MARKETS SPECTATOR: Much ado about Cyprus

The fear mongers are out in full force this morning, with the world once again set to collapse following the bailout of Tasmania … errr, sorry, Cyprus.

While anything can happen in financial markets, I’m really struggling to believe that this event could derail everything, especially after the world forgot about the hung Italian election within 48 hours.

Of course all the talk is about how this will cause a run on banks across Europe, especially in Spain and Italy. If it had happened a few years ago when the world was a lot more fragile then we may have seen widespread panic. However, now everything is recovering with the US going from strength to strength and China showing signs that its GDP growth has bottomed.

Markets and participants are much more positive now than a few years ago. Confidence globally is improving and this is being seen in sentiment. People are looking at the glass as half full, not half empty.

The classic sign of this was the Italian election a few weeks ago. My view is that if the eurozone was going to fall over, then this would have been the perfect opportunity. Yet, the reaction to it speaks volumes in my mind. When a market can’t go down on bad news, then it’s a positive sign of underlying sentiment.

The chart above is the Euro Stoxx 600 index, which is one of the broadest measures of European stocks. Not only has the index been able to track sideways, its recently broken out to the upside and is once again making multi-year highs. There’s no doubting the bulls are firmly in control of these markets.

Don’t get me wrong there are a lot of problems in the world but there always is. Markets never wait for there to be no concerns and then start moving higher; they always climb the wall of worry. We’d never see another bull market in history if we had to wait for a perfect world.

Another sign that tells me people are too concerned yet (although we’ll get a better idea when European trade open tonight) is the fact that gold opened the new week higher, around $US1604. It then rallied to $US1608 before the sellers moved back in and pushed it down to $US1591.

Gold should move sharply higher as people to look to switch into safehaven assets if there is actually going to be panic in Europe. We’re not seeing any signs of this yet.

So while I think the odds are pretty low that this latest Cyprus event derails equity markets, I do note the incredibly strong start to the year for equities across the globe and the fact that we are approaching a period where equity markets have a tendency to go into a seasonal holding pattern.

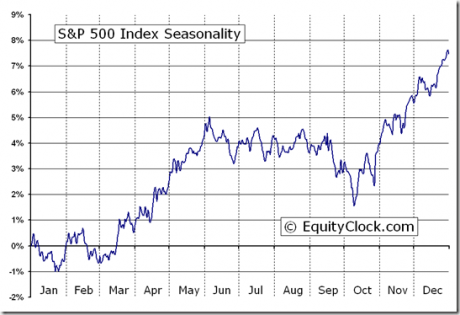

Everyone has heard of the famous market adage, ‘sell in May and go away’. Well the above seasonal chart of the S&P 500 (from 1990-2009) illustrates this perfectly as much of the northern hemisphere heads away for their summer holidays. Australia has a tendency to follow these seasonals too, although nowhere near as closely.

While I remain firmly in the bull camp in the medium to long term, shorter term I’m more towards the bullish end of neutral. I think the most likely course of action over the next few months is that equities go into a sideways trading range, with dips well supported by bargain hunters but participants not willing to push the big, heaviest weighted stocks meaningfully higher.