More to forecasting than neoclassicals and Nostradamus

Paul Krugman recently posted on predictions of the crisis before it happened, in a piece entitled “Non-prophet Economics”. It had a set of propositions about how one should evaluate such claims with which I completely and utterly agree. I’ll quote it in its entirety, because it’s an eminently suitable starting point for evaluating whether a prediction was in fact made:

“So as I see it, we should first of all be evaluating models, not individuals; obviously we need people to interpret those entrails models, but we’re looking for the right economic framework, not the dismal Nostradamus.

“Second, we should be evaluating models and the individuals who claim to have these models based on broad performance, not single events; if your approach (say) predicted the housing crash but then also predicted runaway inflation from Fed expansion – I assume everyone knows who we’re talking about [for those that don’t, Krugman is referring to Peter Schiff] – it’s not a good approach.

“Finally, I think we’re looking for conditional predictions – what happens given events that are themselves not part of the model – not absolute predictions. It was, for example, very hard in the fall of 2011 to know how the ECB would respond to the escalating financial crisis in Europe; failing to predict that Mario Draghi would find a way to funnel vast sums to debtor nations through discounting would have lost you a lot of money, but wasn’t really a failure of the economic model.”

This is an excellent set of criteria. All I would add is one more in a similar spirit: that the model has to be evaluated on its own grounds, and not on grounds that suit a different approach to modelling. For example, a model that is purely a simulation can’t be rejected because it doesn’t make an empirical prediction based on current data, nor can models that acknowledge “the butterfly effect” (that a complex system can’t be predicted beyond a very limited horizon) be criticised for not getting the timing of an event right.

With that one addition, Krugman’s guidelines state precisely what I wish neoclassical economists (and others) would do. Unfortunately it’s not what they do – and that includes the piece Krugman referred to by Noah Smith that led to him writing the above in the first place:

“A few days ago Noah Smith had a good piece on the many people who beat their breasts and loudly boast about having “predicted the crisis”. As he says, by and large, the louder the boasting, the thinner the evidence for any special achievement.”

Smith’s piece focused upon me, and prior to Krugman’s post – and a tweet by the influential neoclassical academic Justin Wolfers (see figure 1) – I was going to ignore it, precisely because it failed to properly evaluate my models, and instead “played the man rather than the ball”.

Figure 1: Wolfer's tweet about Smith's post to his 36,000 followers

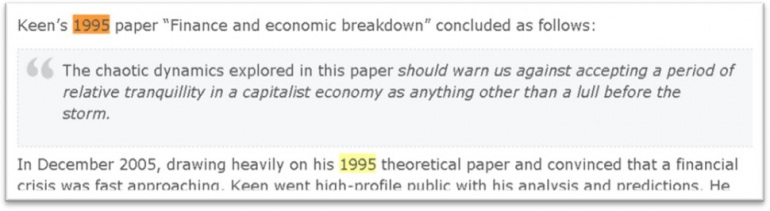

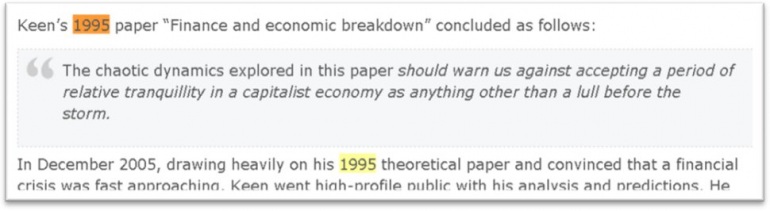

One would think, from Krugman’s comment that Smith “had a good piece”, that it had met his extremely sensible criteria for evaluating a claim to having predicted the crisis. Instead, there was no considered evaluation of the models I developed; there was instead just trash talking. I’ll give just one instance of this from Smith’s piece: his claim that a website (in fact the blog , for the Real World Economics Review, part of the World Economics Association, in its announcement that I, Nouriel Roubini and Dean Baker had won the “Revere Award”) alleged that I had predicted “an imminent global recession as early as 1995” (see figure 2).

Figure 2: Smith's comment on the Revere Award citation

Well, it was possible that “this website” made such a claim. But here’s in fact what it said:

Figure 3: The actual Revere Award reference to my 1995 paper

I hope it’s obvious that “drawing heavily on his 1995 theoretical paper” is not the same thing as “predicting an imminent global recession as early as 1995”. There are many other such distortions and inanities in Smith’s piece, but the point here isn’t Smith – or even Krugman. It’s the failure of the economic mainstream to seriously engage with rival traditions in economics, and its tendency to dismiss and disparage them instead.

This makes no sense if you think of economics as a dispassionate intellectual discipline. But it makes plenty of sense if you think about it as a set of competing religious faiths – and situate yourself in the days before ecumenicism as well.

The one way in which that analogy stretches reality is that, when one religion trash-talked about another, that other religion had a strong base of its own from which to return the favour. In economics instead, the neoclassical religion dominates almost all academic economic departments, the most prestigious economic journals, and virtually every official economic body (the exceptions here are the Bank for International Settlements and recently the IMF, which is starting to display some non-dogmatic economic thinking).

Even though the crisis has led the public to be more sceptical of economics in general, the dominance of neoclassical economics has if anything increased in academic institutions, while the Post Keynesian approach – to which I belong – is even more endangered than it was before the crisis began.

That’s the light in which I interpret Krugman’s promotion of a piece that broke every guideline he gave for how a claim to having predicted the crisis should be evaluated. As he has himself stated, Krugman pushes the neoclassical envelope, but he doesn’t break it: he is, as he said in 1996, “a maximisation and equilibrium kind of guy”:

“I like to think that I am more open-minded about alternative approaches to economics than most, but I am basically a maximization-and-equilibrium kind of guy. Indeed, I am quite fanatical about defending the relevance of standard economic models in many situations.”

I’m not going to make too literal an interpretation of the word “fanatical” in that statement: part of Krugman’s appeal is his colourful use of language, and I’m hardly one to throw stones on that front either. But conventional economics does defend itself against rival approaches in a way that is much better characterised by the word “fanatical” than by the sensible, dispassionate criteria that Krugman put forth in his post.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.