Oblivious to the essence of equilibrium

This is the concluding article in a four-part series. View part one here, part two here, and part three here.

So where is the economy, in terms of the IS-LM diagram? It isn’t, as soon as you acknowledge that the economy is in disequilibrium, the IS-LM model can’t be used to represent it.

Some neoclassical economists think you can make IS-LM into a dynamic model by drawing phase diagrams onto an IS-LM backdrop, showing how the model will move when you start from a disequilibrium position. But that doesn’t work either, and again this is because the model is fundamentally a Walrasian one – not a Keynesian one.

Have you ever wondered how a purportedly macroeconomic tool like IS-LM can omit the labour market? It does so because John Hicks used Walras’ Law to ignore it: using the logic that if the goods (IS) and money (LM) markets were both in equilibrium, any third market must also be. But this depends crucially on equilibrium: in equilibrium, using Walras’ logic, as Hicks did to conceive of IS-LM in the first place, you can omit a third crucial market from a general model because it will be determined by what happens in the other two:

"It will readily be understood, in the light of what I have been saying, that the idea of the IS-LM diagram came to me as a result of the work I had been doing on three-way exchange, conceived in a Walrasian manner. I had already found a way of representing three-way exchange on a two-dimensional diagram... As it appears there, it is a piece of statics; but it was essential to my approach… that static analysis of this sort could be carried over to 'dynamics' by redefinition of terms. So it was natural for me to think that a similar device could be used for the Keynes theory."

But once you are out of equilibrium in either IS or LM, then you are (probably) out of equilibrium in the labour market too: what happens there cannot be ignored. You are forced “to have recourse to sequential methods of one kind or another” – or, in other words, to abandon equilibrium thinking and take up genuine dynamics.

This led Hicks to appreciate that you can’t use the IS-LM diagram to represent an economy out of equilibrium: the only way IS-LM can be used to represent an economy is if you are willing to believe that the economy is in equilibrium at all times. If you believe that the economy is actually in a disequilibrium, then you have to throw IS-LM away, since only the point of intersection of the two curves can be regarded as describing reality – and that in turn requires believing that the economy is always in equilibrium:

"Applying these notions to the IS-LM construction, it is only the point of intersection of the curves which makes any claim to representing what actually happened (in our '1975'). Other points on either of the curves say, the IS curve – surely do not represent, make no claim to represent, what actually happened. They are theoretical constructions, which are supposed to indicate what would have happened if the rate of interest had been different. It does not seem farfetched to suppose that these positions are equilibrium positions, representing the equilibrium which corresponds to a different rate of interest. If we cannot take them to be equilibrium positions, we cannot say much about them. But, as the diagram is drawn, the IS curve passes through the point of intersection; so the point of intersection appears to be a point on the curve; thus it also is an equilibrium position."

This didn’t wash with Hicks, for the same reason it doesn’t wash with Paul Krugman now: it makes no sense to describe a time like today, or the Great Depression, or even Hicks’s example of 1975, as a time when the economy was in equilibrium. Krugman is forced to reason in disequilibrium because the problem of the “zero lower bound” is an essential part of his argument. Hicks rejected equilibrium because he couldn’t swallow the idea that a period of economic crisis was also a point of equilibrium.

"That, surely, is quite hard to take. We know that in 1975 the system was not in equilibrium. There were plans which failed to be carried through as intended; there were surprises. We have to suppose that, for the purpose of the analysis on which we are engaged, these things do not matter. It is sufficient to treat the economy, as it actually was in the year in question, as if it were in equilibrium. Or, what is perhaps equivalent, it is permissible to regard the departures from equilibrium, which we admit to have existed, as being random. There are plenty of instances in applied economics, not only in the application of IS-LM analysis, where we are accustomed to permitting ourselves this way out. But it is dangerous. Though there may well have been some periods of history, some 'years', for which it is quite acceptable, it is just at the turning points, at the most interesting 'years', where it is hardest to accept it."

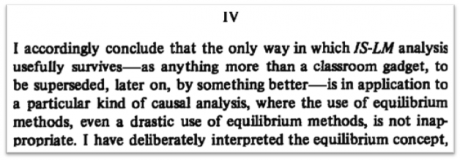

Faced with these problems, Hicks argued that the model should be abandoned:

Figure 10: Hicks 1981: IS-LM: An explanation

I hope you’ve noticed that I’m quoting Hicks to argue against a model developed by Hicks – and obviously this is a paper that Krugman (and DeLong, and many other neoclassicals) – have never read. This paper – "IS-LM: An Explanation" (Hicks 1981) – is one which I (and many other Post Keynesians) have been for years now forlornly imploring “New Keynesians” like Krugman and DeLong to read.

They seem completely oblivious to its existence, which is evidence of the 'academic apartheid' that exists in economics: non-neoclassicals like myself do read neoclassical papers and journals, but neoclassicals don’t read papers in non-neoclassical journals or by non-neoclassical authors.

Unfortunately, this crucial paper by an eminent neoclassical economist appeared in a non-neoclassical journal, because of Hicks’s unlikely but welcome friendship with Paul Davidson, who both founded and edited the Journal of Post Keynesian Economics. Hicks and Davidson met at a seminar in Italy in 1974 that attempted to bridge the neoclassical-Post Keynesian gap. The seminar – which included Joseph Stiglitz and Axel Leijonhufvud as well as Hicks and Davidson – was a failure, according to Davidson.

"It was a five-day conference and it was a disaster, because each group organised a session and they talked at cross purposes, with no communication whatsoever – absolutely no communication. People didn't listen to the other side's views," he said in an article in the journal.

But Davidson and Hicks found themselves in general agreement, and they corresponded regularly after meeting.

"We were moving along at that point of time in a very similar vein, so when he came out with 'IS-LM: an explanation', which originally came out in a seminar in Italy that he gave, he sent me a copy of it. I said I would like to publish it in the Journal of Post Keynesian Economics and that's what we did," Davidson said in the same piece.

This paper became part of the lexicon of Post Keynesian economics – and it vindicated this school’s decision, decades earlier, to treat the Hicks-Samuelson interpretation of Keynes as a bastardisation – but it remained largely unread and certainly unappreciated in neoclassical literature.

However, I doubt that it would have had any influence on neoclassical thought, even if it had been published in a neoclassical journal. There have been many instances where a leading neoclassical abandoned some aspect of the neoclassical faith and criticised it, only to be ignored by the faithful. Robert Solow is the latest to be receiving this treatment, as his vehement condemnation of DSGE modelling has fallen on utterly dear ears within the Citadel.

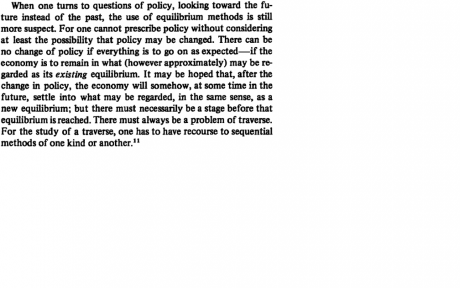

However, in a reversal of zen (“If a crucial plank of neoclassical economics collapses, and no neoclassical listens to it, has it still fallen over?”), Hicks’s logic stands – even if the vast majority of economists have never read him. In this crucial paper, the father of IS-LM analysis established that you can’t use an equilibrium-oriented tool like IS-LM to model the dynamic economy. Instead, you had to use dynamic tools in which disequilibrium was the rule rather than the exception:

Figure 11: Hicks 1981, final paragraph

Will Krugman do this? I doubt it. Equilibrium thinking is utterly ingrained into the neoclassical mindset and, as Krugman asserted ages ago, it’s an essential part of his way of thinking that he’s very loathe to abandon.

"I am not exactly an evolutionary economist," he said. "I like to think that I am more open-minded about alternative approaches to economics than most, but I am basically a maximisation-and-equilibrium kind of guy. Indeed, I am quite fanatical about defending the relevance of standard economic models in many situations."

John Hicks was a “maximisation-and-equilibrium kind of guy” too. But even he felt obliged to abandon equilibrium thinking for dynamics when he thought deeply about the topic.

So economics has indeed gone backwards over the last 70 years, and not only because the microfoundations myth has taken over economics: yesterday’s neoclassical greats were far more willing to question their assumptions than today’s. And while today’s might claim to honour Hicks today by reviving his model, if Hicks knew what they were trying to do I expect he’d be doing anything other than lying statically in his grave.

Steve Keen is professor of economics & finance at the University of Western Sydney and author of Debunking Economics and the blog Debtwatch. His Minsky Kickstarter page is here.