Markets: Relax regulator, banks have it covered

Having to appease shareholders, customers and the regulator is a tough task for any company, none more so than the banks of Australia.

A warning has come from financial services regulator, the Australian Prudential Regulation Authority, which thinks lower interest rates could fuel systemic risks to the economy over the longer term.

This smacks of unnecessary hype. It should be business as usual for our banks.

A shock to the global banking system such as arrested credit markets, crippling liquidity is systemic risk. The mere thought of Australia’s banks possibly over lending with a back drop of lower lending rates is not systemic risk.

As a regulator, it seems like APRA feels it should make this type of comment on the back of international trends. But the question is does it actually believe this is a realistic possibility?

APRA explain international trends can lead to rising household leverage and housing market pressures. Australia is experiencing the opposite of this – saving is back in vogue.

The reality is that APRA, along with ratings agencies, can sound all the warnings they like but the event most feared should be the one thought not possible. Or not thought about at all. When Lehman Brothers collapsed and caused international money markets to freeze, zapping daily liquidity that all financial institutions are dependent on, we experienced systemic risk. Bad loans eating into profitability is not.

At worst, bad loans will cause falling share prices, upsetting investors and the broader market along the way. Pinning something purely on lower interest rates isn't enough.

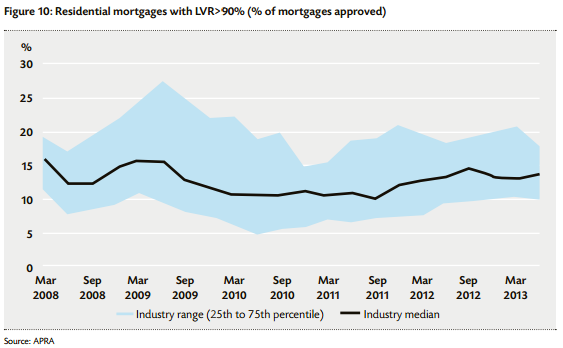

If you are concerned about business loans, National Australia Bank is the one to avoid with around 31 per cent of the loan book sent in this direction. ANZ and Westpac have the least exposure to this type of lending. Still, when was the last time consumer and business confidence was this low? It is hardly conducive to writing imprudent loans.

For the year to end March, net profit after tax came in at $26.6 billion for the entire authorised deposit taking institution industry. Chopping dividends is an easy and efficient way to ensure liquidity is not an issue. The big four did it in 2009 and there is no reason for them not to consider this again.

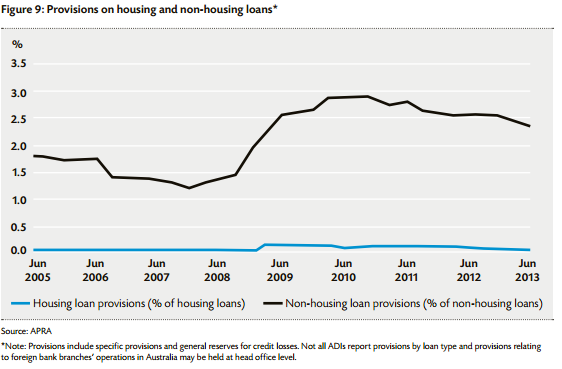

Taking a pragmatic approach to assessing the big four banks, for now bad loans don't offer any concern.