October: Why the bad reputation?

Summary: The month of October features in 9 of the worst 16 one day falls in the US share market. But the month marked the start of only one of the worst 11 market crashes in the US. October's average return makes it the seventh most profitable month. In Australia, October is on average a down month, with November even worse. |

Key take-out: From 1985 to 2012, October was a winning month for the Australian share market overall, with 18 wins compared to 10 losses. |

Key beneficiaries: General investors. Category: Shares. |

October is identified with two horror days in share market history – the Black Tuesday 1929 crash and Black Monday 1987. In both cases the steepness of the fall over just a few days shocked investors and caused panic selling.

But in terms of one day falls, Black Tuesday 1929 was only the fourth-largest one day loss in modern US share market history while Black Monday 1987 does not even rate in the top 20 list below. Neverthless the month of October still features in 9 of the worst 16 days in this horror league table.

America's worst one day share market losses

(Based on the Dow Jones Index)

Source: Wikipedia

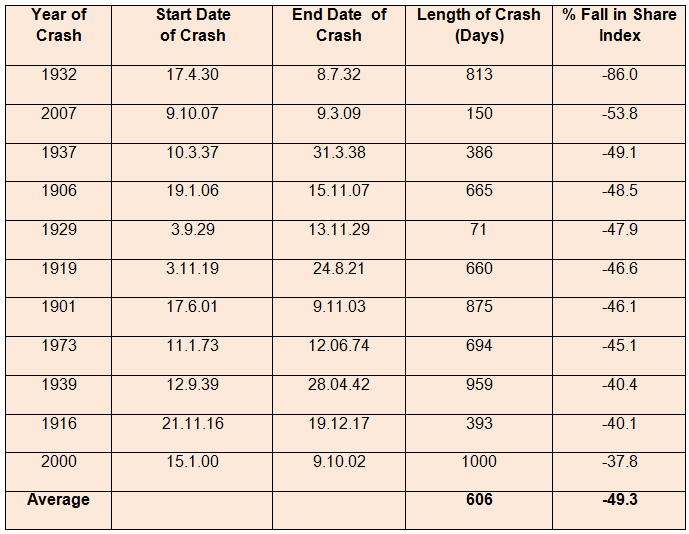

Of course what really matters is whether October is associated with the start of market crashes. The next chart shows the 11 worst cyclical bear markets in US history. Why an uneven number? Because if we had confined it to the 10 worst crashes, the dotcom bust starting in early 2000 would have missed out.

America's worst share market crashes

(Based on Dow Jones Index)

Source: DProgram

Note in the above table, October marked the start of only one market crash, that of 2007-2009.

Note also that bad crashes averaged a share price index fall of almost 50 per cent from peak to trough and lasted just over 600 days. But the range in price falls was from almost 40 per cent to over 80 per cent and the average duration was from under 100 to over 1000 days. No pattern here.

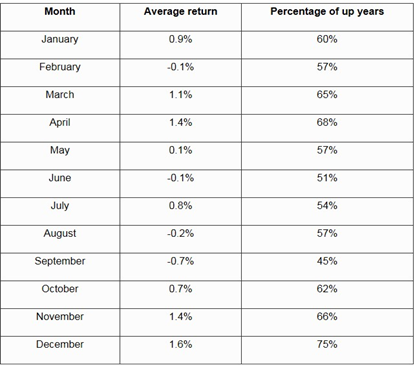

Another question is how has the month of October stacked up against other months of the year in terms of average share index movement?

The following table shows the average monthly performance for the S&P 500 since 1950.

America's average monthly share index movements, 1950-2014

(Based on S&P Share Index)

Source: Moneychimp.com

Note that October has not been too bad with an average return of 0.7 per cent since 1950, making it the seventh most profitable month. In fact, October has been up 62 per cent of the time which puts it in fifth place.

October's worst results were in 1987 and 2008 — the market fell 21.8 per cent and 16.8 per cent respectively. Yet October's best returns are 16.3 per cent, 11.1 per cent, and 10.8 per cent. The only other month to match three double-digit gains is January. So in the US October has a reputation for being a “rebound month”.

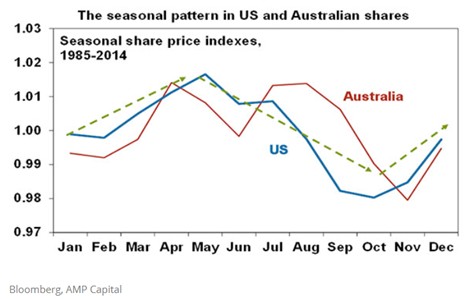

Finally, here is some data on how the Australian stock market has performed in the month of October. The chart below shows that on average October is a down month with November being even worse. By contrast the US market usually bottoms in October.

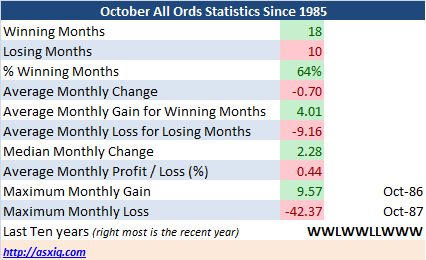

The next table covers the period since 1985, except for 2013 and 2014 (which were up months for October). It dissects October in detail.

Source: ASXIQ

What it shows is that the All Ords index averaged a loss of 0.7 per cent in October, though the most common (median) change was 2.3 per cent. Like America, October witnessed horrors like the 42.4 per cent fall in 1987, but overall, it was a winning month with 18 wins to 10 losses over the period 1985 to 2012.

Percy Allan is Editor of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds see www.markettiming.com.au.