Oil: How low can it go?

Summary: The key US crude benchmark, West Texas Intermediate, has fallen 20% to around $US85 a barrel over the past four months. The market fears it will fall further as global growth supposedly weakens and the US provides excess supply, potentially creating a price war with OPEC. However, the rhetoric on the world's growth is over the top when considering actual growth outcomes, and any price war will be restricted by the US as a higher marginal cost producer. |

Key take-out: Crude oil prices are likely to keep range-trading above $US80 and we would have to see something new or of substance to breach the key support level. The prospects for a price war are limited, geopolitical tensions are likely to provide support and, as a final point, speculative traders still hold net long positions on crude. |

Key beneficiaries: General investors. Category: Commodities. |

From a peak in June, West Texas Intermediate, the key US crude benchmark, is down 20% from around $US107 to around $US85. That's a sizeable fall – a bear market – which brings crude to its lowest level since 2012.

At this point the trend is clear – prices have been falling hard for about four months now. The reasons for the slump appear numerous and on the fundamental side include weak global growth; talk is that Europe is again flirting with recession and the IMF attaches a 40% chance of that event. Strong supply - especially from the US – is also expected weigh. On these metrics alone the downside for crude would appear to be substantial.

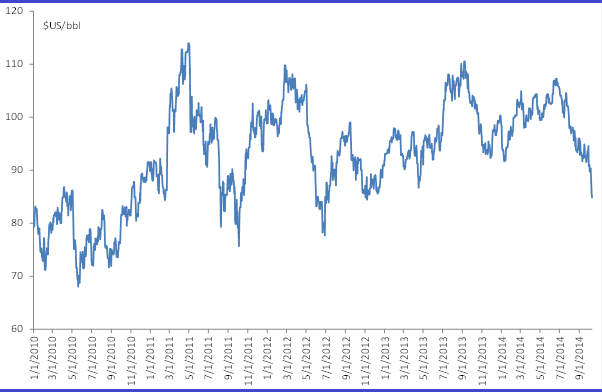

However, it's worth noting that despite the 20% fall, crude is still range trading. Take a look at chart 1 below. As you can see we've been down at this level six times over the last 5 years, with key support found at $US85 to $US86 and then again at around $US80. At the top, resistance can be found around the $US110 mark and this range has been in place from some years now. It's well established.

Chart 1: Crude still range trading

Now the reason this is important is because that price action suggests that we would need to see something new, or something of substance, for the current range to be breached. Yet what could that be? Nothing immediately stands out as a candidate.

Global growth still looks healthy

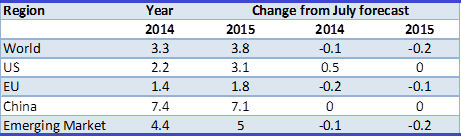

The rhetoric on global growth is a little over the top considering actual growth outcomes and expectations going forward. Following stronger-than-expected growth of 3.3% last year (IMF figures), growth is expected to be 3.3% this year and 3.8% in 2015. That is, growth is expected to accelerate over the next 12 months following OK growth this year.

Don't forget that growth was hit by severe weather in the US, while Europe is reeling from the Ukraine-Russian crisis. Underlying momentum for economic growth is otherwise very good.

Table 1: Global growth: Not that fragile, not that uneven.

In particular, note that recent downgrade by the IMF have actually been quite modest. In fact growth was revised up substantially for the US. Chinese growth was left unchanged at a strong 7.1%, while the emerging markets more broadly saw only small downgrades.

The market is well supplied, not oversupplied

On the controversial issue of supply, it seems clear that we still haven't seen much of a supply surge. Indeed the broader demand-supply dynamics haven't changed much, which isn't a surprise.

According to the International Energy Agency, total demand of 92.1 million barrels per day has been matched by supply of 92.1 million barrels (last four quarters of data). It should also be noted though that modest excess isn't unusual as the market frequently oscillates between positions of modest surplus and modest shortage. Crude on reserves (for the OECD) again hasn't changed much at about one month's supply, which is sufficient to deal with short-term supply disruptions only.

In so far as US crude and other fuel production has surged, the impact on global crude supply is overstated. To date, US production of crude and related liquid fuels has increased by 2.6 million barrels per day – over the last two years.

That's been sufficient to meet the lift in world aggregate demand (largely from the non-OECD) but not sufficient to lead to a situation of significant oversupply. As production from the organisation of the petroleum exporting countries (OPEC) has been constant over that period, there has been a change in the composition of supply but not supply as such.

With that in mind, some of the talk currently in the market about prices is something we need to keep an eye on, and in that regard OPEC's meeting in November will prove crucial. The decision to be made is whether OPEC will cut production to defend their previously stated price target of $US100 or defend a potential setback to market share from the production of US shale oil by keeping production where it is.

We need to be careful not to overplay the prospects for a price war, though as the US is a higher marginal cost producer anyway (some estimates make shale production viable only at oil prices over $US90), that would seem to limit the prospect for a price war.

Two other points are worth noting. The crude bear market itself has occurred despite a flare up in geopolitical tensions – conflict in the Ukraine and the Middle East. It is extraordinary by itself that crude prices have plummeted while these tensions which involve the world's key energy regions rage. To my mind, while these conflicts haven't seen energy prices rise, they surely must limit the downside.

On that basis, then, I can't see too many reasons why crude would break out of its current trading range. That would suggest a maximum downside of around $US80, with a more likely trough around $US85. Remember, a surging US dollar has played a key role in seeing crude prices fall. Yet the US dollar won't rise into perpetuity and indeed is at the top of its range itself.

As a final point, and perhaps surprisingly given the price action, data from the US Commodity Futures Trading Commission shows that speculative traders still hold bought positions on crude (on a net basis). Certainly the number of shorts has grown markedly, but the fact that speculators are still net long suggests there is a lot of support for crude.