Markets: Consumers talk the talk

Welcome back confidence! Making a comeback is consumer confidence, business confidence and investor confidence.

While it is still early days yet, it is enough for the market to come close to testing the ASX 200 yearly high of 5,249.6 points. Positive news on domestic sentiment, solid economic data from china and reduced market volatility are set to have investors thinking about risk once again.

Measures like consumer confidence ultimately make us feel better about the economy, but for retailers this still needs to be actually reflected with customers putting their money where their mouth is.

September's spike in sentiment should give retailers fresh hope after what has been a trying two years .Admittedly, the resurrection of consumer confidence is going to be something that slowly works its way through the economy. But the signs are pointing towards a better outlook.

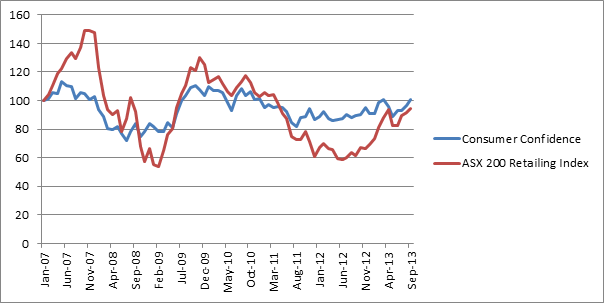

The below graph explains the relationship between the percentage change on a monthly basis between the Westpac Consumer Confidence index and the ASX 200 Retailing Index. We can see that the retailing index often moves more severely than the actual consumer confidence level.

If past trends keep true to form, it should almost be time for the retailing index to pick up.

Myer report earnings tomorrow and this will be a fair gauge of the immediate outlook for all major retailers.

The common theme during reporting season was the cautious outlook for the year ahead among retailers. Improving confidence domestically, against a backdrop of supportive data from China, could see domestic economic conditions distinctly different in the months ahead, pushing retailers higher.

However, improving confidence won’t have the same impact on all retailers. Some sections will clearly fare better than others. Of the specialty retailers, improving housing finance uptake and home prices point to stronger sales across furniture, furnishing and hardware. Companies like Harvey Norman and Nick Scali are directly leveraged to this and could benefit most.

Better yet, if the string of interest-rate cuts we have had gain traction, the stars could be aligning with a confidence-led pick up for retailers. Increased sales will spur healthier balance sheets and, arguably, higher share prices.