Markets: A rare bond bull

Markets have it all wrong. Tapering might end up being the most talked about non-event that evaded markets all year.

If the Federal Reserve couldn’t muster up the courage to start tapering earlier this month, there are huge problems facing the world’s largest economy. Damien Boey, strategist at Credit Suisse, has said it best – “If the best data points don’t allow you to taper, nothing will.”

As tapering talk gained traction, commentators were quick to call the end of the bond bull market. How things can change in financial markets. Consequently, Boey has commented he is a bond bull over the long term.

Commentary from Boey is definitely contrarian relative to other market strategists. However, the points he makes are simply too logical to just dismiss.

If Boey is right in his thinking that the yield on US Treasuries could go down to historical lows, everything we think we know about the share market will be obliterated.

With interest rates globally depressed and no signs of this changing, investors will have to look for equity investments that have bond-like qualities to mimic this exposure. Boey thinks Real Estate Investment Trusts (REITs), utilities, telcos and consumer staples are wise places to put dollars.

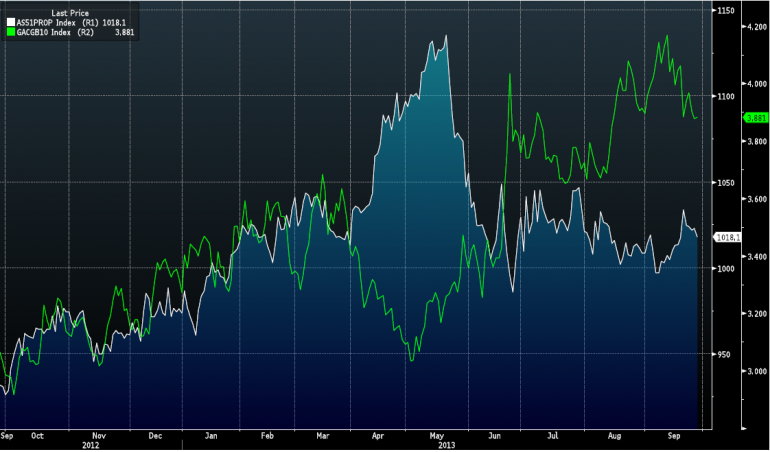

The graph below visualises exactly what Boey is talking about. The relationship between the yield on an Australian 10 year government bond (green line) and the REIT index (white line). When bond yields plummeted, the REIT index climbed to yearly highs. As long term bond yields fall in the absence of taper talk, we would expect the REIT index to gain traction once again.

Source: Bloomberg

We can speculate all we like about why the Federal Reserve didn’t taper. But if we look at the specifics of the tepid data, it does begin to make sense.

If the Federal Reserve doesn’t continue with the current stimulus program, there is a serious threat of a slowdown in the global economy. A global slowdown would see a shift from equities into bonds, unless policymakers intervene and take action to lower bond yields once again.

All of the data has domestic cyclicals out of favour with Boey. The run for the likes of JB Hi-Fi and Harvey Norman could be over sooner than they would like.

It is completely feasible the yield on the Australian 10 year government bond could meet up with the current cash rate, changing the slope of the yield curve. If this does materialise, the economy would be slowing and investors would be flocking to safe-haven investments, like bonds, once again.

The idea of bonds is back, in the form of equity exposures.