Our model portfolios beat the market

It has been a very successful first six months for the Eureka Report model portfolios. As we move into the holiday season, and business enters a quiet period, it's a good time to report on the performance and risk nature of our Growth, Income and LIC models.

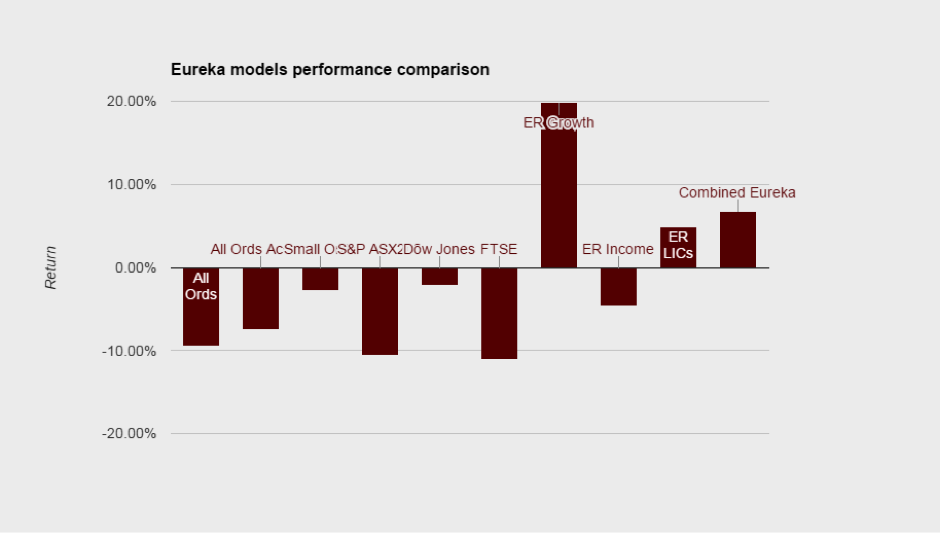

Broadly speaking the Growth First portfolio has been a stellar performer, driving a return of more than 20 per cent since its inception on July 1 2015. The LIC portfolio has introduced investors to a method of ASX investing that is extremely well diversified, low volatility and has been providing impressive out performance to date. The Income First portfolio suffered a minor setback as one stock significantly under performed, but the overall performance of the model has been resilient, with income generation set to lift into 2016. Here is a chart showing the performance of each portfolio from inception through to December 11, compared to many of the major indices that investors might use as benchmarks.

Combined portfolio performance

The above chart shows a final bar that is indicative of the combined performance of the Eureka model portfolios since inception, assuming equal investment in each portfolio on the respective start dates. This bar highlights that the portfolios can be used in combination, as some investors may seek a combination of growth and income, or even to follow the LIC model as a base exposure. Overall, this strategy, based on the theoretical returns, has generated strong performance to date.

LIC model

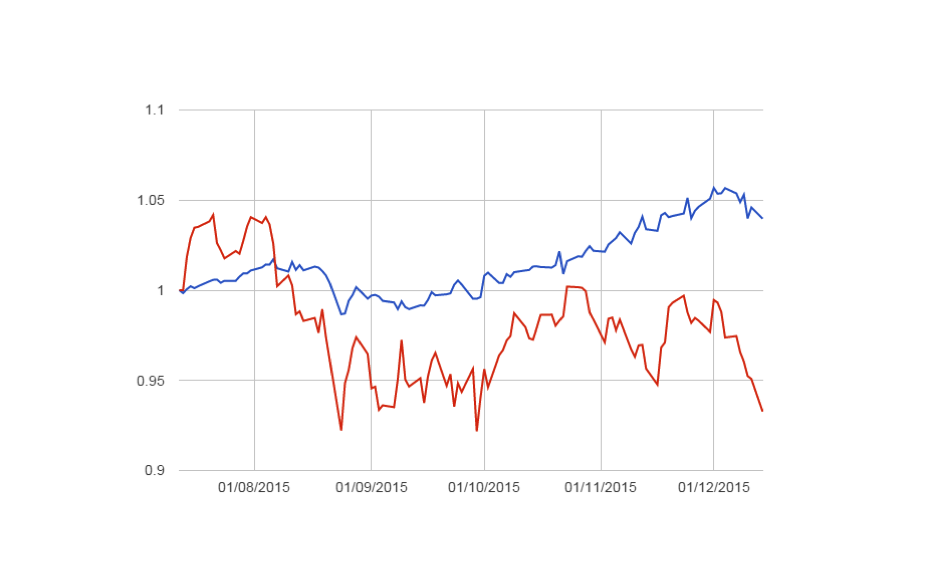

The LIC model has provided investors with strong returns, lifting by 5.16 per cent (intra day price December 21) since inception. Here is a chart of performance to date:

LIC portfolio - blue, LHS

What is interesting about a LIC portfolio is that it is akin to a fund of funds, meaning that it invests in businesses that in turn invest themselves. The reality of this is that the portfolio is extremely well diversified, and the challenge is to manage the underlying exposure of the portfolio. Pleasingly, this has been done with aplomb to date, and the portfolio is taking advantage of investment in a diverse range of managers in terms of both investment strategy and geographic exposure. The highlights thus far have been the investments in Thorney Opportunities (TOP), and WAM Research (WAM). Below is a chart showing the daily performance of the LIC model versus the market. What this displays is that the LIC portfolio has a lower daily volatility than the market thus far, which is an impressive achievement given the additional return generated:

Income Model

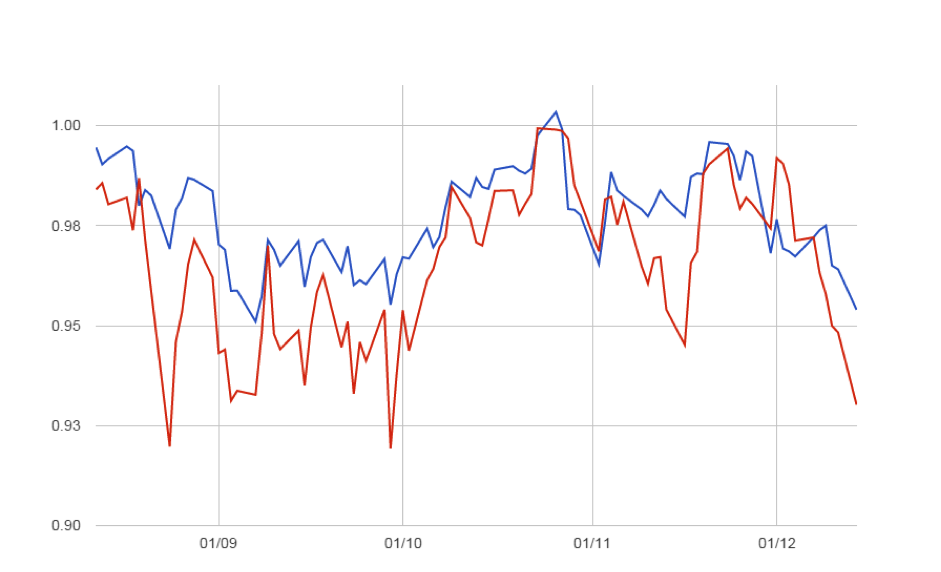

The Income First model portfolio has underperformed the All Ordinaries slightly. However, one can easily see the reason for this: a poor investment in Dick Smith Holdings (DSH). Despite this, (and if you want to read more on the model, click here), the portfolio has seen some impressive performances from businesses set to grow dividends in 2016. The highlights thus far have been the positions established in DWS Ltd (DWS), Wellcom (WLL), and Virtus Health (VRT). What this shows me is that you don't need to invest in big blue chip household names to take a defensive income stream. The performance of Telstra (TLS) and the big four banks over the same period (since August 11) has been nothing short of underwhelming. Overall, the portfolio has been tracking relatively in line with the market:

In terms of risk, the Income First model portfolio has tracked to a lower volatility than the market in terms of daily performance. There are two factors at play here that lead me to believe that it is still too early to fully understand the volatility of the portfolios and what to expect going forward. A high cash balance is cushioning volatility, perhaps leading to understated movements. This may change as the portfolio nears full investment in 2016. Additionally, the single stock decline in DSH was irregular, and may have led to a larger than normal level of volatility for a short period. Nonetheless, here is the plot of returns thus far.

Growth First Model

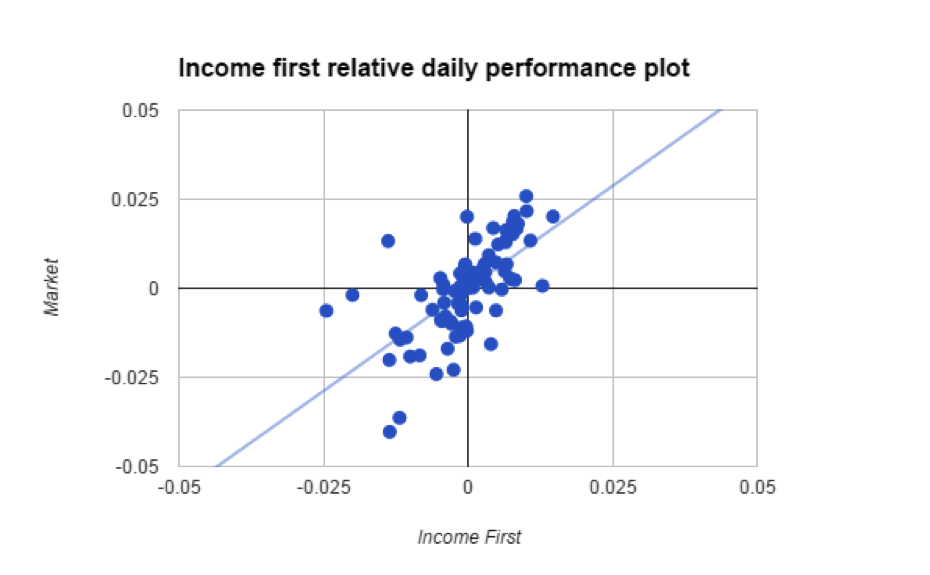

To date, the Growth First model has thrown off the shackles of a listless market and streaked ahead. With NetComm Wireless (NTC), AMA Group (AMA) and Vita Group (VTG) providing significant upside for investors, underachievers have become immaterial (and few in number). The idea of the Growth First portfolio is to uncover stocks that are bucking the trend and likely to grow earnings by virtue of businesses with unique opportunities. Here is a chart of the portfolio's performance since inception on July 1 versus the All Ordinaries accumulation index.

Growth First model portfolio - blue, LHS

Though the portfolio is only around 65 per cent invested, volatility has been well above that of the market, and this makes sense. The nature of exposure to smaller cap growth stories is likely to introduce higher levels of volatility and risk. However, with strong research backing up the picks, performance has been outstanding. Here is a plot of the daily returns showing that the portfolio is more volatile than the market to date:

More coming in 2016

In 2016, readers can expect to see the LIC portfolio targeting more of the same. The portfolio is 95 per cent invested, and will remain that way unless a reason to either add an exciting opportunity, or a need to review a position, arises. The Growth First model portfolio is still looking for more opportunities, and will be adding further to the investments in 2016. That said, diversification and risk management will also necessitate the practice of locking in profits as stocks run – this has already been done with NTC and AMA. Finally, the Income First model portfolio will be looking to further invest in 2016. The immediate focus will be the approaching February reporting season and round of dividends, with the clear aim of producing a strong income from the capital base in 2016.

All three of these portfolios are objective-based, and all three are delivering on their set objectives. Overall, as shown by the combined returns figures above readers might consider an exposure to more than one portfolio, keeping in mind their own risks, personal situation and needs.

Over the break, the portfolios will be monitored by the investments team. Feel free visit the model portfolio page for any further updates.

Have a fantastic summer break.