Our top takeover targets

Summary: In the year ahead we're keeping an eye on Challenger annuities as Australia's aging population puts a focus on the nation's collective retirement savings, and fertiliser producer Nufarm as Chinese demand for Australian crops grows. Investors should watch for a bidding war between Dexus and China Investment corporation for a merger with IOF. |

Key take out: It's a matter of if, not when, car group AP Eagers merges with Automotive Holdings Group (AHG), while international players cannot be ruled out to buy Iress (IRE). |

Key beneficiaries: General Investors. Category: Shares. |

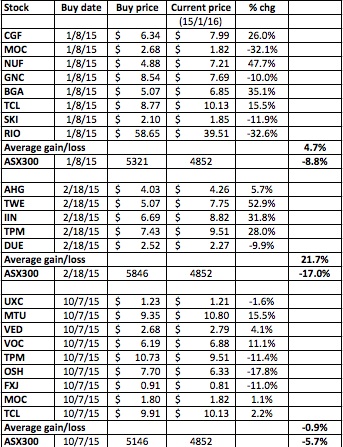

Last year we had a pretty good run with our takeover target picks. As the below table shows, the stocks recommended in the three articles I wrote on this subject generated average returns (not including dividends, from the date they were mentioned in Eureka Report until January 15, 2016), of 4.7 per cent (vs the ASX300 index return of -8.8 per cent), 21.7 per cent (vs ASX300 return of -17.0 per cent) and -0.9 per cent (vs the ASX 300 return of -5.7 per cent), respectively.

Takeover calls for 2015 (ignoring all dividends)

The sectors that performed well for our portfolio were telecommunications (IIN, TPM, MTU and VOC) and agriculture (NUF, GNC, BGA and, arguably, TWE). Industry consolidation forced by the looming completion of the National Broadband Network (NBN) provided positive impetus for the telco space, a trend I expect will continue. In agriculture, a lower $A plus booming Chinese demand for our dairy products enabled this sector to outperform in a most dramatic fashion. Again, this trend should continue in 2016, although the share prices of dairy producers like BGA and A2M and may need to retrace a little before genuine value re-emerges.

In contrast, financial services were a mixed bag (CGF up; MOC down), while anything to do with iron ore (eg. RIO) or oil & gas (eg. OSH) was a disaster as the prices for these commodities tumbled.

So what about 2016? The overall share market's recent fall should provide some interesting opportunities for astute stock pickers. Although the negative themes of higher US interest rates combined with slowing Chinese growth are unlikely to change anytime soon, unlike the 2008/09 financial crisis, the world is not now facing a genuine threat (such as the collapse of major banks) to the established economic order.

Here then are my top takeover targets for the year ahead:

Challenger (CGF)

Despite its recent share price strength, we are sticking with this listed annuities provider. The adequacy of Australia's collective retirement savings is a huge political and economic issue at the moment, and the ageing of the population means it isn't going away anytime soon. The withdrawal and spending of lump sums from super funds, before transitioning to the Age Pension, is a real problem for Treasurer Scott Morrison. As a result, there's a strong chance annuities of the type CGF provides could be made compulsory in the near future.

Nufarm (NUF)

We're also sticking with this manufacturer of agricultural chemicals. Notwithstanding the fact the Chinese economy is slowing, the growth of its middle class continues unabated. Wealthier consumers there are shifting their dietary preferences towards more meat and dairy. At the same time, Australia's established farmlands are expected to produce more crops from a given amount of land. Fertiliser producers like NUF should continue to benefit from these trends.

Aurizon (AZJ)

This stock has been hammered in recent weeks due to profit downgrades caused by weakness in coal and iron ore prices. Despite this, Aurizon still has valuable haulage contracts that'll remain in place for some years to come. It also possesses a monopoly rail network in parts of Queensland that should prove attractive to potential predators. Consider it an electric blanket in summer purchase.

Cover-More (CVO)

Cover-More is a travel insurance business with a large presence in Australia, and smaller operations in India, China, Malaysia and Singapore. While a weaker $A does reduce the number of Aussies heading overseas on holiday, CVO has recently seen annuities provider Challenger (see above) double its stake to 11.4 per cent. CVO's appeal is boosted by the fact both its earnings growth and cash generation remain strong.

Investa Office Fund (IOF)

Last December, IOF agreed to merge with fellow real estate group Dexus (ASX Code: DXS) in an all-scrip deal worth around $2.5 billion. Since then, however, DXS's share price has fallen, thus reducing the attractiveness of the merger to IOF shareholders. On Monday it was reported that Chinese sovereign wealth fund China Investment Corporation was considering a rival, all-cash takeover for IOF. Given that IOF's assets are worth as much as $3.5bn, IOF shareholders should wait and see if a genuine bidding war emerges.

Iress (IRE)

Iress is Australia's leading provider of share market information and trading platforms to brokers, fund managers and investors. In essence, it is the reason global behemoth Bloomberg isn't as strong here as it is overseas. While weak stock prices reduce demand for IRESS licences in the short term, in the longer run Australian finance professional have little choice but to subscribe to this business. The also-listed ASX is the most logical buyer of IRE – but other financial information players (like Bloomberg) cannot be ruled out.

Automotive Holdings Ltd (AHG)

Despite all the gloom and doom about the local economy, the number of cars bought by Australian motorists continues to grow. Just a few years ago, we cracked the one million new vehicles per annum mark; now this figure exceeds 1.1 million. Fellow car group AP Eagers (ASX: APE) continues to hold a 19.9 per cent stake in AHG, and as I've written before (see Beyond Toll: More takeover targets to watch, February 18, 2015) it is only a matter of when, not if, these two companies merge.

Nib Holdings (NHF)

Like industry giant Medibank Private (ASX: MPL), Nib Holdings is a locally listed player in Australia's health insurance market. Health insurance is a funny business here: On the one hand the tax office provides substantial incentives for consumers to purchase private cover; on the other hand, however, the government retains the power to regulate industry pricing rather than leave it to the market. An American trend we are beginning to emulate is for health insurers to move into the direct provision of health care via, say, the ownership of opticians, dental practices and even private hospitals. The bigger insurers become, the more able they are to purchase assets in this space. Expect NHF to play a key role in the likely consolidation of this crucial industry.