Origin's King playing with fire

Sometimes it can be difficult deciphering how Origin Energy chief executive Grant King’s mind works.

Yesterday in the Australian Financial Review it was reported,

“Mr King stepped up his criticism of Australia’s fixed $23 per tonne carbon price, which is almost five times higher than in Europe. He said it was making no difference to emissions and was only a 'deadweight cost' to the economy.”

This is all rather confusing because back in July 2011 he told Ali Moore on ABC Lateline,

ALI MOORE: … You're also part of the Business Council of Australia, which wanted a $10 carbon price. Did the government get it right with $23?

GRANT KING: Look, I think the government has struck a reasonable balance….So I think the carbon package, the carbon part of the package is in about the right place. It will cause some change, not as quick as some would like, but that price together with the offsetting measures I think is a reasonable package.

ALI MOORE: …a couple of years ago you said – in fact more recently than that – that if they wanted to achieve their 5 per cent cut in reductions on 2000 emissions by 2020 on price alone, you'd need a price in the $40-$60 category. So you believe that there are enough other mitigating factors around that price to make it work?

GRANT KING: Yes. There's three phases. If you think about how to reduce carbon, there's sort of three phases in the process. The first is we have to change the capital that we're going to spend in the future, particularly to generate energy. And in fact the very simple carbon scheme at a starting price of $1 would do that. That would cause us to change the way we spend capital in the future. If we want to change the way we use our current power stations and change the energy we use, change the fuel we use and the way we use them, that's what this scheme will cause us to do and it will start that process and it will accelerate the rate at which we reduce carbon emissions.

As detailed on Tuesday it is undeniable that the $23 carbon price, although certainly not the carbon price alone, has substantially reduced the profitability of NSW black coal generators and consequently their output and emissions. For example Eraring Power Station (who’s output and trading profits Origin acquired in late 2010 for about $856 million), has suffered a 60 per cent drop in profitability since the carbon price came into effect (compared to the average of the prior six financial years).

However, one has to admit that King has a point when it comes to emissions from the industrial manufacturing sector. There are other factors having a far more profound impact on their motives and behaviour than the carbon price:

– the Australian dollar; and

– underlying rises in energy prices independent of climate change policy.

These suggest that the scrapping of the carbon price by the Coalition, especially the emaciated one that will transpire if Europe fails to tighten-up the stringency of its ETS, may have less impact on emissions than would have been envisaged several years ago.

The rise in energy prices the industrial sector is experiencing due to network charges and rolling onto new LNG-linked gas contracts dwarf the impact of the carbon price. Australian Bureau of Statistics data, illustrated below, shows a rapid rise in both electricity and gas prices that commenced well before the carbon price came into effect in mid 2012.

Index of business energy prices in Australia

Source: ACIL Tasman, based on ABS data

As an illustration of the relative impacts let’s look at the wholesale price of gas which historically traded at about $3.50 per gigajoule on the Victorian market.

A $23 carbon price would increase this by $1.61 (if combusted but not if used as material feedstock – for example, for plastics). But once you take into account free permits for trade-exposed industry, the increase would be between 16-64 cents or 4.6-18.2 per cent.

By comparison the development of LNG plants means Santos and Origin can now charge industrial customers prices of $7 to $9 per gigajoule, an increase of 100 per cent to 157 per cent.

The other factor, the Australian dollar, needs no real explanation. It’s incredible impact on the competitiveness of manufacturing fills the newspapers every day.

The rise in the gas price, and increased electricity network charges, combined with the rise in the Australian dollar are accelerating a process of restructuring of heavy manufacturing industry that began with the removal of tariffs.

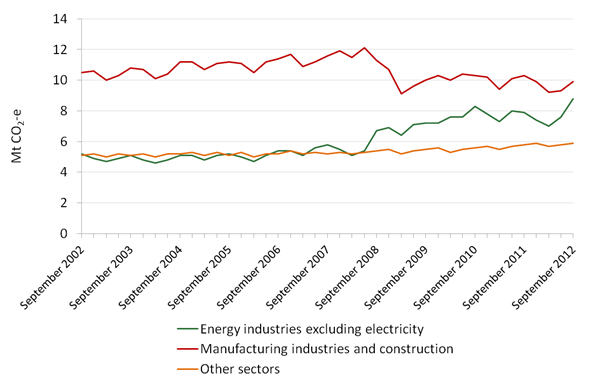

If you look at direct emissions from combustion of gas and coal from the manufacturing sector (the red line in the chart below), it dips at the point of the GFC, but then never recovers. This can't be traced to the carbon price as it wasn't in effect until the tail-end of the chart in July 2012.

Emissions by sector from direct combustion of gas and coal excluding electricity sector

Source: Department of Climate Change and Energy Efficiency (2012) December quarter emissions inventory

Given the LNG-induced spike in gas prices, King should be careful stirring up fears with his suggestion the costs of the Renewable Energy Target might push industry overseas. In reality it may actually reduce electricity prices for heavy industry once you take into account the concessions trade-exposed industry enjoy, as explained here. His claim reported by the AFR that carbon and green costs were weighing on manufacturers far more than gas prices is laughable.

This is now dawning on heavy industry and union leaders like Paul Howes. Two days ago Paul Howes delivered a speech that should send chills down the spine of Grant King and other gas producers. He argued rising gas prices were a far greater threat to Australian manufacturing than the carbon tax. Citing the US shale gas boom experience, Howes argued Australia should be reserving a large amount of our gas supplies solely for domestic use.

Whipping up fears of an industry exodus could well backfire on King, saddling his company as well as other gas producers with a domestic gas reservation requirement. This could easily hurt their profits far more than a $23 carbon price or the Renewable Energy Target.