Mid-caps in the sweet spot

Summary: Middle sized companies, sandwiched between the top 50 and smaller than 100 companies that most investors focus on, offer attractive investment prospects and are often left out of portfolios. |

Key take-out: As the yield boom and interest in large cap stocks recedes, mid caps seem to be benefiting. |

Key beneficiaries: General investors. Category: Shares. |

Most investors miss out on capturing the returns from middle capitalisation (“mid cap”) shares – those technically sandwiched between the top 50 “big cap” companies, sought after for their dividends and security, and the smaller than top 100 “small cap” companies sought after for promised high performance. This is a shame as this size band offers better industry diversification and perhaps more reliable excess performance.

Many investors are worried the yield boom is ending and some seem to have turned to mid caps as an alternative. This year to date, Australian mid cap shares are up 7 per cent compared with 1 per cent for large caps.

Here let me define for you what mid cap stocks are, the rationale for investing in them, past returns and ways to get them into your portfolio.

Big cap companies drive 75 per cent or more of index returns

Investors often hear about the returns from various investment indices. The All Ordinaries, S&P/ASX300 or S&P/ASX200 are the most popular indices used to describe our share market's general performance. Specifically their returns match those from a basket of Australia's largest 500, 300 and 200 companies respectively. Their makeup defines the construction of unlisted and exchange-traded index funds (ETFs) and influences the stock mix of many active style funds afraid to drift to far from these benchmarks' returns. As these indices are based on the market value of companies, their returns are heavily skewed to the returns of the biggest companies. This is particularly problematic in oligopolistic Australia.

Incidentally there are over 1,000 companies and entities listed on the ASX but as you will see, tracking the smallest makes little sense, except to a speculator.

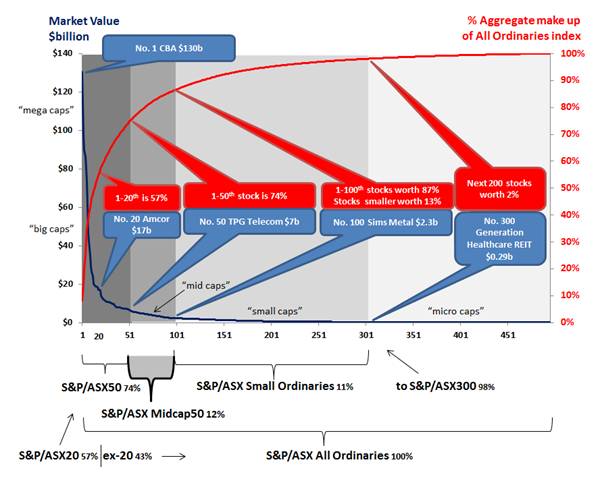

Figure 1 shows the size of the largest 500 companies in our market ranked from #1 “mega cap” CBA, worth on June 5 $130 billion, to 500th “small cap” minnow, Alliance Aviation Services – a fly in, fly out Queensland charter airline worth then $45m. After about the 200th largest company I challenge you to even detect the relative size of these companies in the blue line running along the bottom of the chart. Hopefully this line isn't a heart monitor like signal for some!

Figure 1: Ranked range in market value (left axis) and cumulative % makeup of companies in the All Ordinaries index (right axis) on June 5, 2015. Shown at the bottom are various market size based indices and the % of the All Ordinaries they make up. Source: Professional Wealth

Shown in this chart in red is the cumulative % makeup of companies in the All Ordinaries index. Given the large difference in size between our few big companies and many small ones, this curve rises steeply. CBA alone represents about 8 per cent of the index (before it was BHP and a bigger number). It and the next 19 stocks total 57 per cent and the top 50 companies represent three quarters of the All Ordinaries. Despite being 90 per cent by number, having another 450 stocks in your portfolio would only contribute 25 per cent of the return. If your preferred broad market index is the ASX200 or ASX300, then note the % that big companies make up of this is higher.

Mid cap stocks are an interesting slice of 50 companies sized currently between $6 and $2 billion market capitalisations but which make up only 12 per cent of the All Ordinaries index.

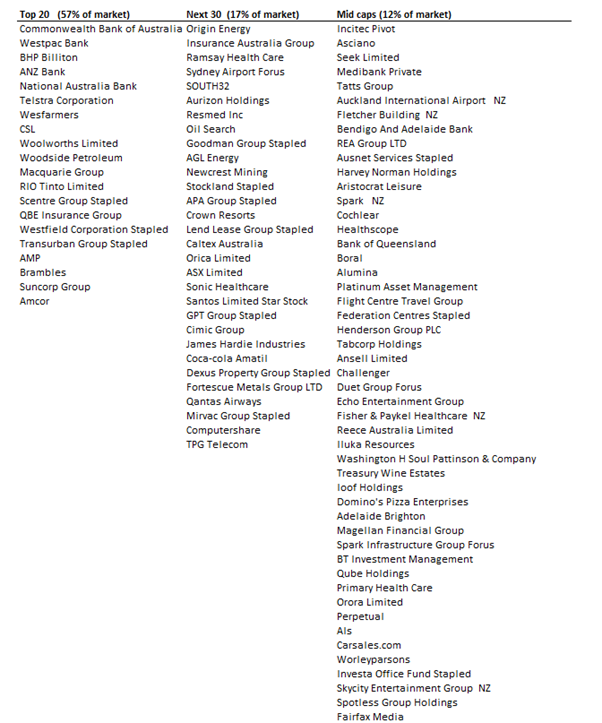

Mid caps: Who are you? Who, Who

The below table lists the current top 20 and next 30 “big cap” and the next 50 “mid cap” stocks as at June 5. Most DIY investors' local share allocations are dominated by stocks in the left column(s) of this table. Those seeking a slice of returns from smaller companies might use Eureka Report's regular small cap ‘picks', or one of the 30 Morningstar tracked small company funds which invest mainly in stocks smaller than the top 100 (the “Small Ordinaries”). As a consequence of this index cut-off, many professional investors skip over mid-sized companies in their portfolio.

(Most Australian stock picks from the Eureka Report analyst team are in the ‘small cap' sector – to see our recommendations click here. We also have a mid-cap recommendation which is currently a ‘hold' on Qube Holdings, one of stocks listed in the chart below.

Mid cap companies offer investors a more balanced exposure to companies operating in different industries. Compared to large companies, there are less mega-banks and mega-resource companies in this size band. Compared with the small ordinaries, the mix of industries is more stable and avoids fads like when 50 per cent of the Small Ords in 2010 was made up of ready-to-crash small resource companies.

Last month I warned investors about the high concentration of bank shares in the broader market index, which sadly have since fallen more than the broader market (see Asset allocation alert 1: Bonds and traditional index funds fade, May 20).

Portfolio managers suggest mid caps make good investment prospects also as their size makes them meaningful takeover targets and they too can reliably fund high dividends from organic earnings growth, unlike cash starved small companies.

Mid cap returns are not in the middle

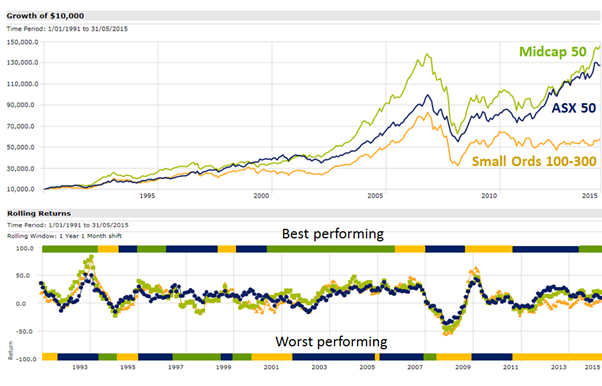

Over the last 15 years, returns from mid cap companies outperformed both larger and smaller companies as shown in Figure 2.

Outperformance versus big caps occurred despite the rally in big high dividend paying companies from 2012-2014 and not being as sought after for safety in gloomy 2008- 2009. This year so far, and the first half of the 2000s, were especially good times to be in mid cap stocks.

Before you give up on small company investing, realise that small cap selection can always offer opportunities. Moreover, the Small Ordinaries index is a very ordinary index and nearly all active style funds and the few quant, smart screening style funds all beat this index. That aside, returns from mid caps have been better and more consistent.

Figure 2: Total returns, dividend plus capital growth, investing in the top 50, next 50 mid cap, and next 200 small capitalisation companies since 1990. Shown above is growth of $10,000 invested and below, annual rolling returns. Horizontal bars represent times when each colour coded company size range performed best and worst (big caps in blue, mid caps in green, small caps in orange). Source: Professional Wealth

Getting mid cap companies into your portfolio

If the prospect of including many middle sized companies in your self-assembled share portfolio looks administratively difficult, then you can turn to a few fund managers for assistance. Compared to over 90 Morningstar counted funds hunting large companies and over 30 small company funds, I count only half a dozen targeting mid caps. These would include the following available on Eureka's brightday platform :

- Unlisted BT Wholesale MidCap Fund

- Unlisted Bennelong ex-20 Australian Equities Fund

- Listed investment company “QVE”

- Listed ETF ishares “IHD” (which focuses mainly on high dividend companies, but observe 7 of top 10 holdings are in the 30-100 size range).

Other interesting funds in this area include:

- Unlisted Concise Mid Cap Fund

- Unlisted Paradice Mid Caps fund

Surprisingly, the prolific ETF industry has not launched an ETF specially dedicated to this space.

For several years I have maintained that a great opportunity exists for a mid cap company ETF or an “ex-20” ETF to diversify self-assembled share portfolios. Let's add MID™ and EX20™ ETFs to the imaginary Professional Wealth ETF series (see Goodbye to the ‘All Ordinaries', June 6, 2012). ETF suppliers, ring now!

The Australian share market, and the main indices used to track and reproduce returns from it, are dominated by big companies – especially from the financial and resources sectors. By introducing an allocation to middle capitalisation companies in your portfolio, you may both de-risk your portfolio and add additional return. If you are wondering “What next?” after the yield boom fades, maybe mid caps are the answer?

Dr Douglas Turek is Principal Adviser with independently-owned, family advisory and money management firm Professional Wealth (www.professionalwealth.com.au). Investment funds listed here are for educational purposes only and don't constitute a product recommendation. Do your own research or speak to a licensed financial advisor before investing.