Making the most of more uncertainty

Summary: The Brexit throws up opportunities for investors as markets tumble, but there are a number of issues still to play out: including how the EU negotiates terms of trade with Britain, how central banks execute looser monetary policy, and the US Federal Reserve's response. |

Key take out: It will take weeks or months to get a handle on what Brexit means for global markets, but in the meantime investors can look to assets that outperform in times of uncertainty, ie. Gold and bonds. |

Key beneficiaries: General investors. Category: Economy. |

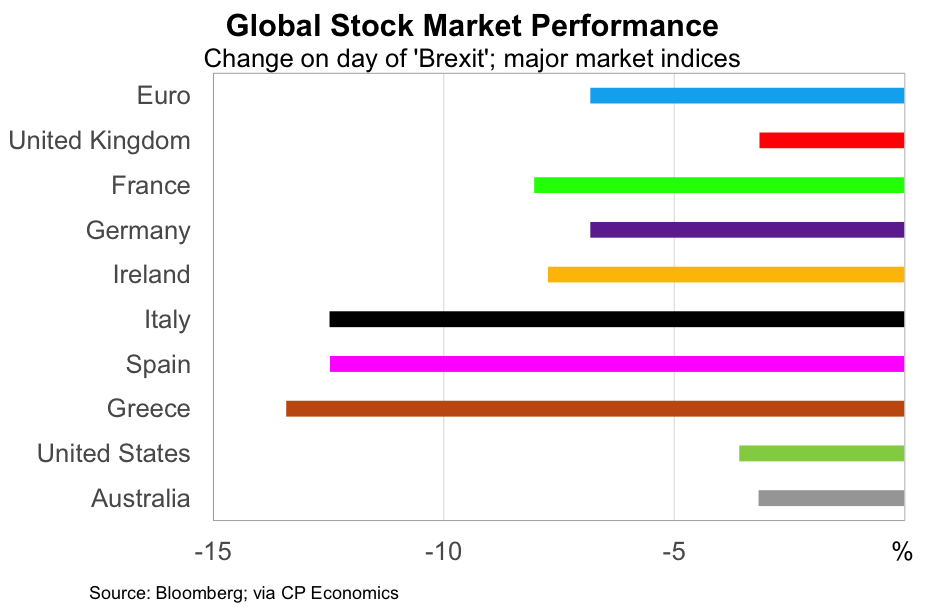

The financial and political uncertainty caused by the Brexit decision began almost immediately. Huge fluctuations in the sterling were observed on Friday and pushed into Saturday morning (Australian time). Markets crashed across Europe and the globe. Remarkably, markets in the United Kingdom experienced a relatively modest decline compared with other European stock exchanges. Australian markets were not left untouched and are expected to shift lower early in the week.

The main channel through which the Brexit is expected to impact the global economy is via reduced trade flows, due in part to a weaker sterling but also via greater protectionism. But market confidence remains an X-factor that isn't well understood. Global investors are on edge and that was captured perfectly by panicked selling on Friday.

The actual path towards exit is not yet clear and that does nothing to alleviate market uncertainty. UK Prime Minister David Cameron has also announced his resignation, creating a power vacuum that at this stage looks likely to be filled by the colourful and controversial Boris Johnson. Pressure is also on Labour leader Jeremy Corbyn to resign.

A second Scottish referendum, to establish independence from the United Kingdom, is a possibility after the Scottish voted in favour of remaining in the European Union. Don't be surprised if Northern Ireland joins them.

The impact on the global economy and financial markets is likely to be much greater than a simple reduction in global trade flows. The Brexit has the potential to become an event similar to the collapse of Lehman Brothers that ushers in a new era for global financial markets.

To understand why, we need to remember that London is one of the world's largest financial centres, with financial sector assets that are more than eight times larger than GDP – this amplifies the risk of disruption and damaging spill-over effects to the broader euro area. Contagion is a very real risk and one that cannot be ignored by global central banks and other policy makers.

Global financial markets are more highly correlated than they were prior to the global financial crisis and market declines in Europe will inevitably spill-over into the United States, Asia and Australia. Market volatility, combined with the likely policy response, is perhaps the greatest risk for the Australian economy.

The central banks

The Bank of England will respond via looser monetary policy. This means that they will buy increasing amounts of financial assets to hold up asset prices during the transition phase of the Brexit. The risk of contagion means that the European Central Bank is all but forced to do the same. The ECB will increase their asset purchases from €80 billion and they will also be buying for longer. They may also decide to dip a little deeper into the world of negative interest rates.

The European Union and the euro currency will come under increasing pressure as other core members consider exit. Perhaps they will be scared off by the economic and financial fallout from the Brexit but hard-right nationalism is gaining a foothold in countries such as France and Italy. These economies have suffered greatly under the shared currency and have far more reason to be frustrated with the European Union than the United Kingdom ever did.

This risk is why the European Union has little choice but to make an example of the United Kingdom. Any weakness in negotiating new trade deals or other favourable decisions will create a precedent that could encourage other countries to exit in the future.

The European Union is at a tipping point and we are on the verge of another currency war. Most major economies are buying up financial assets and the United States is a lot closer to joining them than people realise.

Market uncertainty, combined with lacklustre inflation and softer employment growth, leaves the Federal Reserve in a difficult spot. Do they make good on their forward guidance and raise interest rates, ignoring market concerns, or do they delay again and risk further damage to their credibility?

The Fed is optimistic but not delusional. Given the risks, they will inevitably choose the latter. A recession in the United Kingdom and softer growth across the euro area indicates that the next move for rates may well be down rather than up. The Federal Reserve is a lot closer to introducing QE4 than most realise.

In the meantime, the United States will need to tolerate a higher US dollar. That will boost household spending and retail in the short-term but also undermines manufacturing and US production. A stronger US dollar also increases the cost of key commodities such as oil and iron ore and that presents another risk to global economic growth, particularly for Australia.

Another round of quantitative easing in the United States and greater asset purchasing from the likes of Europe and Japan are likely to exacerbate the very factors that led to the Brexit. The rise of nationalism hasn't occurred in a vacuum: It is the product of eight years of economic and financial failure. It reflects the failure of policies that have enhanced the market valuation of banks and other assets but have done little to support jobs and put food on the table. Until last week the most visible sign of this phenomenon was the success of Donald Trump.

Another round of quantitative easing will only exacerbate existing inequality and fan the flames of hard-right nationalism. Unfortunately, policymakers are at the end of their tether; they have exhausted most options in managing the worst of the GFC and sovereign debt crisis. They are fresh out of ideas.

The good news from Australia's perspective is that we do very little direct trade with the United Kingdom. Over the past year, the UK has been the destination of around 2.5 per cent of Australia's merchandise exports; the five-year average is under 2 per cent.

The Brexit does complicate Australia's trade negotiations with the European Union. In the absence of the United Kingdom, does Australia even bother with an Australia-EU trade agreement? Much of Australia's trade to the European Union has been directed towards and from the United Kingdom.

Australia, however, is not immune to a currency war. The UK's exit and inevitable asset purchases from central banks will put upward pressure on the Australian dollar. This will be offset to some extent by weakness in commodity prices, reflecting a combination of a stronger US dollar and weaker demand.

Australian markets will not be exempt from market volatility and uncertainty. Investors focused on the ASX200 won't have a great deal of fun in the near-term; bond holders though are set to benefit as investors seek a safe haven and central banks cut rates further. Gold is another asset class that has traditionally outperformed during volatile times.

Investors should be aware that the ASX200, the GBP-AUD exchange rate, and the share prices of many larger corporations might overshoot on the downside in the immediate aftermath of the Brexit. That's quite normal, but it is also incredibly difficult to determine that in real-time.

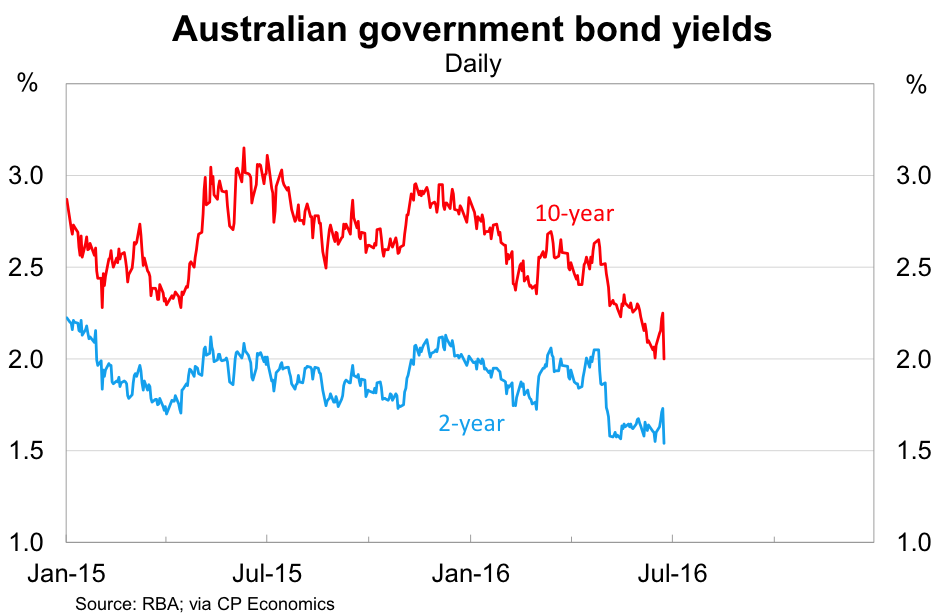

Australian markets have fully priced in another rate cut by the Reserve Bank of Australia by October and a 40 per cent chance of a second cut by December. We are well on our way to a cash rate of 1 per cent or even lower during 2017.

This presents an opportunity for investors, because a bad week for markets could very well force the RBA's hand at its next rates meeting on July 5. At the very least an August rate cut appears more likely than not. Meanwhile, two and 10-year Australian government bonds were smashed on Friday but remain under-priced in my opinion. These could be options for those who prefer fixed-income products.

None of this is particularly fun reading for investors, but these are extraordinary times. Rarely have we seen a major economy so enthusiastically shoot itself in the foot. Financial markets have partially adjusted to this fact but it may take weeks or even months before we have a good idea of the damage that has been done. In the meantime, investors would do well to hedge against that risk by considering assets that tend to outperform during difficult times such as gold or government bonds.