No property bubble: It's opportunity knocking

| Summary: There are ongoing claims that a price bubble is forming across the Australian residential property market, but the numbers don’t stack up. But even if it was, don’t worry about being in property. Policy makers will let the market run its course, unless they have major concerns around a deterioration in credit conditions. |

| Key take-out: Weak credit growth, low debt servicing ratios, and a low rate of non-performing bank loans suggest we are a very long way from a housing price bubble. |

| Key beneficiaries: General investors. Category: Property. |

The topic of a housing bubble has attracted a lot of attention this week, although in truth, the talk has been around a lot longer.

Now, up front, and while I think a housing bubble is a real risk, investor’s shouldn’t be scared off.

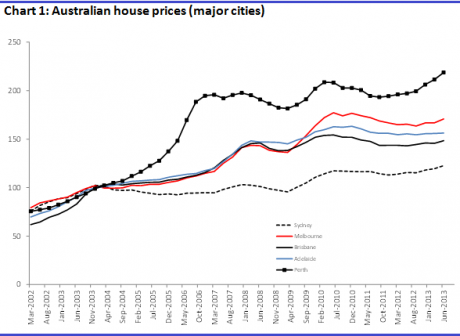

Firstly, and as other commentators have noted this week, we are not in a bubble now and no reasonable person would suggest this. You can see this most simply by noting that house prices nationally are only up 5% for the year – and this largely reflects price growth in Sydney (6% year-on-year) and Perth (11% y/y). In other cities, house price growth has been modest. For example, Melbourne (3% y/y), Brisbane (3.7% y/y) and Adelaide (0.6% y/y). Looking over a longer horizon – the last five years say – house prices are only up about 15% or so. That’s a growth rate of around 3% per year. There’s nothing bubble-like about that.

So far that’s pretty simple then, and as far as investors are concerned that should be the end of the discussion at this current juncture. The problem is that many people think we will – it’s inevitable, according to an ex RBA Board member – go into a housing bubble down the track. And I think this is a legitimate concern.

Yet there are two issues investors need to consider at this point:

Timing and bubble action

The timing of any bubble, and what action, assuming we did have one, policy makers would take to address it. That’s because it will be the policy response that poses the biggest threat to your investment.

Obviously, the question of timing (bubble now or later) is important for investors, because if we were in a bubble now you would avoid, and I would recommend avoiding, property like the plague. The expectation of a bubble down the track yields a different response, however. I mean let’s be blunt. It’s all the more reason to gain a first-mover advantage – all the more reason for investors to buy now. And that’s not as risky or as foolhardy as it sounds. Indeed, even if we are headed toward a bubble, or even if it’s only a risk, that doesn’t mean property is too risky to play – a game only for the brave or short-term speculators.

For me, I’m confident property remains attractive as a medium to long-term investment – bubble or not – and that’s because of the second issue investors need to consider. And that is, the policy response.

The policy response

This is ultimately the reason why I don’t think investors shouldn’t be scared off by talk of a bubble – now or later. Put simply, policy makers aren’t likely to do anything about it. And this is what matters. Why would they do nothing? Well, there are a few reasons:

1. Firstly, there is no well-defined or accepted definition of a ‘housing bubble’. That being the case, it is unlikely policy makers, or the broader community, will ever agree on the existence of a bubble at any given point. Rising housing prices themselves do not necessarily indicate a bubble – no matter how high they go. Take Sydney – there is no stock, the population is growing by about 1.5% per year, incomes growth is solid, and interest rates are at record lows. Why wouldn’t prices rise strongly? A bubble implies some ‘irrational exuberance’ or some departure from fundamentals.

Even if I’m wrong on that, and by some miracle people could agree on the definition, we are a long way from that point. This is because, and as I’ve discussed in past notes, house price growth has been quite modest (on average) for many years. In fact, price growth has actually been below income growth in most cities for about a decade now.

Similarly, there is no sign of debt distress. We are a long way from that. Debt-to-disposable income levels are high, sure, but this is a misleading statistic. What matters is the ability to service that debt.

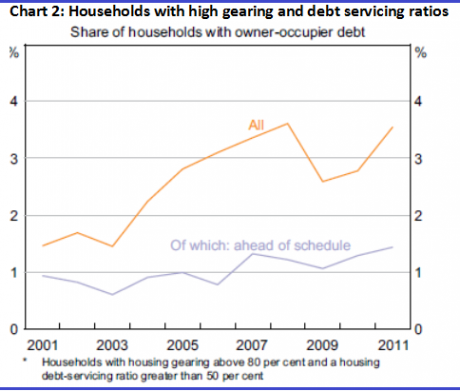

Nationally, debt servicing ratios are around decade lows (at around 9% of income), and the RBA’s own research notes no evidence of mortgage stress – highlighting that that only 3-4% of households with debt could be characterised as having ‘high gearing and debt servicing ratios’ (see the above chart 2 from the RBA). That is a debt serving burden of 50% or more, and of those 40% have a buffer. Indeed, the aggregate household buffer is about 20 months of repayments.

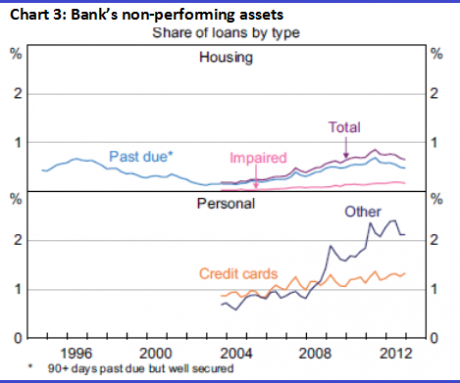

So if there are no signs of debt distress and only a tiny fraction of households are heavily geared. Add to that the fact that banks have a very low proportion of non-performing loans – less than 1% (see chart 3 below from the RBA). Then how could the central bank possibly mount an argument to intervene, no matter how hard prices run? The answer is it couldn’t, and the fact is it wouldn’t even try. That’s provided loans are being made to people who can repay them – which touches on the second reason policy makers would do nothing.

2. Think about this. Should, for some reason, there be an agreement on the definition of a bubble (highly unlikely) there is no agreement in policy circles about what action should be taken – if any. The prevailing wisdom had been, and I haven’t seen strong evidence this has changed much, that policy is better placed to clean up after a bubble has burst than to try and prick it. The GFC has changed this thinking at the margin, but not by much. The argument now is that more harm would be done trying to prick an asset bubble than letting it run its course, unless that asset bubble is accompanied by a rise in credit. And then, not just any old rise in credit, but a harmful rise – risky credit. This includes ‘low-doc’ lending to low income earners etc., or sub-prime lending if you want to think of it in American terms. I would add to that a glut of actual housing stock.

Even in that instance, the current wisdom is that intervention should be more targeted, rather than left to a generalised increase in the cash rate. This is where the IMF and others suggest ‘macro prudential controls’ (just another term for regulation), and central banks from New Zealand, Sweden and Canada have used these to limit lending. Yet, these controls aren’t intended to head off rapid house price growth or stop a price boom. They are only to restrict lending to high-risk (of default) households. In fact, policy makers in economies currently experiencing rapid house price growth aren’t really doing anything to mitigate the actual price momentum. And neither would the RBA. While that may sound odd given the GFC, the consensus still argues that more harm would be done in trying to address rapid house price growth – to the rest of the economy – than in letting it run its course (unless accompanied by a risky credit or a surge in housing stocks as discussed above).

Conclusion

To conclude then, investors have very little to fear and everything to gain from a housing bubble – whatever that is.

Firstly, there is no agreement on what a price bubble actually is, and secondly there is no agreement on what the policy reaction should be if there was one. The policy consensus appears to be that a house price boom should be left to its own devices, unless it is accompanied by a harmful surge in credit growth.

Current indicators – weak credit growth, low debt servicing ratios, and a tiny rate of non-performing bank loans – suggest we are a very, very long way from that.