Oil: Ready to recover?

Summary: Shell's £47 billion proposed takeover of BG Group has reignited debate about whether the oil price has bottomed. While we need to be careful as there isn't conclusive evidence for oil to have troughed, the price action offers some suggestion. Further, expectations are for US crude oil production to fall – meaning the supply ‘glut' may have reached its peak. |

Key take-out: There is a good chance the oil price has troughed. Supply is only just keeping up with demand – even with the shale oil boom – and more experts in the sector are making huge plays on a recovery over the next few years. |

Key beneficiaries: General investors. Category: Commodities |

The price action on crude has been nothing short of incredible, almost halving from mid-last year. I should imagine it'll form the basis of PhDs for some years.

The Bank for International Settlements, for its part, doesn't think fundamentals have played a major role in the action to date, and that's a view I would agree with.

The big question is whether oil has bottomed. Looking at the price action there are some grounds to think that it has (As a side note, one of the most leveraged ways you can invest in an oil recovery is through Whiting Petroleum, which Clay Carter has recommended as a "buy" in this edition).

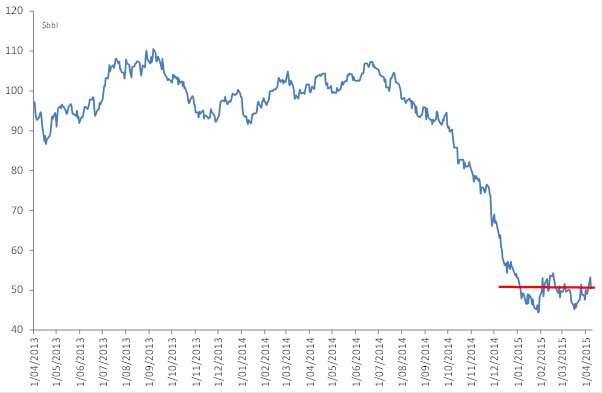

I'm not table thumping here – we need to be careful. Yet the price action does offer some suggestion. Take a look at the cart below.

Chart 1: A crude trough?

As you can see from the chart, following the dramatic and sudden slump mid last year where prices fell over 50 per cent, crude has been stable around the $US50 mark for about four months now.

I'm not suggesting for one second that this is categorical proof of a bottom, although stability is often an important signal in itself.

Think about the backdrop. The crude oil price has fallen to levels last seen in the GFC and, before that, in 2004. But since those times the global economy has grown 50 per cent and 74 per cent respectively. Crude oil demand is 7.3 per cent higher, while supply is only 7.9 per cent higher.

There is no huge glut – supply has only just managed to keep up with demand and that's with the US tight oil boom. Thought of another way, in the absence of the shale oil boom there would be a sizeable shortage of oil.

Even if you are of the view that there is an oil glut, US crude production is actually forecast to fall modestly. That is according to the US Energy Information Administration, which forecasts a slight decline over coming quarters into 2015 and 2016. If that's the case, then the supply glut has reached a peak, and while that may not be grounds for a huge rebound in crude, it does suggest a bottom.

Rising takeover activity

Takeover activity would also seem to support that view; specifically, Royal Dutch Shell's £47bn ($97bn) bid for BG group – the largest ever in British history – if regulators approve it.

In making the bid, executives from Shell stressed they weren't making a play on the oil price. But the fact remains that they probably wouldn't have made the bid they have – which is at a 50 per cent premium to BG's current market value – if they thought more carnage was due.

Indeed, Shell also announced that the valuation on BG does assume a recovery in crude prices – and thus gas (which is BG Group's speciality) – over coming years.

Once again this is not table thumping evidence – but it is another very good signal. Real money is being thrown into the sector and the talk is that at these prices more consolidation in the energy space is inevitable.

Traders, in contrast, appear less certain. There has been a sizeable lift in the number of long (bought positions) in crude oil futures and options contracts, but then again, short (or sold positions) have increased sharply as well.

On balance there have been a modest increase in the number of long positions and, while I wouldn't call it a strong conviction call, it is a directional bias, and that bias is upward.

Summary

I think there is a very good chance that oil prices have troughed – and it appears that real money agrees; $47bn is a lot of money to throw away on a spurious gamble. That takeover must be seen as an expression of faith by experts in the sector.

I have to emphasise that there is no consensus view on this as yet – there isn't even a consensus view on what happened over the previous six months, let alone what will happen over the next six months!

The conditions do appear to be in place though. Australian investors will need to be conscious of currency considerations as well, although with currency wars raging and everything depending on the US Federal Reserve, there is a lot of uncertainty.

Putting all those issues to one side, the Aussie dollar is currently around its post-float average. So viewed in that context, investors needn't be too concerned about short-medium term currency plays.