May 2015 - International Equities Diversified Portfolios Update

The largest US companies have led the market higher over the past few years, and fortunately that’s where about 60% of the portfolio has been invested. However, we think it’s time to reassess that strategy. It’s never a good idea to have all your eggs on one basket, especially if it looks like the eggs might have gotten a bit expensive.

One of the really difficult things about markets is that you have to worry not only about whether a company or economy is going to do well but whether too many other people think the same thing. If you end up investing in a winning economy but at ruinously short odds, you still lose money.

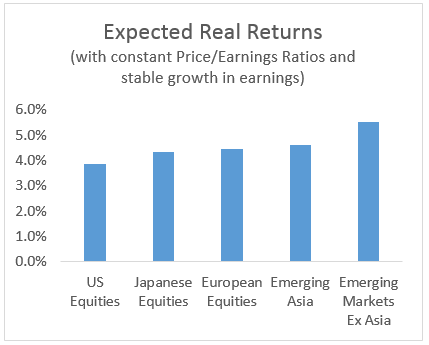

The chart below shows InvestSense’s expectation of long-term returns after inflation for different stock markets. Even if nothing much changes in the short to medium term we expect the US market to deliver sub-par returns.

Note that these are just our estimates, but we think they are based in sound logic and we are happy to share that with any investors who are interested. Simple metrics such as the price/earnings ratios of major regional indices, which you might see in the papers, tell a similar story.

This is what market professionals call being ‘priced for perfection’, and since nothing is perfect in investment markets it is a situation that often leads to disappointment.

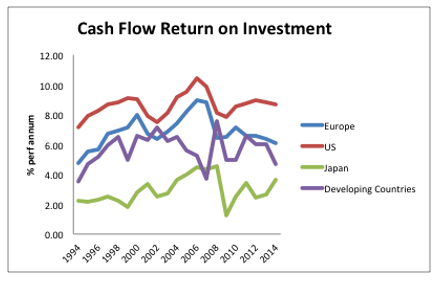

The following graph shows Cash Flow Return on Investment for these countries and regions. This is very similar to the Return on Equity often quoted in the press, being the return an underlying company can generate per dollar of invested capital.

Clearly the US has been the top-performer and US companies will probably continue to be the most well run in the world for some time to come.

But everyone knows that, and that’s why the odds are already relatively short.

What really matters is what happens next.

If moribund Europe does a bit better than expected or a change of regime in India leads to better use of capital then investors in those markets will do well. Equally, there is no guarantee that corporate America can continue to deliver to the extent that it has in recent years. Earnings are linked to the business cycle and that means they go up and down as a company battles competitors and suffers overinvestment or underinvestment.

Portfolio Implications

In a diversified investment portfolio we don’t just have to bet on the winner, and it makes sense to back a few different economies.

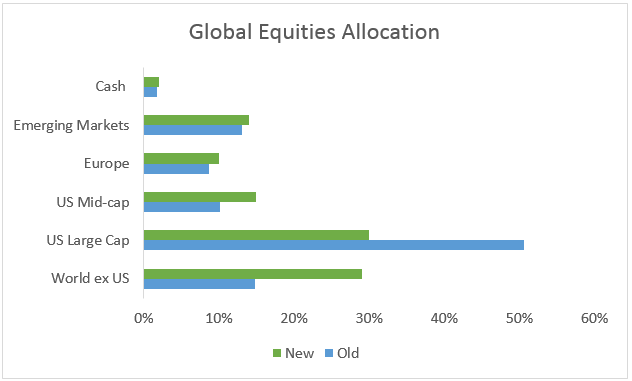

As we can invest cheaply in thousands of companies it now makes sense to broaden the International Portfolio’s exposure to different regions. The changes shown below reflect that.

|

28th April 2015 |

New Allocation |

|||

|

VEU |

International Equities |

VANGUARD FTSE ALLW EX-US-CDI |

14.8% |

29.0% |

|

IVV |

International Equities |

ISHARES CORE S&P 500 ETF |

50.6% |

30.0% |

|

IJH |

International Equities |

ISHARES CORE S&P MID-CAP ETF |

10.2% |

15.0% |

|

IEU |

International Equities |

ISHARES EUROPE -CDI |

8.7% |

14.0% |

|

IEM |

International Equities |

ISHARES MSCI EMERGING MK-CDI |

13.1% |

10.0% |

|

AAA |

Cash |

BETASHARES AUS HIGH INTEREST |

2.7% |

2.0% |

Frequently Asked Questions about this Article…

Diversifying your investment portfolio is crucial because it helps spread risk across different assets and regions. By not putting all your eggs in one basket, you can potentially reduce the impact of a poor-performing investment on your overall portfolio.

'Priced for perfection' refers to a situation where a stock or market is valued at a level that assumes everything will go perfectly. This often leads to disappointment because it leaves little room for error or unexpected events, which are common in investment markets.

The US market is expected to deliver sub-par returns because it has been a top performer for several years, leading to high valuations. When too many investors expect continued high performance, it can drive prices up to unsustainable levels, reducing future return potential.

Investing in different regions can benefit your portfolio by providing exposure to various economic conditions and growth opportunities. For example, if Europe or India performs better than expected, having investments in those regions can enhance your overall returns.

Cash Flow Return on Investment (CFROI) measures the return a company generates per dollar of invested capital. It's important because it provides insight into how efficiently a company is using its capital to generate profits, which can be a key indicator of its financial health.

The International Portfolio's allocation has been adjusted to increase exposure to non-US markets. For example, the allocation to the Vanguard FTSE All-World ex-US has increased from 14.8% to 29.0%, while the iShares Core S&P 500 ETF has been reduced from 50.6% to 30.0%.

Investing in a winning economy at short odds is risky because it means you're paying a high price for the investment, which can limit your potential returns. If the economy doesn't perform as expected, you could end up losing money despite investing in a strong market.

Corporate earnings are affected by the business cycle because they fluctuate with economic conditions. During periods of economic growth, earnings tend to rise, while during downturns, they can fall. This cyclical nature means that companies must navigate challenges like competition and investment levels to maintain profitability.