Our LIC portfolio stands strong

Summary: LICs proved to be trusty sources of stability in the most recent bout of market turbulence. |

Key take-out: Amid some mixed share price moves, underlying performance across the portfolio remains sound. |

Key beneficiaries: General investors. Category: Listed Investment Companies. |

I'm still here! Don't worry all, I am not going anywhere and neither is the LIC model portfolio, or any of the trusty LICs that have seen us through this turbulent period for the market.

Firstly, I am very happy with how the portfolio has come through the recent turbulence. It is often hard to put a finger on when the old turbulence stopped and the new began. But here we are post-Brexit and, finally, post-election.

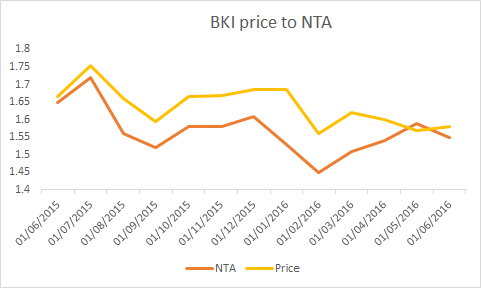

BKI Investments Limited (BKI)

BKI has remained flat throughout the ups and downs of the last few months. The underlying portfolio has ridden the surges of the market as you would expect given the large-cap exposure within it. The team at BKI are doing what it says on the tin, steady as she goes long-term investing. There are no knee-jerk reactions from the Pitt Street Mall office.

Commonwealth Bank, National Australia Bank and Westpac remain the top three positions and BKI's preferred banks over ANZ. In the latest quarterly report the team highlighted their view on the banks – click here to read.

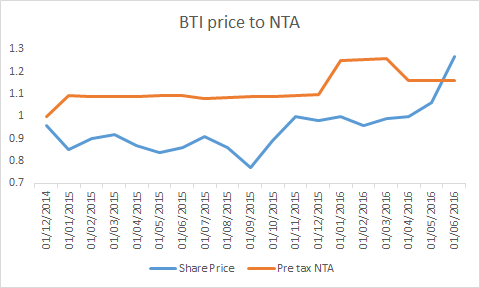

Bailador Technology Investments (BTI)

It was only a few short weeks ago I had a quick catch up on the phone with BTI co-founder David Kirk and we spoke about the volatility in the share price. He was not concerned and nor was I. It has been business as usual with a new company in the portfolio and topping up an existing one following on from the cash injection from the exercised options.

Bailador invested $4 million in Click Loans Group, an online business looking to get a slice of the mortgage industry pie. The investment equates to 3.4 per cent of the Bailador portfolio. Online video content provider Viocorp got a top up as well making it a significant proportion of the portfolio at 23.9 per cent.

Bailador has been volatile and it will continue to be so and this is why we are content with the current weighting.

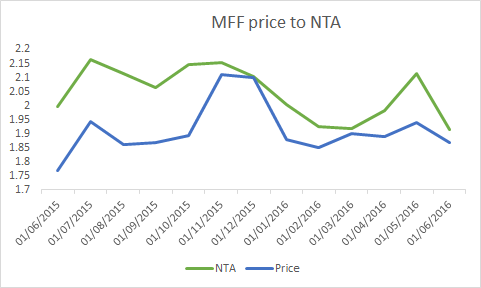

Magellan Flagship Fund (MFF)

The Brexit gave investors an opportunity with Magellan Flagship Fund as it dropped to a 12-month low of $1.72 before rebounding in the space of two days. The LIC model portfolio took the opportunity to top up, as highlighted in this article on June 27.

As we have consistently said, the portfolio is quality and managed by a high quality manager. This was the most significant dip we have seen to date with Magellan Flagship Fund and we were more than happy to wade on in. It is worth keeping an eye out on these stocks throughout these volatile times because you may get a short window to add to a position.

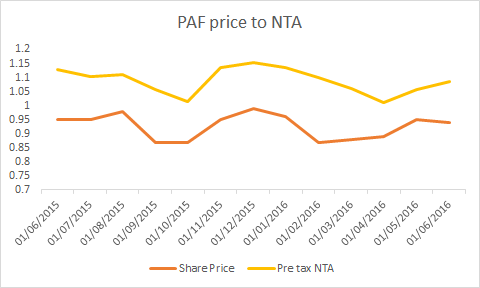

PM Capital Asian Opportunities Fund (PAF)

PAF continues to lag in the portfolio but the underlying performance is still pleasing and with the options now out of the way there is nothing hindering the share price from closing the gap to NTA. Well, except for sentiment and future performance but other than that, there's nothing.

The options expired on May 31 with the share price closing at 94c on the day. Currently the share price sits at 96.5c with the NTA per share sitting at $1.043.

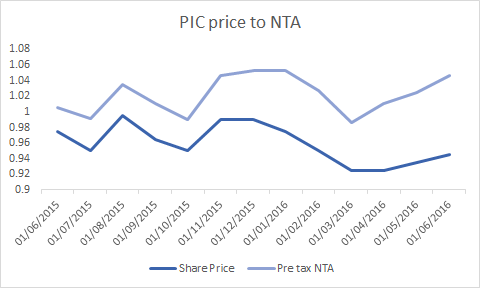

Perpetual Equity Investment Company Limited (PIC)

The original investment thesis for PIC was the big swag of cash it had on hand at the time of a significant market pullback. On top of this it was a highly experienced team with the clout of Perpetual behind it but on a scale small enough to be agile.

All of the above still stands and just like PAF, the options are now out of the way as well. At the last monthly update the portfolio was still 22 per cent in cash leading into the short Brexit downturn followed by the political uncertainty. It will be interesting to see the next monthly update to see if some of that has been distributed.

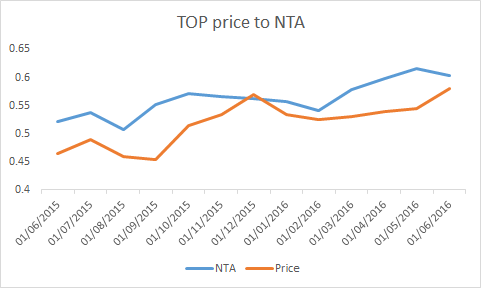

Thorney Opportunities Limited (TOP)

Thorney has enjoyed a nice run recently off the back of its successful investment in Service Stream Limited (SSM) and superannuation trustee and administration provider Diversa (DVA). Diversa recently received a merger proposal from OneVue Holdings (OVH).

In the recent chairman's update Alex Waislitz briefly mentioned a new LIC launched by the Thorney team focusing on technology-based investment opportunities. No mention if these would be listed or unlisted but it is something to keep an eye on as currently the only other LIC in this space is our LIC model portfolio's own Bailador Technology Investments.

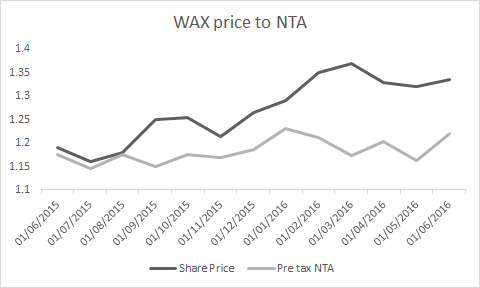

WAM Research Limited (WAX)

The most expensive position in the portfolio when comparing share price to NTA, but we remain happy with our small to mid cap exposure with WAX. Once again the portfolio maintains a healthy cash balance which has aided it recently.

That being said, a hefty amount of cash was deployed between the April and May update with close to 10 per cent entering the market. That's a significant move for the WAX team. As of now the cash balance stands at 25.5 per cent.

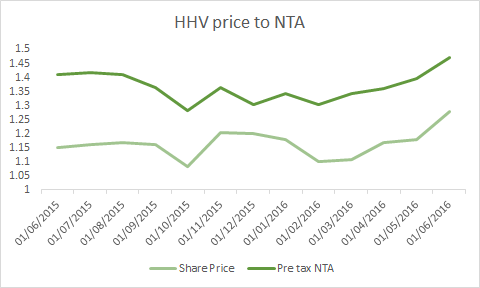

Hunter Hall Global Value Limited (HHV)

Here's a non-portfolio related, a quick update on an LIC outside of the portfolio but still covered by us here at Eureka. Hunter Hall Global Value Limited continues to enjoy success off the back of two key positions, St Barbara Limited (SBM) and Doray Minerals Limited (DRM). The portfolio is still trading at about a seven per cent discount to NTA.

A subscriber emailed the other day asking about an LIC with exposure to gold. If gold is what you are after, HHV is a good place to start with gold explorers and producers making up 14.8 per cent of the current portfolio.