Oil price drop defies logic

Summary: European stocks followed other markets to rally last week, but investors are concerned as to how sustainable growth will be in the face of the latest disappointing macroeconomic signals. Whether the economy has bottomed relies on the tensions with Russia being sorted – and we can't know this for certain. For European equities, however, it's a different story. |

Key take-out: Europe remains attractive as an investment destination. While Russian tensions have created uncertainty on a macroeconomic basis, equities have shown they don't need strong economic growth outcomes – and the structural foundations are there. |

Key beneficiaries: General investors. Category: Commodities |

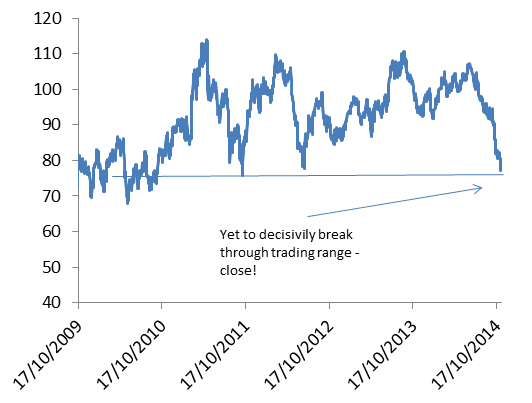

Firstly, I should eat a little humble pie. It was only a month ago that I wrote crude (the West Texas Intermediate benchmark) was unlikely to crash through the $US80 mark (Oil: How low can it go, October 13), and here we are at $US78!

Having said that, this level is still within the trading range that's been in place for the last five years or so – if only just.

Chart 1: WTI crude price slumps

The million dollar question is, now what? Technically this should be the bottom, but the downward momentum is strong and a string of investment banks from Goldman Sachs to Barclays are now calling lower crude prices through 2015. Goldman Sachs for instance recently revised their March quarter 2015 WTI forecast to $US75 from $US90.

A big part of the problem is that analysts disagree as to what is driving the price decline. The secretary-general of the Organisation of the Petroleum Exporting Countries (OPEC), Abdalla Salem el-Badri, suggests it is market speculators that are driving the price fall, noting that “fundamentals don't deserve this price decline.”

You can perhaps see the truth in that statement given the market completely ignored the closure of Libya's largest oil field, the Sharara oilfield, recently. Some analysts expect this oil field to soon ramp up production, but there is a significant degree of uncertainty and, at the very least, it shows just how vulnerable supply still is from some Middle Eastern nation. None of that is priced in and the market totally ignored a sizeable disruption. This is very unusual.

It's fair to say that the OPEC secretary-general would be expected to make those comments about recent price moves being speculatively driven. Yet it is a position supported by the facts. As I noted in October, the crude market is well supplied but not oversupplied. Global growth is accelerating.

The other view in the market is that there is a surplus of crude – especially in the US. Now I've dealt with this before, noting that while there may be a surge in US shale production, the momentum of global production hasn't changed much.

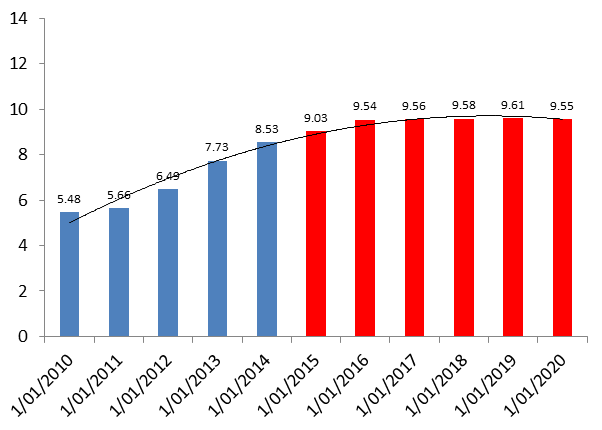

Moreover, while the US Energy Information Administration suggests US crude production has increased substantially since 2008, future production increases are limited. Indeed, US crude production is not expected to rise materially over the next decade.

This is a problem, especially as the apparent surge in US crude production and the subsequent drop in imports hides the fact that the lift in US production has only just been sufficient to cover the increase in world crude demand over the last couple of years.

Chart 2: US oil production (mb/pd) nearing a peak?

This fact is perhaps unsurprising given the very low energy return on investment that shale oil (and tar sands) offer. Traditional crude and natural gas offer returns many, many times that (4.5 to 10 times) of shale oil, and indeed, according to recent research at Stanford University sources such as hydroelectric, wind, certainly nuclear and geothermal offer greater returns than shale. In the words of one mining executive I spoke to over the weekend, shale oil and in particular the process of fracking is costly, inefficient and “stupid”.

Given this, valid questions can be and are raised as to the viability of shale oil. It should be noted that cash returns are yet to exceed capital outlays and at $US78 it's even less likely that the industry will see positive returns. Shale is already close to some estimates of break-even – consultancy group Wood Mackenzie suggests $US75, although I've seen estimates as high as $US95.

It's hard to see, against that backdrop, what it is exactly that would drive crude lower from here.

Admittedly crude oil prices moved little even after the US labour force numbers showed the longest streak of jobs gains since World War II, the strongest increase in jobs since 1999 and a 1.4 percentage point drop in the unemployment rate over the last year. It used to be the case that a surging US economy was bullish crude.

Nor can we simply defer to the spike in the US dollar to explain the crude movement. The greenback is up about 9% against the other major currencies, but this doesn't explain much of the 30% slump in crude prices since June.

But while there doesn't seem to be a clear reason for this rout, there equally doesn't seem to be too much on the horizon that would break the momentum either.

Where does that leave us? Waiting. All the information we have at hand suggests stronger crude prices, however, markets can depart from fundamentals for a long time. Much will depend on the OPEC certainly, and if they cut production this may be the jolt the market needs.

In the interim, lower crude prices are a boon to global equities – if you want to know more about global equities, I will be appearing at the 2014 international investment summit later this month alongside speakers including Alan Kohler, Robert Gottliebsen and Kerr Neilson.

One last thing: Lower oil prices are also a key positive for global growth...even more than interest rate cuts or quantitative easing action from either the Bank of Japan or the European Central Bank.