.00% |

| NAB | $34.54 | $2.03 | 8.40% | 100.00% |

| SKI | $1.68 | $0.12 | 7.16% | 0.00% |

| Code | Value | |||

| Cash | $33,625.74 | |||