New Zealand's economy is shaping up for a solid year

Consumer prices in New Zealand limped into the New Year as lower oil prices continued to weigh on global inflation trends. But the medium-term drivers of growth remain in place and ensure that the New Zealand economy is well placed for a solid year.

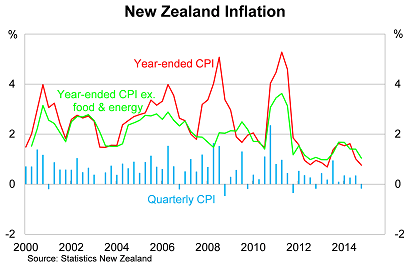

Consumer prices fell by 0.2 per cent in the December quarter, missing market expectations, to be just 0.8 per cent higher over the year. Annual inflation is now at its lowest level since June 2013 and has slowed considerably since the beginning of last year.

Petrol prices tumbled by around 5.5 per cent during the December quarter, with the price of diesel fuel falling by 7.7 per cent. Consequently, transport prices were down 0.9 per cent in the quarter to be 1.8 per cent lower over the year.

Food prices were also a source of weakness, falling by 0.7 per cent in the quarter, led by fruit and vegetable prices, to be 0.5 per cent higher over the year.

Core inflation -- which removes volatile items such as food and energy -- rose by 0.3 per cent in the December quarter, to be 1 per cent. Both results are well below the comfortable level for the Reserve Bank of New Zealand.

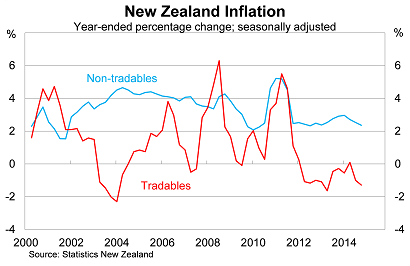

Much of this recent weakness has been concentrated within the tradables sector, which refers to goods such as petrol and food as well as other goods that are imported. Consumer prices in the tradables sector fell by 0.8 per cent in the December quarter, to be 1.3 per cent lower over the year.

By comparison, inflation across the non-tradables sector has been much higher. Consumer prices for this sector rose by 0.3 per cent in the quarter and have eased to a 2.4 per cent pace over the past year.

In the near term, inflation across New Zealand will remain at a fairly subdued level. During this period, lower oil prices will continue to dominate developments, but this downward shift should prove to be only temporary.

The medium-term outlook depends on a number of factors. There is good reason to believe that inflationary pressures will begin to pick up in the next couple of years, reflecting ongoing capacity pressures due to the Canterbury rebuild and a softer New Zealand dollar.

Speaking in December, the RBNZ forecast that inflation will push towards the 2 per cent midpoint of its annual target over its forecast horizon. Recent developments in oil markets may have pushed that schedule back somewhat -- or at the very least created a more volatile outlook for consumer prices -- but the central drivers of medium-term inflation appear to remain unchanged.

Low inflation has given the RBNZ the opportunity to assess its decision to hike rates earlier this year. It also ensures that the RBNZ will sit on the sidelines for the foreseeable future.

Nevertheless, the New Zealand economy appears to be well placed for a solid 2015. Growth has become increasingly broad-based, although in the medium term the economy will still be dominated by the Canterbury rebuild.