November enviro markets update - VEECs and ESCs

Recent months have yielded substantial changes in Victoria’s Energy Efficiency Certificate market, with considerable price movements and a decline in supply coinciding with the previously announced alterations to the Standby Power Controller (SPC) methodology.

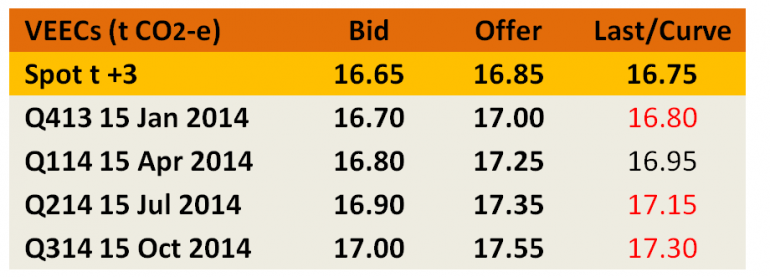

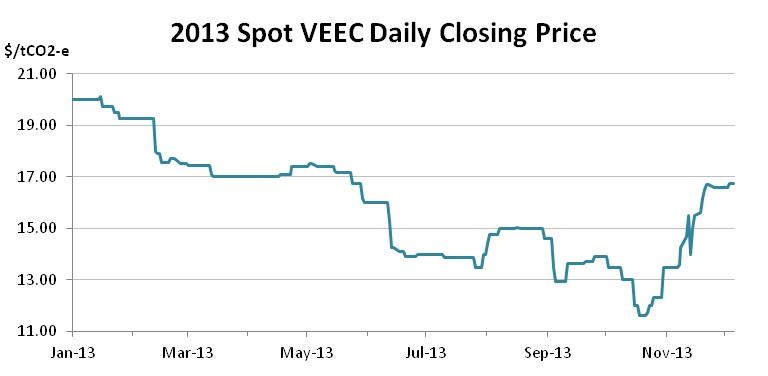

Across most of the year the staggering numbers of VEECs derived from the SPC methodology had been contributing to an enormous oversupply and hence responsible for the continuing downward trend in prices. In early September the scheme’s regulator, the Essential Services Commission, announced a reduction in the default value for the methodology that would take effect in early October and bring to an end the viability giveaway business model. It took a number of weeks after that date for the spot price to cease its descent which occurred in the latter part of October after the market had reached the mid $11s.

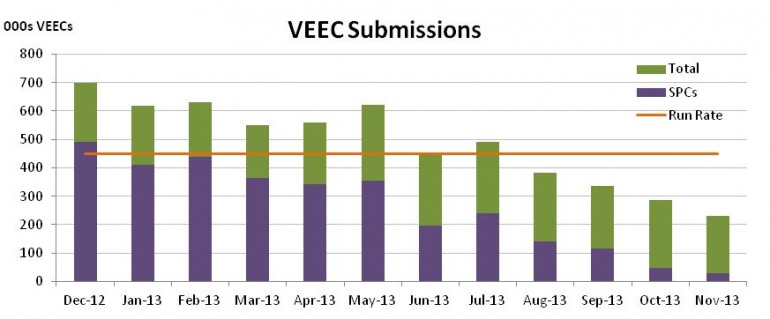

At that point it had become obvious that a large surge in SPC installations and the flood of VEECs that would have followed had not eventuated and, instead, supply from the controversial methodology which had so dominated the previous 24 months was in sharp decline (see purple area in the chart below).

Interestingly, VEEC supply from non-SPC methodologies has also been in decline of what was a very consistent level (circa 250,000 per month) across most of 2013. There may have been a number of contributing factors at play in this decline however the principal influence was almost certainty the decline in spot prices.

With VEEC supply diminishing the price recovery was rapid with the spot price back to $13.50 by early November and into the high $16s by early December, a staggering 45 per cent rally off the market’s lows.

While VEEC supply has fallen dramatically in recent months and now sits below the ‘run rate’ (calculated by taking the annual target and dividing it by 12 to determine the monthly number of VEECs required), the substantial surplus of VEECs which remains is providing a sizable buffer allowing plenty of time for a recovery in submissions to come down the track. Once this year’s target is taken into consideration, there are currently 2.37 million VEECs that remain either ‘registered’ or ‘pending registration payment’ (the latter having passed the registration process and simply awaiting payment of the creation fee), with another 500,000 in the ‘pending registration validation’ category. There is some debate around exactly how many of these VEECs will eventually be registered with some believing as many as half will not meet the Regulator’s requirements. Should such an outcome transpire, the market has already managed to meet roughly 50 per cent of the 2014 target with just under 14 months left to create the remainder.

The early part of 2014 will also be greatly anticipated for the rerelease of the Napthine Government’s proposed plans for the next phase of the scheme which begins in 2015. A consultation process has taken place across the second half of this year and while initial concerns existed that the government may scrap the scheme altogether, those fears appear to have diminished.

New South Wales Energy Savings Certificates (ESCs)

In New South Wales the downward run ended with the forward market having traded several times in the mid $12s before the release of a Rule Change consultation paper which, among other things proposed the removal of certain lighting methodologies, which have to date been a significant contributor to ESC supply. Despite also proposing an expansion of creation methodologies particularly into the domestic sphere, other changes designed to avoid giveaways have combined with the lighting changes to bring an end to the falling ESC price.

With supply having clearly outpaced demand for the first time in the ESC market’s history in 2013, the spot ESC price spent most of the second half of the year losing ground until a substantial regulatory announcement changed matters considerably. The downward run in the market came to an end in late October following the release of the Rule Change Consultation Paper.

The document proposes raft of potential changes to the scheme with the major take-out points being that several existing commercial lighting methodologies (T5 adaptors and linear LED adaptors) appear likely to be removed, while the government will look to open up the residential sector by including a brace of methodologies (including a number employed in the Victorian scheme). In each of the residential, commercial and industrial sectors the government has also outlined its intention to avoid the operation of any giveaways by requiring a co-contribution from the customer in each instance.

On the one hand the commercial lighting changes threaten to impact significantly on future supply, though it currently appears the changes will not take effect before April. On the other, the foray into the residential sphere provides a new opportunity for additional supply to come online, although how long that will take remains unclear given the time required to establish the new methodologies and see accreditations completed, as well as for companies to begin the rollout could be considerable.

The release of the Consultation Paper came at a time when the forward market had softened well below $13, with trade for late 2014 reported at $12.40. While the spots themselves did not trade below the $13 mark, the market certainty appeared lower than that figure around the same time.

The market’s reaction to the Paper, along with a number of other changes that were implemented by the scheme’s regulator has been clear, with a prompt recovery which has the market rally circa 30 per cent off its lows to reach the $16 mark by early December.

The coming months will see the focus remain on the proposed rule changes as well as on the supply coming online before they take effect. As it stands there remain just over 3 million ESCs currently registered, leaving roughly a 700,000 surplus above the 2013 requirements.

Marco Stella is senior broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.