Our CEO invests $1 million - His first quarterly update

A few months ago, I shared a series of emails with members about where my wife and I invested $1m and why. It created lots of interest (see part 1 here) and requests for regular follow-ups.

Well, here’s my first quarterly update, starting with a screenshot of our Dashboard below. It shows the product we’re invested in - the InvestSMART Balanced Portfolio – and the asset class breakdown:

.png)

Over the past 3 months, it’s performed pretty much as expected, ending the quarter to 30 September 2021 up 1.98%, as the chart below shows.

.png)

Performance is relative, though. It pays to compare this figure to other similar funds, although you must be careful about timeframes. Quarter-to-quarter performance doesn’t mean much, which is why the charting function in the Dashboard allows you to set varying timeframes.

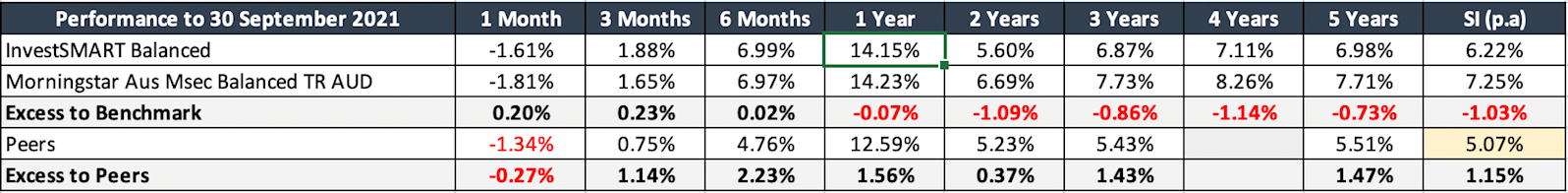

InvestSMART Balanced Portfolio is benchmarked against the Morningstar Aus. Msec Balanced TR AUD index. The InvestSMART website has all the details and aggregates the performance of all other funds using the same benchmark. Here’s the table:

Did you notice the discrepancy? My wife and I got a return of 1.98% for the quarter on our Balanced Portfolio but InvestSMART reported 1.88% over the same period.

The difference is explained by the fees. For reporting purposes, InvestSMART calculates fees of 0.55% p.a. on all portfolios based on a minimum $50,000 investment. But this fee is capped at $451 for investments above $82,000.

On a $1 million investment, my wife and I pay just $451 a year rather than $5,500 (0.55% of $1m). As a result, the performance of our portfolio will always be better than that reported on the InvestSMART website. And, as our portfolio grows, our fee as a percentage of the portfolio’s value will get even smaller.

This is the value of a fixed, economical fee. We start the next year with an extra $5,049 that would otherwise be lost to fees. Through compounding over the years, this really adds up.

One of the attractions of investing through the InvestSMART Professionally Managed Account platform is the ease of opening an account, adding and withdrawing money and setting up an automatic contribution plan.

.png)

In the coming years, we hope to increase the $5,000 monthly contribution as we near retirement, the kids finish school and we have more money to salary sacrifice. That’s an easy thing to do in Investment Preferences:

.png)

During the quarter, we changed the bank account from which our monthly contributions are deducted. Security is vital so it was reassuring to see three levels of authentication; account login; entry of bank account details; and mobile verification code.

We’re happy with our balanced asset allocation for this investment and have no plans to change it given our investments in direct shares, the main one being InvestSMART itself (ASX: INV). I’m a strong believer in investing in yourself (via education) and your own business before diversifying into other asset classes but that’s just me - others may feel differently.

Incidentally, my wife uses our new Corporate Alerts function to get all INV announcements, so she doesn’t have to ask me how our stake is going over dinner. If you are interested in getting these alerts, you can join up here. We are hoping to introduce this free service for all ASX-listed companies soon which we will announce in InvestSMART Insights.

Until next time happy investing.

Links to the original series:

https://www.investsmart.com.au/investment-news/qanda-from-ceo-invests-1m-series/150003

Frequently Asked Questions about this Article…

The InvestSMART Balanced Portfolio is an investment product that offers a diversified asset class breakdown. Over the past three months, it has performed as expected, ending the quarter to 30 September 2021 with a return of 1.98%.

The discrepancy is due to fees. InvestSMART calculates fees of 0.55% p.a. for reporting purposes, but for investments above $82,000, the fee is capped at $451. This means that on a $1 million investment, the actual fee is much lower, resulting in better personal portfolio performance.

InvestSMART's fee structure benefits larger investments by capping the fee at $451 for investments above $82,000. This means that as your portfolio grows, the fee as a percentage of the portfolio's value decreases, allowing more of your investment to compound over time.

The InvestSMART Professionally Managed Account platform offers ease of account management, including opening an account, adding and withdrawing money, and setting up automatic contribution plans. It also provides robust security with three levels of authentication.

You can easily increase your monthly contributions through the Investment Preferences section on the InvestSMART platform. This flexibility allows you to adjust contributions as your financial situation changes, such as nearing retirement or having more disposable income.

InvestSMART ensures account security with three levels of authentication: account login, entry of bank account details, and a mobile verification code. This multi-layered approach helps protect your financial information.

You can use the Corporate Alerts function to receive updates on all INV announcements. This service is currently available for InvestSMART and is expected to expand to all ASX-listed companies soon.

A fixed, economical fee allows you to retain more of your investment returns, which can significantly add up over time through compounding. This approach ensures that more of your money is working for you rather than being lost to fees.