Origin Energy stretches the friendship

I have oft been told when trying to understand politics that applying logic is futile. For example logic would suggest that a government that supported lower electricity prices for consumers would support the existing Renewable Energy Target, particularly given its own panel review of the RET (and multiple other recent studies by market experts) found that a reduced target would push prices up.

From a political perspective more than 80 per cent of voters (including Coalition supporters) support the existing or higher RET – especially a RET that keeps their electricity prices down. Supporting it is therefore a no-brainer, right? The political aspect has yet to play out fully so I will comment no further, for now.

When it comes to business it's more difficult to stare down logic. In a competitive market where there are winners and losers it is incumbent on officers of corporations to execute a strategy that benefits their shareholders. I, for example, am writing this to support the interests of Infigen Energy's securityholders. I have a vested interest. But the evidence I draw on to make my assertions is independent, and sourced from third parties without the same bias. I'm ready and willing to look at the other side of the argument, if supported by evidence.

I contrast this with Grant King's appearance on Radio National Breakfast on Friday morning. In his concluding comments, King argued that changing the RET would not improve the profitability of Origin Energy, though he wished the opposite were true. Are we therefore to believe that he is commenting on this piece of public policy for some altruistic purpose, for the greater benefit to society? Or is it more likely that he is being disingenuous about the effect the RET has on the profitability of Origin's business?

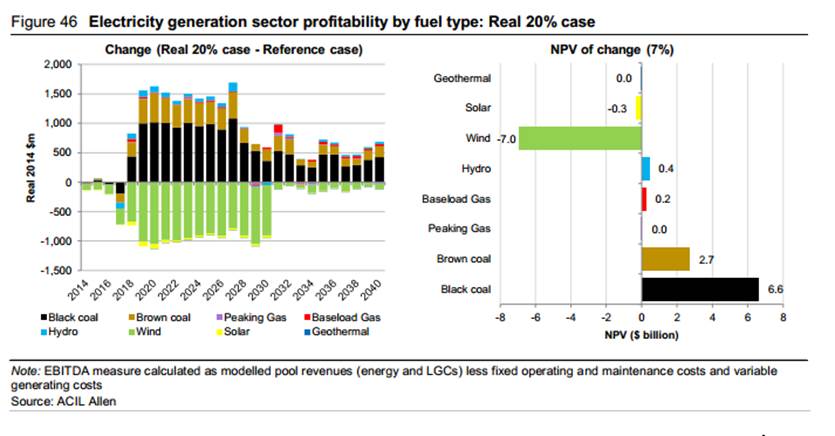

Recent studies (including the government's RET review) have shown that the existing generators in the national electricity market would benefit to the tune of $9-$11 billion if the RET is reduced. Origin owns a sizeable generation fleet across the country seemingly insulated from any effect that the RET may have on the electricity market.

So let me examine some of King's comments from Friday morning and apply some logic to them (I hope the readers will pull me up if I've let my logic slip somewhere along the way).

King said that the RET was brought in on the premise that it would meet the additional demand for electricity, not strand existing assets, and that Origin supported a ‘real 20 per cent'. I have three points to make on this:

– Firstly, Origin and others made final investment decisions to construct new thermal plant when the expanded RET scheme was contemplated, thereby competing for this increasing demand (or contributing to the reserve capacity).

– Second, Origin and others acquired existing thermal generation in the knowledge of the legislated fixed gigawatt-hour targets for renewable energy through to 2030, bidding prices for those assets that reflected the expected (over)supply-demand dynamics.

– And finally, if the RET was supposed to meet the increase in demand for electricity (notwithstanding this appears nowhere in the legislation), what logic supports Origin's position that the target should remain, just a lower one? Why does Origin support the addition of any new generation capacity? Perhaps it has more to do with reaping the benefits of being perceived to support the policy.

King said that the RET was not driving down wholesale electricity prices and that there were other factors at play, so it is difficult to attribute lower wholesale prices to any one particular factor.

Of course, it is incredibly difficult to predict the future. We use models to assist us but these are inherently biased to the input assumptions. Therefore I like to look at as many models as possible and then view the outputs as broad trend indicators of what the future might look like. Where models are more useful is in sensitivity/scenario analysis. If you hold all assumptions bar one constant, what effect does that changed variable have on the model outcome?

This is where I struggle with King's comment that there are not many credible forecasts to suggest that wholesale prices of electricity would rise if the RET was reduced. The overwhelming majority of the publicly available modelling (ROAM, Schneider, ACIL Allen, SKM) conducted on this subject has shown that an electricity market with the RET compared to one without the RET results in lower wholesale prices. Some may argue that it's the increased competition in the market while others will claim the ‘merit order effect'. It doesn't really matter; it's the outcome that matters. I would welcome Origin making public any modelling that delivers a different outcome.

For completeness, a consumer pays the retail electricity price not the wholesale price, and that retail price also includes (among other charges) the cost of the renewable certificates. The same modelling that I referred to earlier shows that even after accounting for the cost of the certificates consumers will be better off under the current RET.

Finally, the one comment that King made that I and the renewable energy industry vehemently disagree with is that the existing target cannot be achieved. I would suggest that King take a look at a photo of Curtis Island from four years ago and compare it to today. Australians can be a pretty industrious bunch when the right incentives are in place or roadblocks removed. The one thing that I could tell our securityholders with conviction over the last few years was that the demand for renewable energy between now and 2030 was a known quantity, enshrined in legislation that had bipartisan support. Our focus and efforts have therefore been on the supply side of the equation. There is 6000MW of approved wind sites across the country and no insurmountable supply side issues from an equipment or labour perspective.

The RET was introduced to facilitate the entry of more renewable energy into Australia's energy mix. Should the reward of success be that renewable energy generators now play second fiddle to the interests of fossil fuelled electricity generators with higher marginal costs and significant carbon emission profiles? Carbon policy in Australia is another area of uncertainty but rest assured, as the world moves further into a carbon constrained environment developing, operating and financing fossil fuelled generation will be increasingly difficult and expensive.

It is unconscionable to contribute to the regulatory uncertainty by fighting against the current renewable energy targets, and then present oneself as being the advocate of good public policy while denying one's vested interests. To be clear, I have no issues with an officer of a company seeking to protect its interests. It's part of the job. Having said that, the community has come to expect that corporations, particularly very large corporations like King's, will also recognise the legitimate interests of the community and participate in community debate and policy making as a good corporate citizen. It is up to the officers of each corporation to decide for themselves how they will respond to these community expectations. Threats from Origin that consumers will end up paying the penalty price that are made in order to influence the debate are hollow and should be given no credibility. If this were a real scenario the certificate prices today would be much closer to the $93 equivalent of the legislated $65 penalty price than the current $35 market price.

I've become somewhat cynical when it comes to expecting an adherence to reality in the politics of energy and environment. But Grant King's interview with Fran Kelly on Friday was beyond the pale. Consumers should expect better, and I hope they turn to the evidence, rather than to the claims of companies set to make windfall gains from a cut to our renewable energy ambitions.

Richie Farrell is group manager, investor relations and strategy at Infigen Energy.