New Zealand takes rate hikes in its stride

The Reserve Bank of New Zealand (RBNZ) left interest rates unchanged at its October meeting, following four rate hikes earlier this year. With inflation well contained -- at least for now -- the bank can afford to take a step back and monitor the effects of tighter policy on economic conditions.

The cash rate in New Zealand remained at 3.5 per cent in October. Rates have increased by 100 basis points since the RBNZ began its tightening phase in March.

According to the RBNZ, strong growth has reduced unemployment and put pressure on existing productive capacity. Strong construction activity and high net migration have supported the rebound in economic activity and are set to continue for the foreseeable future.

Low interest rates continue to support activity and, despite the recent hikes, remain accommodative.

Despite strong activity, inflation is surprisingly weak. Headline consumer prices rose by 0.3 per cent in the September quarter, to be just 1.0 per cent higher over the year.

The core measure -- which excludes volatile items such as food and energy -- rose by 1.4 per cent over the year. The RBNZ wants to keep annual inflation near the 2 per cent mid-point of their inflation target and both measures of inflation are well below that.

Headline inflation should begin to rise in the December quarter when a particularly weak December 2013 outcome drops from the annual estimates. The longer term outlook for inflation remains strong, with unprecedented construction activity set to ignite wage demands.

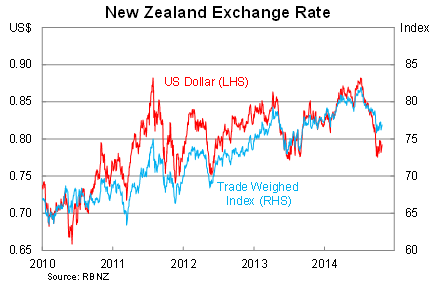

A weaker New Zealand dollar is also expected to contribute to inflation. The New Zealand dollar has depreciated by 5.6 per cent against the trade-weighted index since the end of June and 9.7 per cent against the US dollar. It's even 3.9 per cent down against the Australian dollar over the same period.

Inflation on tradeable goods -- which has a strong imported component -- has until recently weighed on headline inflation. If the recent decline in the New Zealand dollar persists then inflation on tradeable goods will surge and headline inflation will quickly head back towards the RBNZ's target.

As it stands, the RBNZ remains frustrated by the strength of the New Zealand dollar. According to the RBNZ,

“Lower commodity prices and increased global financial market volatility have taken some pressure off the New Zealand dollar,” said the RBNZ. “However, its current level remains unjustified and unsustainable and continues to constrain growth in the tradables sector. We expect a further significant depreciation.”

The recent decline in commodity prices does provide some downside risk to income growth and the broader economy. But while a strong terms-of-trade has been the icing on the cake, it is New Zealand's construction sector that will underpin growth over the next couple of years.

The task for the RNBZ is simple -- create sufficient spare capacity within their non-construction sector to allow the rebuilding of Christchurch and Canterbury to go ahead without creating an outbreak of inflation across the broader economy. The construction sector will need to call on resources -- such as credit, capital and labour -- from the rest of the economy to facilitate the rebuild.

That story should be familiar to any Australian readers. The Reserve Bank of Australia faced a similar challenge when they raised rates by 175 basis points from October 2009 to November 2010 to create room for the mining investment boom.

The primary difference between the two experiences is that New Zealand's construction boom should be less persistent and therefore less likely to hollow out the broader economy. A construction boom will also have significant and far-reaching productivity implications and should put the New Zealand economy in a good position even after construction eases.

Nevertheless, in the near-term, the actions taken by the RBNZ is set to create a two-speed economy.

Overall activity will be strong, but there will be individual pockets or sectors within New Zealand that will genuinely struggle over the next few years.

With inflation only modest -- though likely to pick-up -- the RBNZ has scope to monitor the effects of recent tightening over the next three to six months. Beyond the recent easing of inflation, the New Zealand economy appears to be taking these hikes in its stride and there's little evidence that the economy won't continue to grow at a solid pace in the year ahead.