May enviro markets update: STCs and LGCs

Small-scale Technology Certificates (STCs)

Following an amazing run of price increases across the first quarter, the spot STC market settled into range trading across May with submissions remaining above the rate required by the target, though not dramatically so. Talking points on the issue of STC supply include the mop-up of 44 cent Queensland feed-in tariff installs, changes to the Australian Standard for solar PV modules as well as EU and US protectionism.

With an incessant rally under its belt, which has restored the market to levels not witnessed since the first quarter of its existence (Q1 2011), the last month has seen the spot STC market revert to a tightly contained trading range.

The spot market began May in the mid $36s and progressively strengthened to reach a high of $37.70 a week later. From there the market gradually softened to again reach the mid $36s, before once again rebounding. Similar oscillations have played out since, with the variation in price decreasing progressively, to the point that across the second half of the month the market has traded almost exclusively between $36.80 and $37.25.

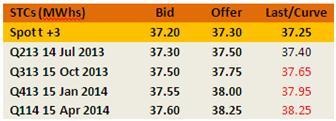

In terms of the forward market, overall levels of activity were fair across May, with the most recent transactions being mid-July at $37.40 and mid-September at $37.50. In a reflection of the fact that the market has a $40 cap and that the spot price is currently relatively close to that cap, the escalation in the forward market (cost of carry) remains relatively low compared to its LGC sibling.

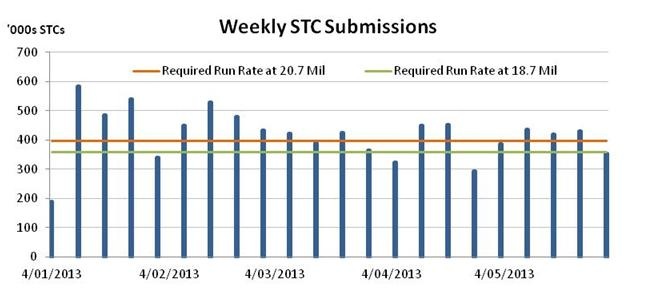

As a backdrop to the spot market’s stability has been the both generally stable and fairly neutral nature of STC submissions across the month. Average weekly submissions during May were 410,000, above the 358,000 weekly average that is required by the 20.7 million base figure (less the 2 million STC pending registration as at December 31 2012).

Average weekly STC submissions for the year-to-date equal 426,000 which, assuming such a trend continued, would lead to a surplus of circa 3.5 million STCs by the end of the year. However STC submissions to-date have unquestionably been inflated by the presence of two-times (Solar Credits) Multiplier jobs across the first quarter of the year, with creations from those progressively decreasing across that time.

With prices where they are, the prevailing rate of submission appears to sit in fairly neutral territory; high enough to continue to suggest a surplus at the end of the year, but not low enough to see the spot price fall through its current trading range.

The coming month will be of particular interest to those closely watching submissions for several reasons. Firstly, the cut-off date for the installation of PV systems to ensure eligibility for the 44 cent Queensland feed-in tariff is June 30. There are many who expect a mini boom of sorts in the coming weeks in the nation’s largest PV state.

Another interesting issue is the cut-off date (July 16) for the achievement of the new Australian Standard for PV modules which requires those modules to have been fire tested. Any panels installed from that date which do not meet the new standard will not be allowed to create STCs.

There are many manufacturers whose panels have met this standard, yet there also remain a great number who have not, with claims that as many as 50 per cent of panels currently approved have not yet cleared the hurdle. As a result of this there may be an increased stimulus for some PV retailers to reduce prices to ensure the panels are installed before that date. In essence, this is an argument for a potential short term reduction in system prices.

In the short to medium-term the June 6 deadline for the European Union (EU) to impose import tariffs on Chinese solar panel manufacturers has also been mooted as a potential source of downward pressure of panel prices and thus PV system prices in Australia. Trading off against these latter arguments, however, has been the recent depreciation of the Australian dollar which has recently frequently been associated with the term ‘overvalued’.

The coming six weeks are therefore likely to be important in determining whether STC submissions will again increase, thus relieving some of the upward pressure on the spot market that may come in the lead up to second quarter compliance. Perhaps only heightening the intrigue, last week’s submission numbers (though potentially only a one off and not necessarily indicative of a trend) fell to the lowest level this year in a week uninterrupted by public holidays.

Large-scale Generation Certificate (LGCs)

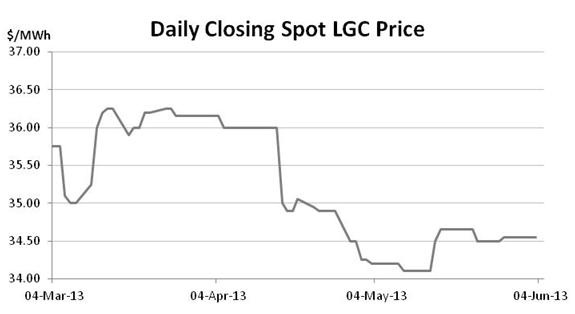

In the nation’s large-scale renewable market stable spot pricing provided a platform for a spike in options activity across May, with Cal 14 and Cal 15 vintages of particular interest. Recent days have since seen the realisation by the Gillard government that it will not have sufficient time to pass legislation which would have brought about the changes outlined in the Climate Change Authority’s RET Review.

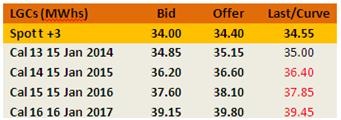

The month of May saw activity in the spot LGC market contained within a $34.00-$34.65 range, with the market toward the upper end of that range in the latter part of the month.

The emergence late last week of media reports suggesting the Gillard government would not have enough time to pass legislation that would have given effect to the Climate Change Authority’s RET (Renewable Energy Target)Review recommendations, saw several trades in the Cal 13 vintage at $35.00 which implied a lower spot price (somewhere closer to $34.00), though no trades have yet been reported in the spot.

The most notable change which would have resulted from this legislation was the decision to alter the frequency of future reviews, meaning the next would have occurred in 2016, rather than the currently slated 2014.

There are some who argue this development effectively creates additional uncertainty; having the next review set in stone in 2016 rather than 2014 would have provided a longer break before the next round of agitation for changes to be made.

Yet there are those who contend uncertainty already existed given the Coalition (which appears set to win government in September) has shown signs of contradictions in its stance on the Renewable Energy Target.

While publicly supporting the RET and saying that it will be guided by the recommendations of the Climate Change Authority, there is an increasingly vocal faction within the Joint Party Room that would have changes made to the scheme. And shadow environment minister Greg Hunt has publicly stated a Coalition government would review the RET Review’s findings within six months of the election.

Whatever the outcome it appears almost guaranteed that speculation surrounding the future form of the scheme will continue across the remainder of the year.

To shift the focus back to trading activity, the highlight across May was certainly the emphasis on LGC options, with Cal 14 and Cal 15 vintages specifically, en vogue. Included among the trades was 50,000 Cal 14 LGC Puts with a strike price of $34.00 which traded at an upfront premium of $0.99. The buyer of the Puts purchased the right but not the obligation to sell 50,000 LGCs in January 2015 at $34.00 and for this right paid the upfront premium of $0.99.

In the Cal 15 vintage, 50,000 $44.00 strike Calls were traded at an upfront premium of $1.10. In this case the buyer purchased the right but not the obligation to purchase 50,000 LGCs at $44.00 in January 2016. For this right the buyer paid the upfront premium of $1.10.

The focus on options reflects the desire among some participants to hedge risks in the forward vintages at relatively low cost while still allowing themselves some flexibility. The recent options transactions have occurred at implied volatilities around the mid-12 per cent mark.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.