New Zealand takes the economic lead

| Summary: The New Zealand economy is building up steam, with exports racing ahead, and government and corporate activity on the rise. With its economic growth rate already stronger than Australia’s, and set to increase further, more investors are turning their attention to the land of the long white cloud. |

| Key take-out: As Australia contends with lower demand for its mineral resources, New Zealand is counting on higher offshore demand for its agricultural commodities and food products. |

| Key beneficiaries: General investors. Category: Economics and strategy. |

It might not be what every Australian wants to hear … New Zealand is suddenly outpacing its trans-Tasman rival on a number of key economic indicators. What’s more, in the months ahead New Zealand is set to stretch its lead.

That’s certainly what the experts are sayings: “Looking at Australia and New Zealand, I’d say that New Zealand is looking quite significantly the better of the two,” says Graham Harman, director of capital markets research at Russell Consulting.

“It is one of the brighter spots on the world scene at the moment.”

This divergence between Australia and New Zealand is partly due to the soft commodity/hard commodity differential, and according to Chris Green of First NZ Capital, is clearly seen in the growth forecasts for both countries.

“Right now, the consensus forecast for New Zealand is 2.7% in 2013 against Australia’s 2.5%. For 2014, the forecast for New Zealand is 3.1%, while Australia is expected to grow 2.8%,” Green said.

It is significant that in the next two years at least, expectations are for New Zealand to outperform Australia.

This marked shift is already reflected in the direction the currency has moved and in the diverging expectations for monetary policy in both countries.

Green says, among economists, there’s an expectation that the New Zealand Reserve Bank will raise official interest rates by 25 basis points in the March quarter and another 25bps in the June quarter. The market is also pricing in a 36bps increase over the next 12 months. In contrast, our own Reserve Bank is expected to cut rates in the coming year.

The interest rate divergence expectation is one factor providing positive support for the New Zealand dollar, as is the deviation between the terms of trade in both countries: New Zealand’s terms of trade are expected to stabilise to above-average levels on the back of strength in soft commodities like dairy, while Australia’s terms of trade are under increasing pressure due to the resources slowdown.

“You can actually see that revealed in the financial markets now, in terms of the appreciation of the New Zealand dollar against the Australian dollar,” Green says. “While both currencies have weakened against the US dollar, there is a differentiation now within the currency peers.

“We’ve seen the New Zealand dollar get up to a level of 85 cent against the Australian dollar, so there’s actually evidence there of the market buying into that expectation.”

While back at home we resign ourselves to a slower-growing China and the implications that come with it, New Zealand is already benefitting from the country’s growing middle class.

As I wrote a few weeks ago, China recently displaced Australia as New Zealand's biggest export market (see: Milking China’s growth spurt). In the three months to March, New Zealand exports to China surged 32% to $2.3 billion, compared with $2.2 billion of exports to Australia over the same period.

New Zealand is setting the scene for its own China-related boom, with dairy giant Fonterra Ltd even setting up farms in mainland China to ramp up supply to locals.

Even the summer drought hasn’t had the negative impact widely expected, with higher dairy prices offsetting the poor levels of production.

“Stronger dairy prices have countered any impairment of volume growth from the drought, so New Zealand is actually doing quite well out of that,” Harman said.

Indeed, dairy prices are 58% higher now than they were a year ago.

Those interested in investing in listed agricultural companies may be disheartened to hear that there are relatively few options. But the New Zealand exchange (NZX) has expressed its desire to remedy this and boost the number of listed agricultural companies on the exchange. With the recent pick-up in the IPO market, it’s not unreasonable to imagine there will be more in the near term. The NZX has already taken to the streets, visiting agricultural companies to explain the benefits of listing.

The country also has another ace up its sleeve to drive economic growth: the Canterbury rebuild.

The rebuild, worth a staggering $NZ40 billion, is already financed and one of the central priorities of the current government. Best of all, the benefit to the economy is not dependent on outside factors like commodity price cycles or the dynamics of the global economy.

The multiple tailwinds working in New Zealand’s favour haven’t gone unnoticed by all, and the stockmarket, like others around the globe, has rallied in the past year. It has risen about 28% in the past 12 months and 7% since the start of 2013, leading some to speculate it’s overcooked.

But according to Green, there is impetus for it to move higher.

“When you look at the PE over the last decade, the long-term average is 14.8. So if we’re at 16.3, with favourable growth dynamics, which should support the economy going forward, we think earnings look OK and underlying fundamentals are relatively attractive, and likely to remain so,” he said.

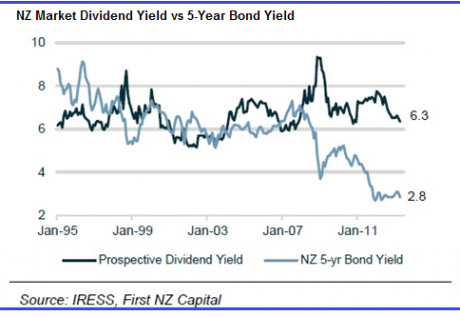

And while dividend yields have declined somewhat, they are still at decent levels, tracking considerably higher than the five-year bond yield.

Before the latest round of volatility seen in recent sessions, there were expectations of a sustained boost to capital markets, with both government and private sector initial public offerings (IPOs) giving retail investors an impetus to re-enter the market.

Mighty River Power floated a few months ago, while Meridian and Genesis are next on the list, with expectations of Meridian floating around October/November.

Unfortunately, it seems the government’s well-laid plans to float its state-owned companies have been the victim of poor timing. The severity of the market reaction to QE tapering last week drove investor sentiment lower, leading Mighty River shares to hit a fresh low of $2.20 last Friday, but the rising market over the past few days has seen its share price recover somewhat.

In the short term, New Zealand’s stockmarket, like all others, will be hit with more volatility as the US tapers its massive QE experiment and the world frets about a slowdown in China. But for long-term investors, the country looks to have all the necessary ingredients for success, and its momentum is starting to catch the eye of shrewd investors keen to get in on the action.

Indeed, while Australia’s resources boom was dependent upon investment-led infrastructure spend in China, New Zealand’s is based on the rapid emergence of a middle class and the increasing taste for the western diet. The policy desire to increase consumption spend in China will only bolster the benefits to New Zealand.

Real estate has also lured international investors to the country in recent years. There are currently no restrictions on foreigners buying residential property in the country, and it seems some Australians have already taken advantage of the rising market.

According to the latest BNZ-REINZ Residential Market Survey, 22% of all foreign purchases in New Zealand are from Australia, while Chinese investors come in second place at 20%.

Because of the influx of international investors and short supply of housing, prices have spiked and the national median house price is now $ NZ392,000. There are concerns that the country is in the midst of a housing bubble, so investors should be prudent when considering buying opportunities and also be mindful of the expected rise in the official cash rate. There is also currently no stamp duty or land tax on property in New Zealand.

Like other markets, New Zealand is at risk of short-term volatility due to global headwinds. But unlike most others, its domestic tailwinds should see it prevail in the long run. As we come to terms with the implications of a resources slowdown, and with economists left and right warning of a looming recession, New Zealand is coming into its own. Perhaps it’s time to open our eyes to the rising market next door.