Markets: Gold's slow-motion bear market

The outlook for the gold price is nothing short of catastrophic, according to Michael Knox, RBS Morgans chief economist and director of strategy.

In Knox’s view, gold is a precautionary asset. It is something you hold when you are scared. History confirms Knox’s rationale – when fear is in vogue, gold is something investors have flocked to. The relationship has been positive, with gold returning tidy profits to investors.

Given gold doesn’t create any income, as a gold buyer you are simply hoping it is going to be worth more in the future. You would want to time your purchases carefully.

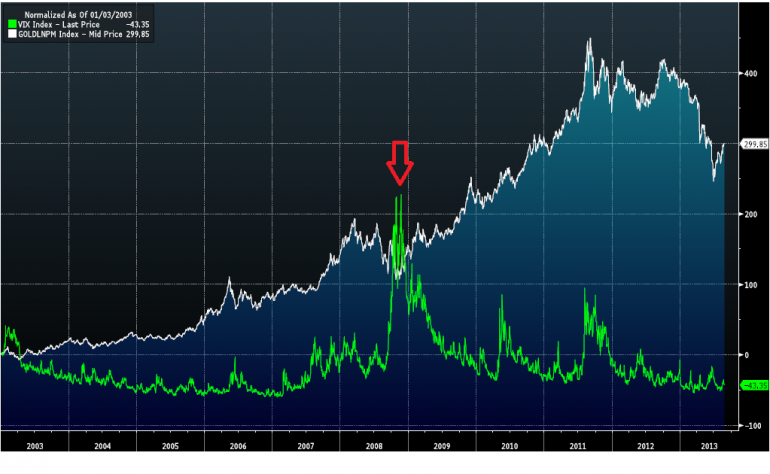

When equity markets began to lose steam in the second half of 2007, the gold price gained momentum from around $US700 per ounce. At the same time, equity market volatility was creeping up from low levels.

At the end of 2008 when market volatility peaked, marked by the red arrow, it spurred the price of gold to new highs.

Now fast-forward seven adventurous years and equity market volatility is back to pre-crisis levels, leaving little justification for gold to gain from here. If anything, it has further to fall.

As governments in both the United States and Europe have pursued fiscal tightening, inflation has declined and economies have flirted with deflation. The US has shrunk its budget deficit from 10.1 per cent of GDP in 2009 to 4.7 per cent.

Knox explains that quantitative easing has inflated the gold price, in a period of deflation mixed in with fiscal tightening.

With fiscal tightening for the US set to continue and the gradual withdrawal of current stimulus, the outlook for gold doesn’t look shiny. Investors have been pricing in this reality. The graph below shows the S&P 500 climbing, with gold moving in the opposite direction.

Ultimately quantitative easing has changed investor appetite for risk and longer-dated investments. Consequently with the global economy slowly picking up strength, gold has fallen out of favour and is coming down from its illustrious highs. So it is only logical gold would be penalised when stimulus is withdrawn and the US dollar well positioned to strengthen.

In the second quarter of this year, hedge fund manager John Paulson cut his losses and reduced his holdings by 53 per cent in the SPDR Gold Trust, the biggest exchange-traded product for gold, and George Soros sold his entire exposure to the commodity. The second quarter was gold’s worst performance on record.

The fundamentals for gold are flimsy. There is no inflation in the developed world and the global economy is gradually recovering. If inflation looked like rearing its head, you could justify holding gold at this point.

Knox tips gold will return to a long-term relationship with US CPI of around $US780/800 per ounce, with another sell-off to come next year.

Gold will always remain a safe haven in the face of economic, financial and geopolitical events. But at present only a dramatic geopolitical event could shock gold prices higher.