MARKETS: Nimble retailers win out

Premier Investments results confirm specialty retailers might just be nimble enough to survive the new age of retail.

Retailers have cried through the reporting season that the retail environment in Australia is challenging. But Premier’s results prove if you can understand your market place and make the necessary changes to adapt, you can still be profitable and generate positive returns for shareholders.

Premier’s earnings per share of 48.3 cents were 1.9 per cent greater than last financial year. Growth is far from shooting the lights out, but compared with department store majors Myer and David Jones with declining earnings it is an impressive result.

For the last financial year, Myer’s earnings per share fell 8.7 per cent. Reporting for the half year in March, David Jones experienced a decline of 15.2 per cent against the previous comparable period.

Results for the financial year confirm the strategic review initiatives, largely driven by retail guru Mark McInnes since joining the company in April 2011, are taking hold and delivering value to shareholders.

International online offerings don’t seem to be hindering Premier Investments. McInnes has previously expressed his disappointment at the government’s treatment of the retail sector with respect to the tax treatment of goods purchased on international website.

Internet sales have received significant attention at Premier, growing 36.5 per cent over the past year. This number is 10 percentage points greater than the NAB Online Retail Sales Index which experienced growth of 26.5 per cent for the financial year just gone.

Premier has a clear plan to grow the online part of its business to 10 per cent of sales. Other retailers are really only just catching up to online shopping as a way to engage customers.

Results being generated today are a culmination of the decisions made over the past two years. Last year saw aggressive cost cutting and a total of 25 stores closed across the group. The nature of having multiple brands under the one umbrella allows Premier the flexibility to make necessary changes to adapt to the prevailing environment.

Premier’s decision to fully hedge its US dollar exposure for this financial year gives the company greater certainty over costs and cash flows, reducing the chance for any one-off surprises.

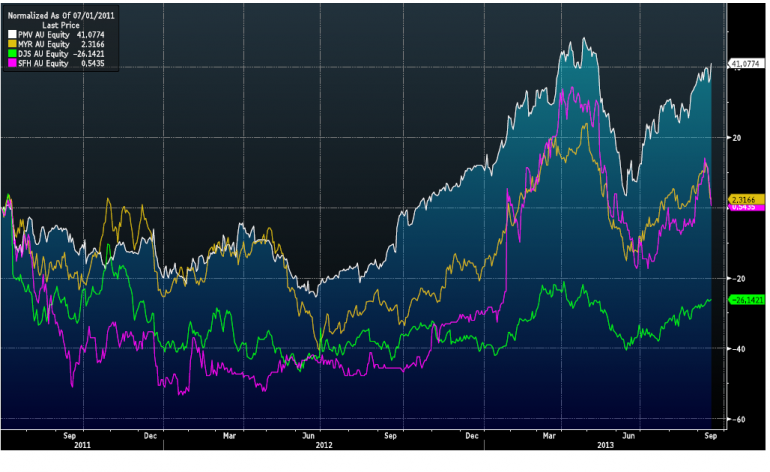

Since July 1, 2011, when McInnes’ presence resulted in material changes, Premier has gained 41 per cent (white line), leaving the rest of the market behind. Of the majors, Myer (yellow line) has gained 2.3 per cent and David Jones (green line) has lost 26 per cent. Fellow specialty retailer, Speciality Fashion Group (pink line) is flat over this time.

Source: Bloomberg

Premier looks well placed to continue dominating the specialty retail sector as it continues to adjust its growth plans to capitalise on market conditions and expectations.