Overdosing on yield stocks

| Summary: Yield-focused investors have swarmed Australia’s major banks in the expectation of high dividend payouts. The strategy has worked well, but experts are warning that the good yield times won’t last forever, and yield compression is already occurring as share prices rise. They also note that higher yield ultimately translates to higher risk. |

| Key take-out: Balance, diversification and low cost should be key features of investors’ portfolios. A long-term strategy that incorporates diversification dramatically reduces risk. |

| Key beneficiaries: General investors. Category: Asset allocation. |

In the past year retail investors have flocked to buy shares in Australia’s big banks, lapping up the tasty yields on offer.

Australian bank shares have effectively become a proxy for defensive assets in investors’ portfolios. But how far can investors continue down this road?

We’re now in the middle of the banking results season, and today (November 4, 2013) was Westpac’s turn to take centre stage. The last of the big four to deliver its full-year numbers, Westpac certainly didn’t disappoint, announcing a record profit of $7.1 billion. What’s more, showing blatant disregard for APRA’s warning to the banks just last week to limit dividend payouts, Westpac announced another special dividend to shareholders.

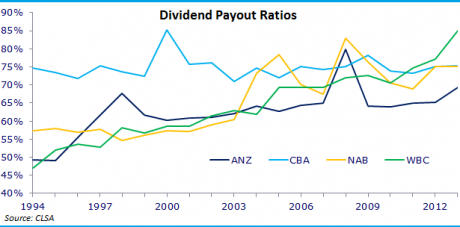

This latest 10 cent per share special dividend follows a special dividend announced by the bank for the same amount at its interim results in May. Today’s move takes the full-year payout to $1.94, up more than 15% from last year. Westpac, it seems, obviously isn’t as concerned as APRA about issuing ever-higher dividend payouts. Westpac’s dividend payout ratio today is 85%, compared with 63% in 2003.

But investors can’t expect dividends to rise forever, and nor should they. As companies increase their payout ratios, there is a higher risk if earnings come under pressure.

We’ve already seen yields compress over the past year. Just 12 months ago, Westpac shareholders were getting a healthy yield of 6.5%. Now, that’s down to 5.5%. Certainly better than a term deposit, paying 4%, but with a lot more risk too, and now it seems regulatory action could well accelerate further yield compression.

The warning from APRA stems from expectations that Australia’s ‘too-big-to-fail’ banks will need more capital buffers than initially anticipated. The banks were reportedly expecting the new capital rules would force them to hold about 0.5% of additional capital in reserve. In fact, it’s now believed they will have to hold an additional 1-1.5% of capital in reserve, which investors fear will eat into dividends, slashing the yields they crave.

An overreliance on yield

Indeed, leading experts are warning investors not to get too caught up in the chase as they continue to tilt the defensive portion of their portfolios to high-yielding assets.

Speaking at the CFA Australia investment conference last month, Mike Hawkins chief investment officer of Melbourne-based Evans & Partners, said: “The defensive asset classes have been corrupted by yield.”

Moreover, high dividend-yielding stocks shouldn’t be used as proxies for bonds.

Renowned stock picker Peter Morgan voices his concern, saying: “What really worries me is that investors are taking too much risk into their portfolios. High yield does not mean safety, it actually means higher risk.

“At some stage interest rates are going to go up and that means risk assets currently in favour will go down in price and capital will be lost,” he continues.

Investors will need to tread carefully as the hunt for yield intensifies. As companies pander to shareholders’ calls for higher dividends, their capital base is at risk of being eroded, posing further risk for both the company and shareholders down the track.

On top of that, more investors clamouring for steady income in the form of dividends continues to drive share prices higher, thus further compressing the yield. Investors should also be mindful of the fact that the staggering share price rises the big banks have enjoyed over the past year are unlikely to be repeated in 2014. Despite being the market darlings, it’s unlikely the banks can continue increasing dividends at the rate they have been.

Just look at how the payout ratios, especially Westpac’s, have moved in recent years.

“When you’re looking specifically at high-yielding assets you need to focus firstly on their credit quality and secondly their payout ratio, if it’s a share. If it’s a 100% payout ratio there’s only one way it can go if earnings go down,” says Morgan.

A higher payout ratio quite clearly puts the risk on earnings growth going forward. It’s that simple.

“ANZ, that payout ratio was much higher than expected. They’re just fuelling the yield-hungry retail base but I think on balance they understand they’re giving up growth,” says Equity Trustees chief investment officer George Boubouras.

(At last week’s full-year result ANZ increased its dividend payout ratio to 69%, which is still lower than its peers.)

“You can’t blame the retail investor for searching for dividend and franking because the system’s rewarding them for it,” Boubouras says.

Nonetheless a more balanced approach reduces risk, especially with the growing threat of yield compression. Indeed, according to head of investments at Melbourne-based private client firm Escala, Giselle Roux, the perceived need for yield to deliver an income flow may be unwarranted.

“There’s a significant cohort of investors who say they want yield from their equities but don’t really necessarily need that income flow. If they do really need it I think they need to be very careful that dividend yield is at the discretion of directors; it’s not a term deposit. I think people need to learn to sell the underlying equity if they have a really pressing need for a cash return.

“In some ways people shouldn’t necessarily view dividends and capital growth all that differently. I think a lot of people, if they buy a stock, for example CSL, would never buy it for yield, but it has had fantastic and very stable capital growth for long periods of time. Nothing is stopping you selling those equities if you did need income,” Roux says.

This sentiment is echoed by Vanguard chief investment officer, Greg Davis.

“To the extent that the portfolio doesn’t deliver the amount of income needed, basically sell down some principal value to get that income versus tilting the portfolio to be solely income producing, which over time isn’t going to give you the same level of risk adjusted return.”

Taking the safe path

The increased popularity and focus on income-generating assets has come at the expense of growth assets. Remember, a combination of income and growth is the safest path to take in the vast majority of portfolios. A higher dividend means less growth. Investors need to be aware of that trade-off and adjust for it accordingly.

When it comes to growth prospects in the local market, investors have limited choice. But there are pockets of growth out there.

One of the few growth sectors we have is health care. Health care companies typically pay low dividends, but are also low beta, meaning low sensitivity, but these companies grow over time because of the structural demand for their services.

“Over the next 10-year cycle the health care sector is one that’s about growth. ResMed, CSL and Cochlear are very long-term growth stocks,” Boubouras says.

ResMed and CSL’s dividend yield is just 1.5%, while Cochlear is a more palatable 4.3%.

Aside from health care, Boubouras says investors should also consider diversified financials and transport companies such as Aurizon and Asciano.

Industrials are gaining favour at the moment because the sector is tipped to be a corporate restructuring story over the coming 12 months. We’re starting to see a lot more corporates willing to shed assets that no longer make sense to them, even if they have to take a bit of a hit in the form of a write-off or a cost to do it. These companies are looking to the long-term benefits of not having to worry about these assets.

Roux sees this development as a positive for the sector, saying, “I think probably the best place for people to look for equities would be in the industrial market, not in the financials or the resource sector per se.”

A balanced approach

Balance, diversification and low cost should be key features of investors’ portfolios. While the migration into high-dividend yielding shares has been a boon for investors, a long-term strategy that incorporates diversification dramatically reduces risk.

For Davis, it’s a case of creating a balanced total return portfolio that’s split between shares, bonds and cash. To the extent that this doesn’t deliver the level of income needed to live on, investors can sell down some of the principal to provide additional income as required, versus being solely in high income shares, he says.

Exchange-traded funds are one way of increasing portfolio diversification, with a variety offering broad-based exposure to the overall market, thus reducing risk. It seems retail investors have finally begun to embrace low-cost ETFs, with Vanguard seeing assets under management of its Australian-listed ETFs climb a massive 46% between April and September of this year.

International holdings are another way to bring further diversification into a portfolio. Again, there are a number of ETFs available to Australian retail investors looking to get exposure to overseas markets.

Vanguard’s US Total Market Shares Index ETF (VTS) returned 35% in the 12 months to September 30. It’s other overseas offering, the Vanguard All-World ex-US Shares Index ETF (VEU) didn’t fare too badly either, returning 30%. But the best performing Australian-listed ETF in the 12 months to September 30 was the iShares Core S&P Small-Cap ETF (IJR), which returned 46%. This was closely followed by the iShares MSCI Japan ETF (IJP), which returned 45% over the same period.