Old utilities know better than Abbott

Tony Abbott may think there's only one way for the poor to get their power – via a powerline running hundreds of kilometres from a big coal fired power station. However, electrical engineers and energy economists are turning their mind to how increasingly affordable, small-scale power supply technologies, such as solar PV, could open up completely new options for how we might design electricity systems and associated markets.

The International Energy Agency's report released on Monday evening, exploring how Sub-Saharan Africa's energy market could evolve, provided a particularly interesting analysis on this topic. Because of the underdeveloped nature Africa's electricity grid infrastructure and also its weak governance (law and order) structures, cost reductions in power technologies that can be located on the power consumer's premises or at least near-by become particularly useful.

This also has high relevance to Australia where rural areas that are very sparsely populated involve high costs to service via grid infrastructure.

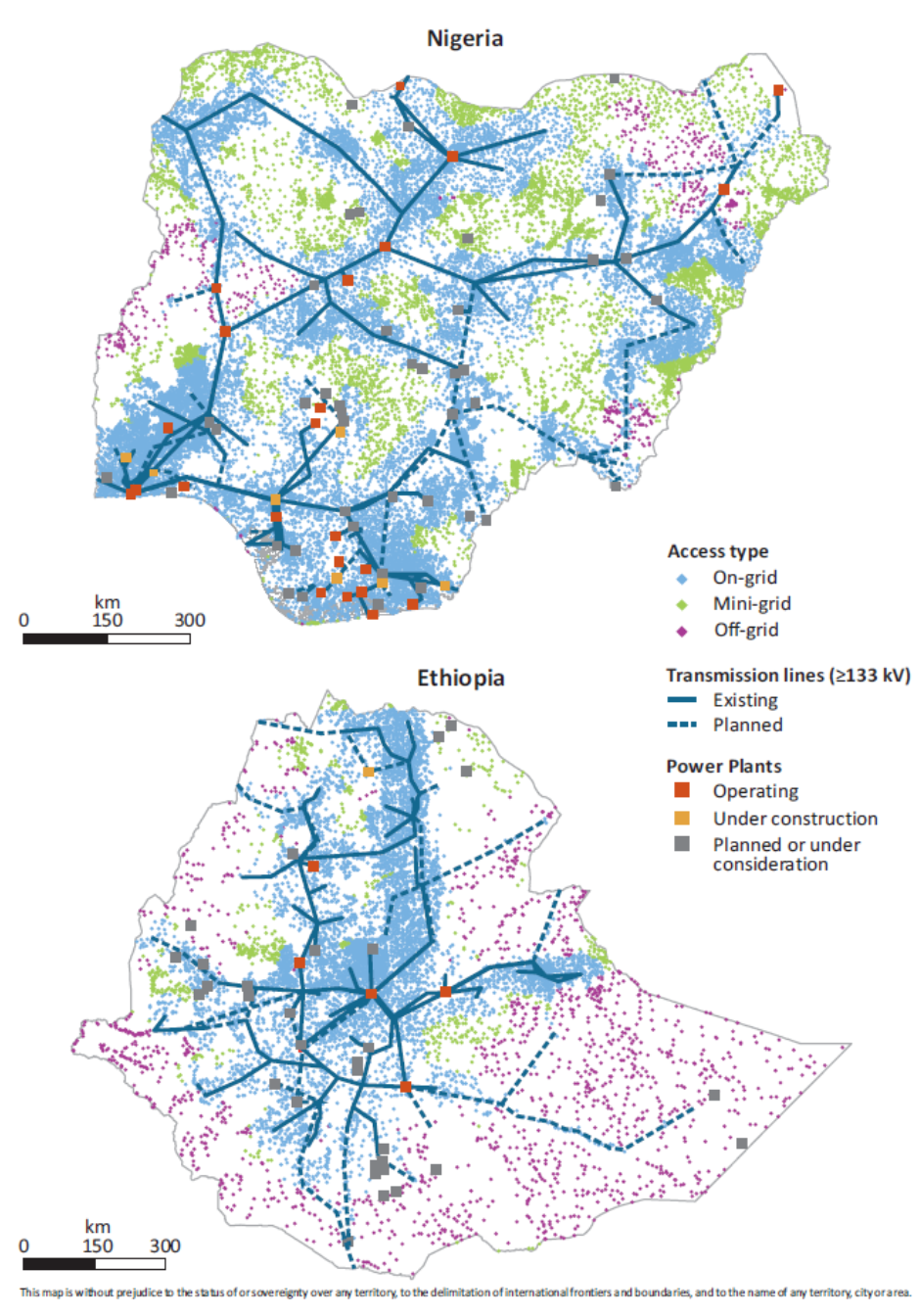

The chart on the left below illustrates how extensions of the grid can be extremely expensive even for small distances. With the grid already in place its costs of supply are a touch above $US100 per megawatt-hour for the area examined. This is vastly cheaper than the cost of the mini and off-grid solutions illustrated in the chart on the right. However, according to the IEA extending the grid just 1km to connect up a new community can involve an additional annualised cost of about $100 per megawatt-hour of power delivered. Extending it 3km pushes costs to around $450/MWh, substantially higher than the mini and off-grid options.

Figure 1: Cost of grid supply and grid extensions versus stand-alone mini and off-grid solutions

Source: International Energy Agency (2014) Africa Energy Outlook

Now, what makes this particularly interesting is that the solar PV off-grid solution is expected to achieve substantial cost reductions over time. By 2040 the IEA forecast self-contained fully-off-grid solar PV plus battery systems achieving a cost of about $180/MWh. A cost of $180 means even in Australia with grid infrastructure already in place, households in urban areas would be better off disconnecting from the grid. And other analysts and industry participants are far more bullish about cost reductions likely to be achieved by batteries. For example, Jason Waters, the chief executive of Western Australia's major utility, Synergy, told the Australian Institute of Energy conference that he expects that by sometime around 2025 to 2030 it will become economic for households to disconnect from the grid.

So if that's the case for built-up urban areas with grid infrastructure in place, imagine what the economics look like for sparsely populated rural areas.

Now, while Australia's rural areas already have grid infrastructure in place, much of it was installed several decades ago. This means a large proportion is in need of replacement. In addition the ongoing cost of maintaining long-distance power lines serving just a few customers can be extremely onerous. These costs are hidden by cross-subsidies that ensure rural customers pay similar prices to urban customers, but the Queensland Competition Authority provides a slight hint. According to the QCA, Queensland's uniform tariff policy subsidy for regional electricity customers serviced by network business Ergon is expected to be $655 million in 2014‐15. Ergon services 700,000 customers so that works out to a subsidy of $936 per customer per year.

Ergon's chief executive, Ian McLeod, explained on Wednesday at the All-Energy Conference that it's not quite that simple. Larger towns such as Cairns and Townsville which represent a large proportion of Ergon's customers are reasonably cheap to serve. However, those on long rural feeders would be costing several thousand dollars per annum more than Ergon is able to charge.

It makes economic sense right now for these customers to be rolled-over to solar plus battery solutions. McLeod explained at All-Energy that he now expects network upgrades to be extremely rare because a combination of batteries, energy efficiency, demand shifting and solar are likely in most cases to be lower cost.

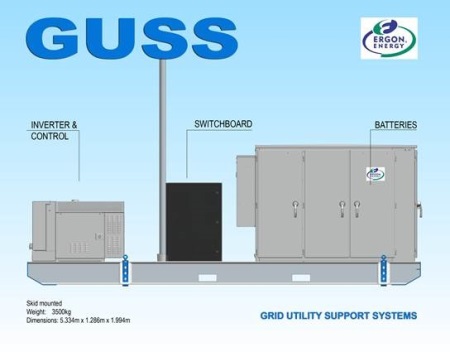

Indeed his company just announced that by mid-2015 it will be rolling out 20 of its battery-based Grid Utility Support Systems, illustrated below. These will go into parts of its network that employ Single Wire Earth Return technology, which is common across large areas of Australia's rural electricity networks, not just Ergon's service area.

These systems will be provided by US-based S&C Electric Company and comprise 50 lithium-Ion batteries with a nominal capacity of 25kVA and 100kWh each.

According to Ergon these systems could reduce their SWER network upgrade costs by more than 35 per cent. So these will be rolled out without the need for any government subsidy.

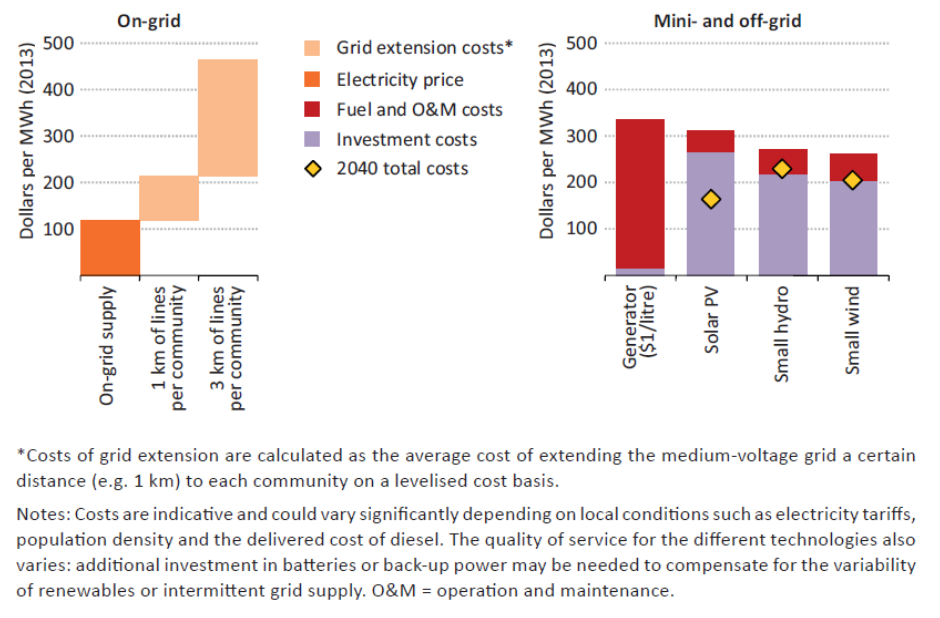

Taking this to its logical conclusion, the IEA's Africa report explored how you would rollout grid infrastructure given the changing economics of distributed energy supply options in Nigeria and Ethiopia, illustrated in the map below. The blue areas are demand centres such as towns which would be serviced by the traditional centralised grid. In addition to this central transmission core, the economics suggested it would be optimal to make significant use of mini-grids (indicated in green) and off-grid solutions (indicated in purple). Now keep in mind Ethiopia has a population of 94 million in a land area just 40 per cent larger than NSW and Nigeria has a population of 174 million people in a land area only 15 per cent larger than NSW.

It serves to show that off-grid and mini-grid solutions could be a big part of Australia's rural electricity sector, not just nations that currently lack electricity infrastructure.

Figure 3: Optimal split of grid type in Nigeria and Ethiopia, based on anticipated expansion of main transmission lines