Only our richest are really buying more

The Abbott government was given a news-cycle reprieve over the past fortnight as the headlines shifted to the tragedies in Ukraine and Gaza, and moved away from the negative stories flowing from the federal budget.

That said, the long run news cycle cannot stay off the budget or the economy for long, and this week's economic data paints a confusing picture of whether that will be good or bad for the government.

Strong retail figures for the month of June (though still negative for the quarter) were hailed by some as a 'rebound' in spending, following a recovery in the ANZ-Roy Morgan consumer confidence figures.

CommSec's Craig James was upbeat: "Car sales remain healthy; services sector activity is improving; exports to China are at record highs; and consumer confidence has only eased a touch after three weeks of gains. With less media attention on the budget, people are getting on with life."

But are they? Drilling down into the retail data on a state-by-state basis, some interesting patterns emerge.

In the charts below I have taken the beginning of Gillard government as a starting point, given the economic chaos of the GFC period preceding it. That provides some insight into which Australians have been on a shopping spree over the past four years, and which have not – the 'leaders' and 'laggards' are separated out for ease of reading.

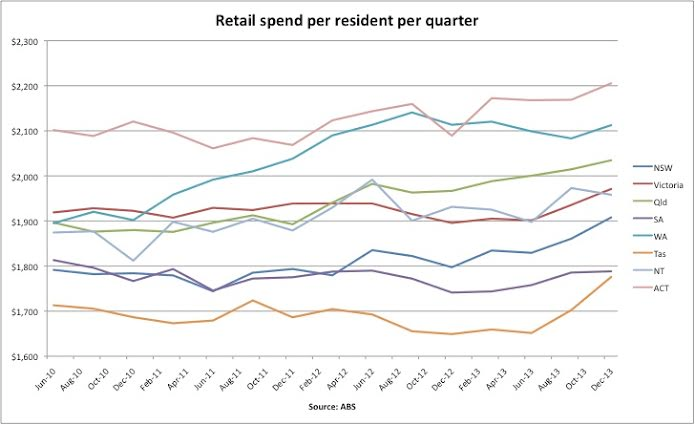

As expected, Western Australians have been treating themselves quite a bit during the high point of the mining boom, with Queensland seeing the next highest growth over four years.

Tellingly, though, New South Wales is emerging as the nation's job creation powerhouse, and is seeing quicker spending growth as the sandgropers ease off a bit.

That's the top level view, at least, though it's important to point out that population movements have complicated the picture somewhat.

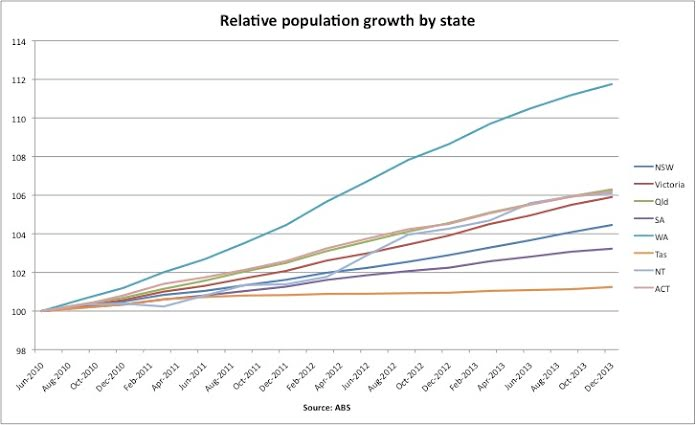

As the chart below shows, WA might have leaped ahead in retail spending, but it also saw its population swell by about 12 per cent through the Gillard years.

Compare that with just 1 per cent population growth in Tasmania, and the scale of WA's boom becomes clear.

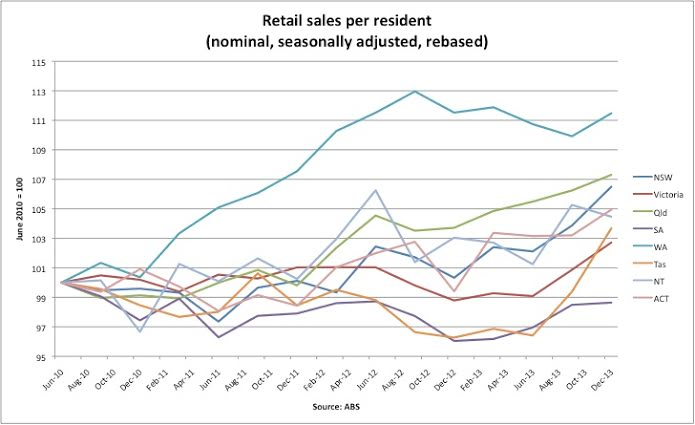

Adjusting the state-based retail figures for population growth, then, it's clear that WA still has a strong lead in retail growth over those years.

In fact, as the second chart below shows, Western Australians are living high on the hog, spending around $400 per person more on retail goods each quarter than the average Tasmanian.

Okay, that's a lot of charts. The big question for the Abbott government when it finally heads into a period less swamped with news of human tragedy abroad, is whether there really is a 'rebound' in consumer confidence and retail spending.

The answer is a little bit 'yes', with quite a bit of 'no'.

When nominal sales figures are looked at, the surge in spending in WA looks impressive, with each resident splashing out nearly 12 per cent more that they did four years ago.

However, ABS inflation data for the same period shows that the broad measure of CPI has increased by 10.6 per cent over the same period.

That means only WA residents are spending more in real terms than they were four years ago. The rest of the nation is spending less in per capita terms.

That is in keeping with the historically high savings rates and household deleveraging, but many retailers know what a lower real spend per capita feels like. And it doesn't feel good.

That's something headline writers might want to keep in mind in the weeks ahead.