New trends in store for US spending

Household spending in the United States returned to more normal levels in February and is poised to rebound further in March as the effects of adverse weather diminish. It points to a fairly subdued quarter for consumption growth, but not as disastrous as many feared.

In the US, real personal consumption rose by 0.2 per cent in February, in line with expectations, to be 2.1 per cent higher over the year. This follows fairly weak results in December and January, which have been widely attributed to poor weather.

Spending on durables -- which were hit particularly hard by weather conditions -- rose by 0.1 per cent in February, following combined losses of 2.5 per cent over December and January. Consumption of non-durables rose by 0.3 per cent after declining by 0.9 per cent in January, while services continued to rise at a reasonable pace throughout winter.

The data in January and February point to fairly weak spending growth in the March quarter. The average of January and February is just 0.3 per cent above the December quarter average.

There could be a bit of a rebound in March as spending activity returns to normal and some spending -- which was delayed due to weather conditions -- is finally undertaken. If that eventuates, then we could be looking at consumption growth of around 0.5 per cent in the March quarter. A lot will depend on a strong retail sales report for March.

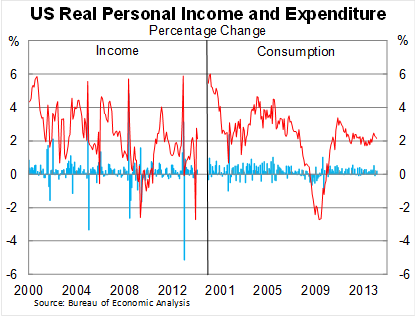

Real income growth can be extremely volatile (as per the graph above) but is broadly tracking growth in household spending. The savings rate is largely unchanged over the year but is down from its high of 5.1 per cent in September.

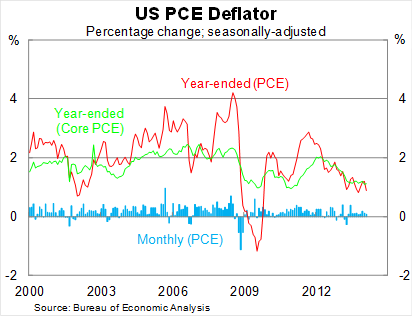

A big concern for the US economy and the Federal Reserve is that the personal consumption expenditure deflator -- the Fed’s preferred measure of inflation -- continues to grow at only a modest pace.

The core measure -- which removes volatile items such as food and gas -- rose by just 1.1 per cent over the year to February. The deflator hasn’t hit the Fed’s long-term target of 2 per cent inflation since early 2012.

The graph above will be a big determinant of when the Fed decides to lift their interest rates. It is reasonable to conclude that there remains significant spare capacity across the US economy and the Fed won’t raise rates for a long time.

On the second point, projections from the Fed indicate that it believes that rates will rise by around 100 basis points over the course of 2015 (The Fed won’t waver from its on-track taper, March 20). But this will be contingent on employment growth continuing to rise at a solid pace and eventually creating widespread wage pressures. We are still some way off that moment.

Spending data in February, along with a range of other indicators, suggest that the US economy got back on track in February. Weather certainly derailed the recovery for a time, but it appears that it was only a temporary factor.

It is anticipated that the economy will rebound further in March as employers and households play a little catch up. Our first indication of whether that prediction is correct will be on Saturday when the Bureau of Labor Statistics releases its monthly employment report.