Navigating the downgrade deluge

Earnings downgrades have caught investors off guard. Confession sessions during annual general meeting season offered weaker outlooks for some companies, but investors have been totally unprepared for the severity of downgrades seen in the past month or so.

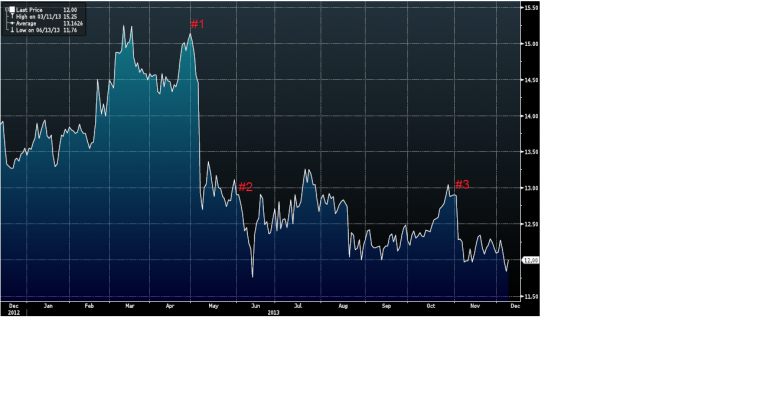

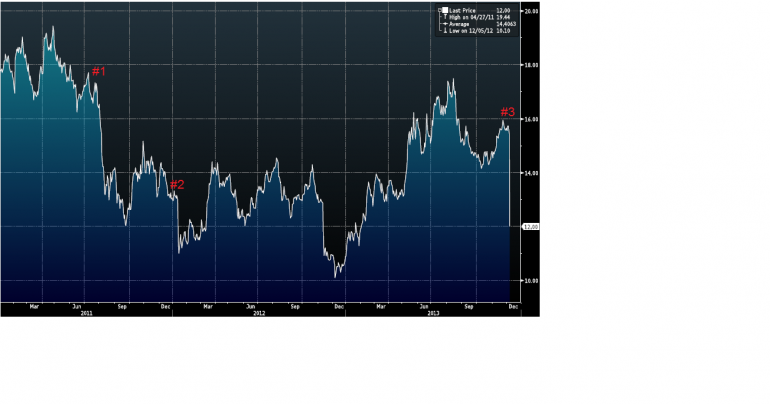

Recent downgrades by ASX 100 companies kicked with Coca-Cola Amatil in early November, followed by Worley Parsons, Qantas Airways and now QBE Insurance Group. Unfortunately for each of these companies, the most recent downgrade wasn’t the first blemish on the trading record over the past two years or so, setting investors up for another round of heartache.

When factors outside the industry are driving earning revisions lower, especially on more than one occasion, it should be sounding alarm bells for investors. While some industries are more susceptible to revisions depending on broader economic conditions, multiple downgrades when peers haven’t done the same are perhaps a warning sign there could be more problems ahead. Credibility is definitely low.

QAN

CCL

QBE

WOR

For the future, investor focus should firstly on how the earning revision came about. Management guidance on plans moving forward and overall strategy should also be put in the spotlight.

Having said this, revising earnings lower doesn’t always necessarily signal a problem company.The reasons for the downgrade can indicate the company has a viable chance of getting the share price back to where it was pre-revision in a reasonable time. For Worley Parsons and QBE, that time may be sometime away when we note the shocking size of their falls, exceeding 20 per cent in one day.

Since the earliest profit warning was announced for each of the above four companies, only lower trading ground has been found. Something drastic will need to change to turn the fortunes of these companies around.

Repeat offenders when it comes to earning revisions should flag investor attention as companies create a pattern. Not surprisingly, the relationship between investors and the boards – responsible for overall management and strategy – are set to be on shaky ground for Worley Parsons, Qantas and QBE. For Coca-Cola, the appointment of Alison Watkins to the post of chief executive from March next year could be enough to restore investor confidence.

These tests of faith in management and strategy could see further sell-side pressure emerge as investors consider breaking up with companies with a history of downgrades.