No stomach for food and beverage

| Summary: The food and beverage sector, beset by a range of operational, competitive and market issues, has severely underperformed the broader sharemarket over recent times. Digesting the issues at hand has been difficult, even for the biggest players, and investors would be wise to keep them off their shopping list at current levels. |

| Key take-out: Paying above-market prices and accepting lower yields may have added up before, but investors wanting a taste of higher returns can definitely find better value in other sectors. |

| Key beneficiaries: General investors. Category: Shares. |

Investors will need to rethink their approach to investing in Australia’s most loved food and beverage brands, as the sector is undergoing a de-rating and more pain is expected to come.

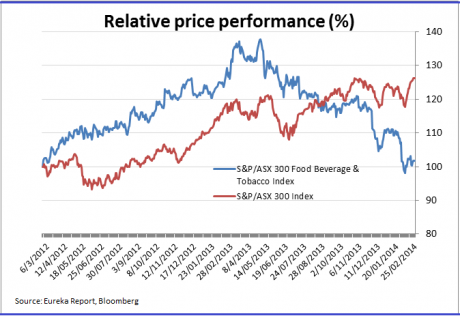

This isn’t what shareholders want to hear given that food and beverage suppliers in the S&P/ASX 300 have shed around 20% on average over the past year, when the broader market is up by over 7%.

The performance gap between the food and beverage index, which includes the owners of household brand names like Coca-Cola, Patties Pies and Meadow Lea, and the S&P/ASX 300 index is the widest it has been since late 2008.

There might finally be light at the end of the long dark tunnel, as the outlook statements from this reporting season are pointing to brighter days ahead for some in the group. But the brand leaders are unlikely to fetch the same market premium they used to as they have, by and large, gone ex-growth.

While food and beverage makers are defensive plays in theory, they are priced like growth stocks. The five-year average price/earnings (P/E) multiple for these stocks is standing at just over 23 times and the average gross yield (which includes franking credits) comes in at 4.4%.

In contrast, the average P/E and gross yield for non-resource stocks in the S&P/ASX 300 come in at around 16 times and 8%, respectively.

Attitudes towards food and beverage leaders have already started to change as the sector’s 2013-14 forecast P/E is currently averaging 16.8 times, although gross yields have not moved significantly from its longer-term average.

The sector’s de-rating, where investors are reluctant to buy these stocks on high multiples like before, has more ways to go.

| Food & Beverage companies in the S&P/ASX All Ordinaries Index | ||||||

| Code | Company | Est P/E FY14 (x) | Est yield FY14 (%) | P/E 5yr avg (x) | Cash flow to div (x) | Total rtn 1yr (%) |

| RIC | Ridley Corp | 15.65 | 5.75 | n.a. | n.a. | -10.67 |

| PFL | Patties Foods | 10.52 | 5.66 | 24.01 | 2.21 | -12.73 |

| AAC | Australian Agricultural Company | 22.70 | 5.39 | n.a. | n.a | -3.16 |

| CCL | Coca-Cola Amatil | 16.36 | 5.17 | 37.71 | 1.72 | -17.10 |

| GFF | Goodman Fielder | 15.56 | 4.48 | n.a. | 0.91 | -11.21 |

| GNC | GrainCorp | 14.98 | 4.20 | 12.23 | 2.45 | -33.86 |

| TGR | Tassal Group | 16.41 | 3.29 | 8.69 | 3.67 | 98.07 |

| TWE | Treasury Wine Estates | 20.69 | 3.08 | 42.56 | 1.57 | -15.76 |

| SHV | Select Harvests | 11.94 | 2.63 | n.a. | n.a | 279.12 |

| WCB | Warrnambool Cheese & Butter Factory | 23.27 | 1.86 | n.a. | 0.50 | 131.60 |

| BGA | Bega Cheese | 26.09 | 1.62 | n.a. | 5.55 | 116.03 |

| Source: Eureka Report, Bloomberg | ||||||

Losing its taste

The rationale for paying above-market P/Es and accepting lower yields in the past was because the food and drink category champions dominated supermarket shelves, and the companies that owned these iconic brands have a number of growth levers to pull.

This isn’t the case anymore due to the steady rise of generics and the highly competitive and mature nature of the industry.

No matter how strong the food and beverage brands are, they are all facing a margin squeeze. Specifically, they have limited ability to offset rising input prices and wages costs due to the dominance of the supermarkets and fragile consumer confidence.

Some of the headwinds are cyclical, but a lot are structural, and these brand leaders will likely contemplate acquisitions for growth sake, driven by a dose of desperation. Such strategies should raise red flags with investors, as they often destroy shareholder value rather than create it.

The “growth by acquisition” strategy touches on the question of “natural ownership”. If you can buy another company to double your size, and your competitor can do the same and get the same result, then you would have gained zero competitive advantage from the acquisition and you are not the natural owners of that business.

However, if you buy a company that is more complementary to your existing business than your competitors and can therefore gain synergies from the merger that is unattainable by your rivals, then there is a good chance you will create value.

The probability that companies will make an acquisition for all the wrong reasons is higher now, because new managers at the helm of some of the market leaders may feel under pressure to look proactive in breaking the down cycle.

Coca-Cola Amatil’s (CCL) managing director Terry Davis is retiring; while Patties Foods (PFL), which owns other frozen pie brands like Four’n Twenty and Nana’s, has replaced its chairman and chief executive within the last year.

New approach needed

This doesn’t mean these stocks are no longer investable – far from it. But it does mean that the value equation needs to change to one where you buy the stock at a P/E discount to the market, and on yields that would make any income investor salivate.

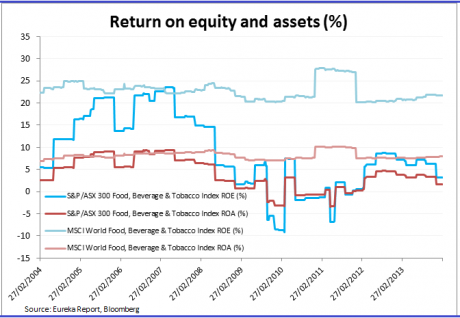

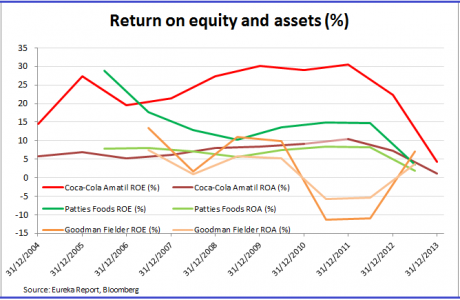

This is a more logical way to buy the sector, also because these companies have a dismal track record of generating an acceptable return-on-equity (ROE), as the chart below shows.

As I mentioned earlier, this de-rating is already underway and attitudes are unlikely to change despite Patties Foods reporting better-than-expected first half sales on Monday and giving full year guidance that implied it would meet consensus expectations. Meanwhile, Goodman Fielder (GFF), the owner of Meadow Lea and Wonder White, forecast a “significant increase in earnings” in the second half over the first-half when it reported its interim results two weeks ago.

The sector is range-bound because of the supermarkets, and companies will be driven to become low-margin cash cows, according to Patties Foods ex-chief executive, Greg Bourke.

“The supermarkets want the majors to be profitable but not too profitable,” says Bourke, who left Patties in September last year. “If you have a really bad result and you are getting smashed by your shareholders, the supermarkets will help.”

But if the brand leaders look like they are growing to a point that would threaten the market power of the supermarkets, the supermarkets will turn the thumb screws.

Bargain bins look empty

For better or worse, the food and beverages sector is far from that point. But it is looking more attractive than it has been in a long time, with P/Es falling well below long-term averages and with yields trending up. It is also reassuring to see that payout ratios are generally conservative, with companies generating cash from their operations in excess of their dividend distributions.

However, compelling value is still very elusive and that is disappointing given how much the sector has fallen. I estimate that yields will have to rise another 15% to attract bargain hunters as their yield premiums look too skinny to capture the imagination of income investors.

Indeed, the additional yield offered by food and beverage companies in the top 300 stock index to the 10-year government bond rate (the risk-free benchmark most income investors would look at) stands at 43 basis points, or 0.43 of a percentage point.

For yields to rise to attractive levels, share prices have to fall (prices and yields move in opposite directions) or managers will have to do a far better job in driving shareholder returns. As the ROE and return on asset (ROA) chart indicates, most food and beverage companies have been poor at managing capital efficiently.

This is not unlike the issue facing the mining majors last year, and BHP Billiton’s (BHP) and Rio Tinto’s (RIO) single-minded focus on lifting shareholder value is the key factor behind that sector’s re-rating

Digesting recent results

At current prices, it hardly seems worth the risk to invest in food and beverage leaders. Coca-Cola is a case in point. The quintessential soft drink bottler and food processer posted its smallest profit in over two decades last week, with 2013 net profit plummeting 82.5% to $80 million due to a big write-down in its fruit canning business, SPC Ardmona.

But the result was disappointing, even without the write-down, as normalised net profit slid nearly 10% to $502.8 million after revenue dipped 1.1% to $5.1 billion. The double-digit sales growth in Indonesia was not enough to offset the weakness, and the challenging conditions facing the group are unlikely to abate anytime soon.

But the Australian-listed entity, which distributes to the local market, Indonesia and Papua New Guinea, is not alone in its struggles and that is a reason to be even more alarmed. The United States mother ship also turned in disappointing quarterly figures as demand in North America declined and growth in emerging markets slowed.

This is prompting some to declare that the king of soda pop has lost its fizz and is past its peak due to changing consumer tastes around the world.

The earnings gloom has not stopped the ASX-listed cola company from keeping its final divided steady at 32 cents a share. Distributions are what help Coca-Cola, Patties Foods and Goodman Fielder to stand out from the sector as the expected yield on the three stocks are hovering around 5.5%.

This is 1.32 of a percentage point above the risk-free benchmark, but even then they represent fair value at best.

For instance, Australian real estate investment trusts (A-REITs) are fetching a 1.4 percentage point premium and the outlook for A-REITs is arguably looking less challenged in the current market.

No-one can tell where growth in the sector will come from, and even Greg Burke struggles to think of any new frontiers of growth outside of acquisitions. But as sure as businesses rise and fall, there will be a time when the food and beverage leaders will come back into vogue. For now though, it’s best to keep them off your shopping list.