Manufacturing a gas crisis

A number of media commentators are suggesting that NSW faces an imminent gas crisis.

This commentary even goes as far as to suggest NSW will run out of gas unless environmental restrictions are removed from coal seam gas development and/or some gas supply is reserved for domestic industrial users. Usually this is framed around a deep concern for the plight of manufacturing jobs and a concern around households having to do without energy for heating and power.

A few weeks ago when I caught up with Origin chief executive Grant King I put this issue to him, asking whether NSW industrial consumers were at risk of running out of gas because the development of LNG plants in Gladstone, Queensland, would draw away all the gas traditionally supplied to NSW.

His answer was pretty emphatic: “There is no problem. There is no shortage of gas.”

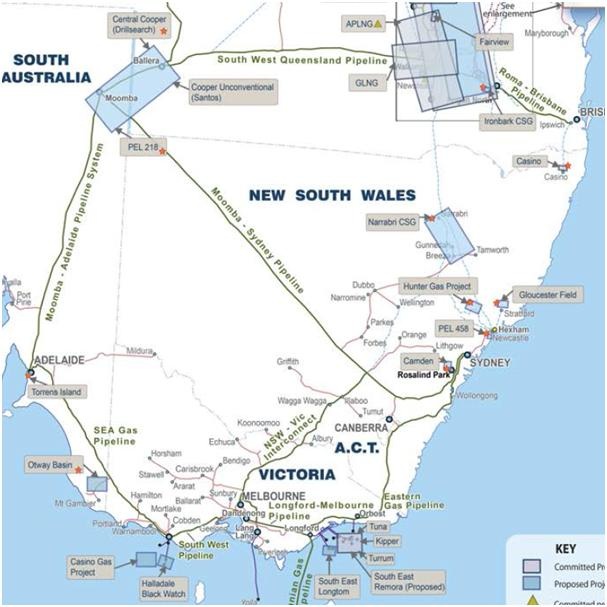

To explain further it helps to have a picture of eastern Australia’s gas supply network, below. Firstly, NSW has historically been entirely supplied by gas from Moomba in the north-east corner of South Australia via the Moomba-Sydney pipeline and from Victorian offshore supplies via the Eastern Gas pipeline and the NSW-Victoria interconnect pipeline. Gas supply from NSW itself has been inconsequential, although there are fields under development (marked by the blue boxes) in Narrabri, Gloucester, Camden and the Hunter.

Source: Australian Energy Market Operator

It’s important to note that gas demand in NSW is not growing noticeably, so this isn’t the thing driving any kind of shortage. Also, the traditional gas fields that have supplied the gas to NSW - South Australia's Cooper Basin and Victoria’s Bass Strait, aren’t about to dry up within the next few years. So, we aren’t actually about to run out of gas in the ground. But there are limits on supply in terms of how much equipment is in place to process the gas and transport it via pipelines into NSW, however this can be changed with a few years lead-time for construction.

The fear centres on the fact that Moomba also has a substantial pipeline into Queensland. Over the 2014-17 period as the LNG plants ramp up, they will suck so much supply from South Australia into Queensland that without development of NSW gas fields, manufacturers and households in NSW will be left short of gas.

King points out that, in reality, such a shortage for industry and households won’t eventuate and this is really just a matter of price. If NSW consumers were in desperate need of additional gas then, without doubt, prices would rise (and they are already rising). Now the interesting thing that King points out is that there is one particularly large consumer of gas that has ready substitutes – power generation. King explains:

This doesn't mean we'll be doing without power, though. What King acknowledged is that the Renewable Energy Target by inducing extra renewable power capacity into the market, it is taking gas out of power generation and also freeing up NSW black coal generating capacity.

The major oversupply of power generation will ensure NSW has no fear of running out of gas or power.

Now, of course, a big rise in the gas price is hardly welcome news for manufacturers. So will freeing up coal seam gas development in NSW help?

It certainly wouldn’t hurt, but the extent of the difference it makes is highly dependent on circumstances. King points out that due to pipeline constraints from Moomba into Queensland its possible for additional supply from NSW to reduce gas prices.

However it needs to be a lot of a supply, which is conceivable but will take time. Just like in any other market, NSW CSG producers will price their product at the competing alternative supplier. If the marginal supplier is still gas from Moomba then NSW CSG will make no difference to price. For it to make a difference it needs to bring forward enough supply over 2014-2017 to more than offset any drop-off in supply from Moomba.

Those suggesting NSW faces an imminent gas crisis are yet to thoroughly explain whether this could be done. NSW manufacturers aren’t likely to find themselves without gas, but they will be paying much higher prices. Extra gas from NSW CSG could help, but it will take several years to make a major difference.

Plus it's worth noting if you look closely in the map above there is a dotted blue line running out of Narrabri into Queensland. That's a proposed new pipeline that would then allow NSW CSG to be exported into the LNG-linked Queensland market. If there really is a major shortage of gas to supply LNG plants and it turns out that NSW CSG is plentiful, then it probably wouldn't depress NSW prices for too long before that pipeline gets built.

To read the transcript of the interview click here.