Markets: Expanding iiNet's cost challenge

The extent of cost reductions and their contribution to boosting earnings will be the focus when Australia’s third largest communications provider by market capitalisation, iiNet, reports tomorrow.

If iiNet’s full year results are anything like the interim numbers, things are looking good.

Earnings for this financial year are estimated to come in around 33 to 37 cents per share, up from 25.7 cents two years earlier and 28.2 cents last year. The consensus from analysts is that earnings are set to grow over the coming two years.

This is in stark contrast to the static earnings growth of Australia’s largest communications provider, Telstra.

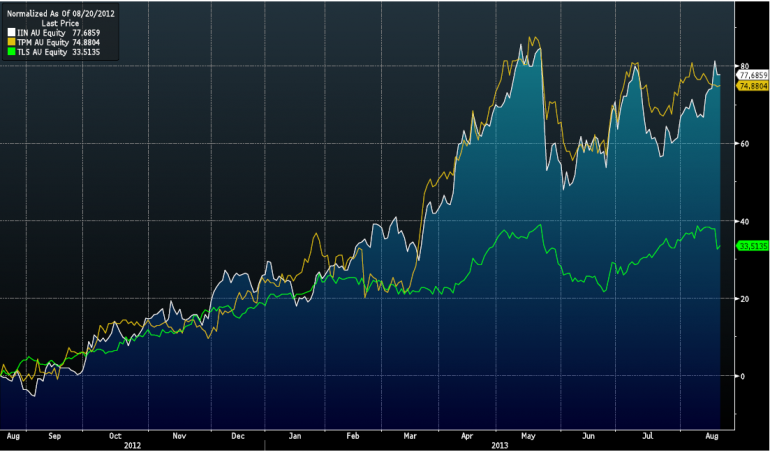

The past 12 months have seen iiNet and TPG, Australia’s second largest communications provider by market cap, dwarf the share price growth of Telstra. Their increasing earnings and future earnings potential have been the main driver of the outperformance.

Source: Bloomberg

The interim report flagged cost reductions across the board. It will be important to see if iiNet is on track with these, especially if external growth opportunities through acquisitions remain scarce. Organic growth by expanding on their existing clientele is the way forward for iiNet.

History shows iiNet has a strong integration track record – rewind 18 months ago when iiNet acquired both Internode and Transact. Both acquisitions have been incorporated and achieved estimated synergies of around $7 million so far. Management will ideally provide more guidance on this when they report.

Although recently acquired South Australian ISP Adam Internet is tipped to add to iiNet’s earnings growth over the long term, we won’t see this just yet. The acquisition doesn’t close until September and cost synergies will not come through until financial year 2015.

Although having a short listed history, iiNet has been a proven performer of generating free cash flows, leaving open the question of an increasing dividend payout. With the ISP market further consolidating, the market will be putting pressure on iiNet to give the cash back if they have nothing to spend it on.

To date, few things have gone to plan with the NBN making it difficult to assess the impact it has had on iiNet and its revenue stream. Any guidance on whether this has influenced customer participation would be welcomed.

So far this reporting season, earnings have been in line with analyst expectations. But the outlook iiNet paints for the future will be the main driver for share price movement. Demanding investors will expect earnings growth to continue. As we have seen, record profit numbers are of no use if you admit a miserable picture for the future.