Merkel's gas gridlock: Will renewables pay?

Reuters

German Chancellor Angela Merkel, after her re-election, must now come up with an energy reform that balances support for renewable power against the need to keep gas-fired plants in operation to ensure reliable supply.

Gas-fired power is vital to ensure that Germany has enough power on a still and cloudy day, but utilities are losing money on gas plants and have been closing them down. The second-biggest utility, RWE, last month alone announced plans to mothball six.

Further closures could drive up wholesale power prices and in extreme cases even jeopardise the security of the grid.

It is too early to say which direction Merkel might take. Her choices range from making sharp cuts in support for renewables, which would hurt some manufacturers, to introducing compensating subsidies for gas, which would push up residential power prices that are already the third highest in Europe.

She may decide on a compromise that includes some of both.

The chancellor has already promised to revamp the power subsidy system but also has said she wants to keep some sort of incentives for green power in place.

The problem arose partly from Merkel's decision to phase out of nuclear power by 2022 and replace it with renewable power and partly from the high prices that German utilities pay for gas under long-term contracts.

Hedged

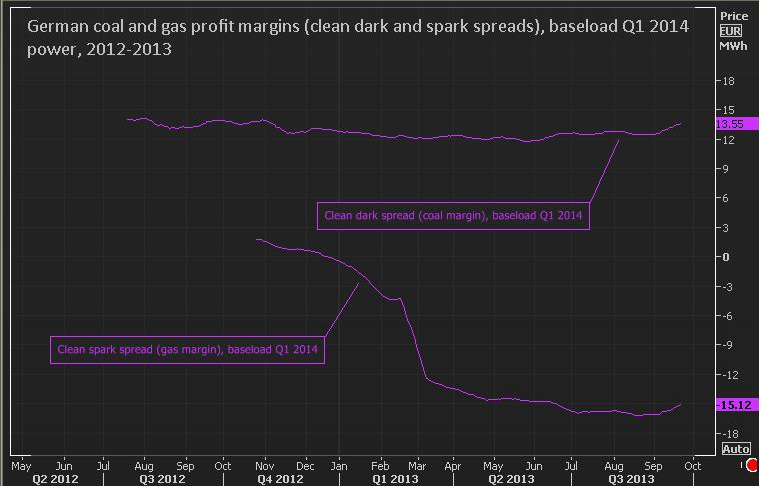

At current wholesale power prices, burning gas loses money (see chart).

But it is companies' prices on forward sales rather than wholesale prices that determine the profitability of their power plants.

All power generators sell a portion of their future output forward to their own distribution businesses, industrial energy consumers and traders on wholesale power markets.

Such forward sales help utilities lock in future profits and avoid exposure to changes in fuel prices.

As of June this year, top German utility E.ON had hedged all of its 2013 and 2014 power and 80 per cent of its 2015 generation in Central Europe, the company said in its second-quarter results.

Swedish utility Vattenfall said it had hedged all of its sales of continental European power for this year, 90 per cent for next year and 69 per cent for 2015.

RWE reported a slightly less conservative strategy, hedging outright at least 60 per cent of its German nuclear and lignite power for 12 months ahead.

Austria's Verbund, a major hydropower generator, has less to worry about in terms of fuel costs and hedges only around 30 per cent of its power sales for 12 months ahead.

Benchmark German year-ahead baseload power prices currently trade at €38.5 per megawatt hour.

By comparison, data from central European utilities show that their hedge prices this year range from €48 to €58 per MWh, depending on how far ahead they have hedged.

E.ON achieved an average of €58 this year in central Europe, which will fall to an average forward price of €53 for 2014 and €46 so far for 2015, its financial reports show.

Vattenfall reported continental European hedge prices of €55 in 2013, falling to €50 in 2014 and €47 in 2015.

Verbund reported a steady fall in achieved prices quarter by quarter to €48.3 in the second quarter from €54 in the corresponding period last year.

Losses

A comparison of these hedged prices with generation costs shows that even fully depreciated gas-fired power plants are already losing money or breaking even at best.

Utilities are buying most of their gas from suppliers such as Norway and Russia's Gazprom under long-term contracts with unfavourable terms that link gas prices to oil prices.

The variable costs of generation, which exclude capital costs and are consistent with a fully depreciated power plant, are about €60 per MWh for gas, €36 for coal, €25 for lignite and €5 for nuclear, according to the utilities team at investment bank Credit Suisse, reporting in their "Utilities Big Book" in July.

The full cost for building and fuelling new power plants, meanwhile, ranges from €51.8 per MWh for lignite to €78.8 for gas and €86.7 for hydropower, Credit Suisse estimated.

At present hedge prices, even the cheapest new-build lignite coal plants would be out of the money by 2015, according to such estimates.

Outlook

Germany's renewable energy strategy has created overcapacity and cut wholesale prices. Conventional power generation, which unlike wind and solar power is not subsidised, is being pushed out of the mix.

Falling hedge prices show that losses on gas-fired power generation are, furthermore, likely to increase over time. The rational response for utilities is to close gas-fired generating capacity.

The question for Merkel's new government is how to avoid closures that would leave the grid less stable.

One option could be to halt subsidies to new renewable projects, which would slow the addition of new wind and solar power. But that would damage domestic manufacturers of wind turbines and solar panels.

Another could be to subsidise gas-fired power to ensure that the system has enough capacity to balance demand, but that would add to Germany's already high power bills.

A compromise could be a bit of both, coupled with a cut in other levies such as the existing eco tax on consumers to soften the impact on power bills.

Originally published on Reuters. Republished with permission.