Passive aggressive… Buffett's new principle

| Summary: Legendary American investor Warren Buffett’s recent advice for his family to take a passive approach to investing by buying index funds should resonate with local investors. The key reasons are: it avoids the higher costs of active investing; it helps avoid timing and selection mistakes; and allows investment in a cross-section of industries. |

| Key take-out: A passive index investment strategy makes sense for many investors. |

| Key beneficiaries: General investors. Category: Strategy. |

If the world’s greatest share investor, Warren Buffett, is earnest in asking his legion of followers to investigate passive investing – that is index funds or ETFs (Exchange Traded Funds) – it’s surely a sign you should too.

Buffet’s original and thought provoking communications with his shareholders never cease to inform and entertain and the 2013 letter to shareholders from the latest Berkshire Hathaway annual report is no exception. This time round the ‘sage of Omaha’ has set the cat among the pigeons in advocating strenuous support for index funds in particular. No doubt Buffett’s ideas will be fiercely resisted by the huge number of ‘active fund managers’ who still represent the heart of the managed funds industry.

Specifically, Buffett has supported the idea of index funds in relation to his family estate and as a way of investing in a conservative manner for his family after he has passed on.

In this year’s letter he emphasises that he puts his ‘money where his mouth is’, encouraging the future beneficiaries of his estate to invest in a low-cost, broad-based index fund of USA shares (S&P 500 index).

Buffett is one of the greatest active investors in the world, who over a 49-year reign at Berkshire has seen the per share book value increase by 19.7% a year, compared to the 9.8% return a year from the S&P500 total returns (includes dividends) index.

So what is Buffett trying to do here?

I suggest, having read many of his comments about financial markets and index funds, there are three key reasons behind his aggressive support of indexing as a strategy;

1. When investing, costs matter:

This is a topic that Buffett has often talked and written about, including in his 2005 annual letter that discussed (with a touch of sarcasm) all the ‘helpers’ in the money management industry. He cleverly notes that investing is a ‘zero-sum game’ – that is that the average return of all the investors must equal the average return from the market, less the costs that we all pay. Paying too much to ‘helpers’ reduces the average returns that investors can expect from the market.

Index exposure is comparatively cheap for an investor – for example, the ASX listed ETF (Exchange Traded Fund) the Vanguard Australian Shares fund has an MER of 0.15. This is less than one tenth of the cost of many ‘active’ managed funds.

2. Avoiding investment mistakes is crucial:

In this year’s Berkshire letter Buffett comments that: ‘Owners of stocks, however, too often let the capricious and often irrational behaviour of their fellow owners cause them to behave irrationally as well. Because there is so much chatter about markets, the economy, interest rates, price behaviour of stocks, etc., some investors believe it is important to listen to pundits – and, worse yet, important to consider acting upon their comments.’

He points to the 2008 crisis, when many people were involved in the panic selling of shares at exactly the wrong time, and destroyed wealth. Instead he advocates buying regularly over time – accumulating shares over a long period. He adds that if investors makes sure that they do not sell their shares when the news is bad, and keep costs low, they are ‘virtually certain’ to get satisfactory returns. An index-style investment, with low fees and the ability to add investments regularly, fits this advice.

3. Benefitting from the overall ingenuity that drives economies:

Buffett has also talked about the great returns that come from investing in all of the companies in the market which is the original idea behind most index funds or exchange traded funds. He notes that in the 20th Century, the Dow Jones index rose from 66 to 11,497 while paying a ‘rising stream of dividends to boot’.

In Australia, the All Ordinaries index started 1900 at a level of 7, and is now above 5,400 points (see ASX graph) having also paid dividends and franking credits to investors.

Buffett emphasises that the goal of the investor should not be to pick winners, ‘neither he nor his ‘helpers’ can do that’ he says, but to own a cross-section of businesses that will increase in value over time. Here he is specific – ‘a low cost S&P index fund will achieve this goal’.

He explains : ‘What I advise here is essentially identical to certain instructions I’ve laid out in my will. My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors.’

An Australian Perspective

I think there are a number of investment approaches in the Australian environment that fit with Buffett’s plan to keep costs low, to benefit from the returns from businesses and allow irregular investment over time.

There are a variety of index funds that can be accessed, although these tend to be a little more expensive in Australia that in the USA. For example, the Vanguard Index Fund that Buffett recommends has expenses of 0.15% a year, whereas in Australia the basic Vanguard Australian Share index fund starts at 0.75%, decreasing as assets increase. Noting this discrepancy in fees it’s worthwhile examining the index fund sector.

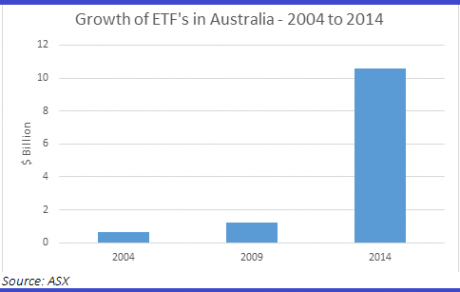

ETF’s (exchange traded funds – managed investments listed on the stock exchange) have grown significantly in Australia over the past decade and particularly for overseas investing or highly selective sector investing ETFs are also worth examining. Basic ETFs have expenses of around 0.15% a year though you will also incur brokerage costs when buying or selling them.

The essential difference between an index fund and an ETF is that an ETF is listed on the stock market. Put simply an index fund is a fund that carries a basket of stocks that mirrors an index such as the ASX 200: An ETF is a fund that carries a basket of stocks that mirrors an index and is itself listed on the stockmarket.

Looking more closely at what Buffett is doing here - and putting into context that he has been such a remarkable investor – suggests that perhaps Buffett knows he was an exceptional share investor and most likely lightning will not strike twice. So he advises his family on a passive strategy. The same might apply for investors in many situations – your overall chances of beating the market consistently are slim, having an appropriate allocation of your investments in passive strategies such as index funds and ETFs will make a lot of sense…even Warren Buffett say so.

Scott Francis is a personal finance commentator, and previously worked as an independent financial advisor.

Frequently Asked Questions about this Article…

Warren Buffett advises everyday investors to consider a passive investing approach by buying index funds. This strategy helps avoid high costs, reduces the risk of timing and selection mistakes, and allows investment across a broad range of industries.

Buffett recommends index funds because they offer low costs, reduce the likelihood of investment mistakes, and allow investors to benefit from the overall growth of the economy. He believes this approach will yield satisfactory long-term returns.

Index funds help reduce investment costs by offering lower management fees compared to active funds. For example, the Vanguard Australian Shares ETF has a management expense ratio of just 0.15%, which is significantly lower than many active managed funds.

A passive investment strategy, such as investing in index funds, offers benefits like lower costs, reduced risk of making poor timing decisions, and exposure to a wide range of industries, which can lead to more stable long-term returns.

Buffett suggests handling market volatility by regularly buying shares over time and avoiding panic selling during market downturns. He emphasizes keeping costs low and maintaining a long-term perspective to achieve satisfactory returns.

An index fund is a mutual fund that holds a basket of stocks mirroring an index, while an ETF (Exchange Traded Fund) is similar but is listed on the stock market, allowing it to be traded like a stock.

Australian investors might consider index funds despite higher fees because they still offer a cost-effective way to gain diversified market exposure and benefit from the overall growth of businesses over time.

Buffett recommends that his family estate invests 10% in short-term government bonds and 90% in a very low-cost S&P 500 index fund, believing this strategy will outperform most other investment approaches in the long term.